Will RBIs decision to allow linking Rupay credit cards with UPI kill Visa and Mastercard?

Last Updated: 10th December 2022 - 06:56 am

UPI literally have revolutionized the way Indians make payments, be it at your kirana shop or a high end restaurant you can make payments in just a click.

Now, before UPI we had debit cards and credit cards, which have become quite old school after UPI came into picture, for most of us they are lying somewhere in our drawers. But you see credit cards have one superpower that cannot be replaced by UPI, it is leverage! You can buy an I phone worth one lakh even when you don’t have the money.

Just Imagine, if we combine the powers of UPI and credit card what would happen?

That is what is going to happen my friend! The whole UPI ecosystem would change after this move of RBI. Let’s call its UPI 2.0

If you ask, why has RBI done this, the first and the obvious reason is to boost the number of UPI payments and second reason could be to promote your own Rupay cards, well our PM doesn’t really like foreign companies, he believes in atma nirbharta a lot, and one reason for this move of RBI is definitely to boost the penetration of Rupay cards.

A fun fact for you, the market share of Rupay in the debit card segment was just 15% in 2017 which rose to 60% in 2021, well that huge jump, was primarily because the government is proactively pushing Rupay cards.

For instance, the government only issues Rupay debit cards to all the people who open an account through Jan Dhan Yojana, further the Finance minister has also stated that all PSUs have to mandatorily promote the Rupay cards to their customers. Further Rupay cards come under zero MDR norms, MDR or merchant discount rate is a fee charged by banks to merchants for processing payments.

This fee is usually split between the acquiring bank (the bank whose card machine a merchant uses), the card network (such as Visa or Mastercard), and the issuing bank (who issued the customer or payer’s card).

Say you shopped something from Pantaloons and paid through your Visa credit card then MDR would be charged from Pantaloons and that fee would be distributed to your bank, the bank where pantaloons have its account, and Visa of course!

Now, the share of Rupay has grown in the debit card segment, while it still lags behind its global counterparts in the credit card space. As per sources, currently, RuPay only has a 20 percent share of India’s credit card market which is led by Visa, followed by MasterCard.

Also, it is behind Visa and Mastercard when it comes to value and volume of transactions, and that is why RBIs plan is a gamechanger for Rupay.

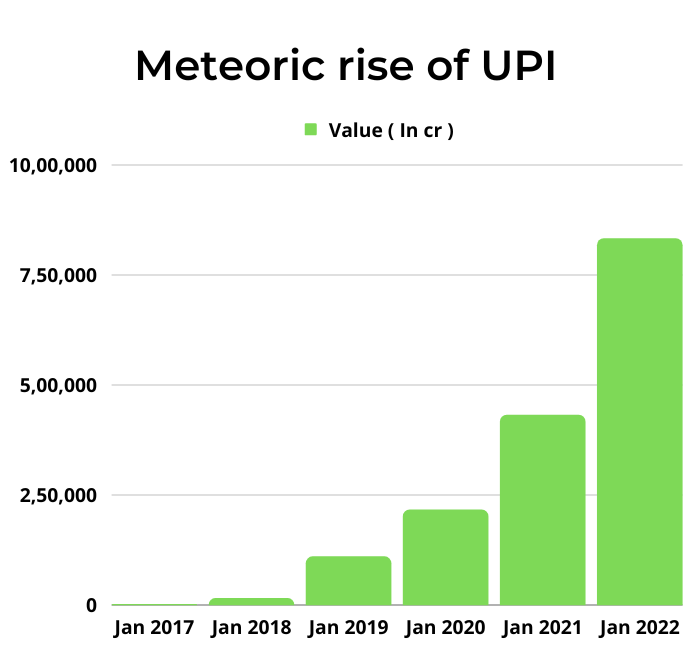

Rise of UPI

Well, UPI transactions in India have grown by leaps and bounds in the last decade.

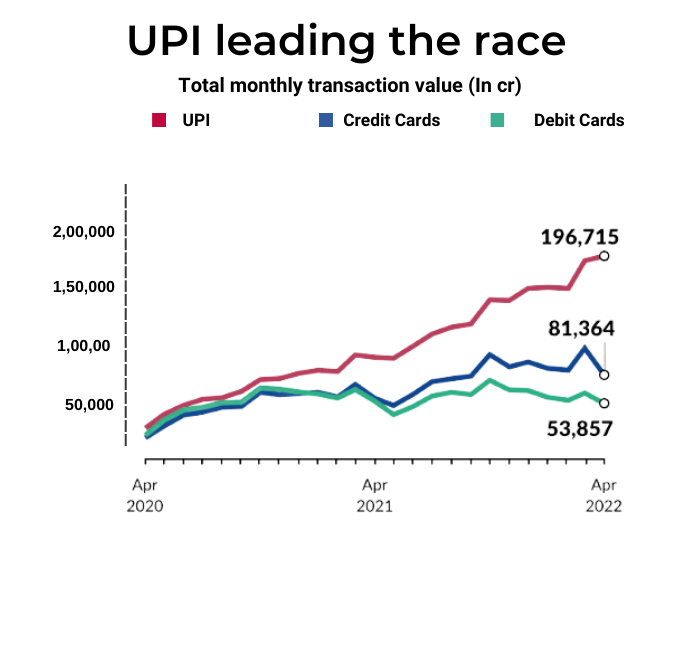

In 2021-22, there were a total of Rs 16.83 lakh crore worth of UPI transactions, as against Rs 7.3 lakh crore worth of debit card transactions and Rs 9.72 lakh crore worth of credit card transactions, according to RBI.

From a value of Rs. 100 cr in 2016 to Rs. 7 lac crore in 2021, they have grown exponentially. In the past few years, UPI has become more popular than debit or credit cards. While UPI is used for high-frequency low volume transactions, while debit and credit cards are now just used for high-value transactions.

Now with this new policy, UPI transactions will further grow, as people will be able to link their credit cards with the UPI ids, this would eliminate the buy now, pay later schemes as you can transact seamlessly with your UPI using your credit card. Further, it is a low-cost alternative for merchants to credit card machines, they just have to keep a sticker of a QR code and they are good to go!

This game-changer move of the RBI can push the Rupay cards in the Indian market and would give it an edge, people would flock to buy these credit cards. If the government for a long time keeps this exclusive to only Rupay cards, the business of Visa and Master card could take a hit!

While the move of RBI has been applauded by everyone in the industry, its economic viability is something that has to be questioned.

One reason UPI is loved by Indians is because it is absolutely free! You don't have to pay anything to Google pay, Visa or your bank to make any transaction but that is not the case with UPI!

So, currently, whenever you pay through your debit card or credit card, a fee called MDR is charged to the merchant and that's how the banks and the card company make money.

As per RBI guidelines, MDR charged to merchants for debit card payments should be 0.4-0.9% of the transaction value(depending on the transaction size).In January 2020,, RBI mandated that merchants should pay no fees for accepting UPI payments; this zero MDR policy is also applied to RuPay debit cards, while on RuPay credit cards banks can charge merchants 0.4-0.9%.

However, on all credit cards, there is no cap on the MDR that can be charged by the bank. It can vary from 1.5% to 3%, depending on the bank, the card variant, and the rates a merchant can negotiate.

Effectively, this means that the MDR on Visa and Mastercard debit or credit cards was higher than that on the indigenous platforms UPI and RuPay.

Remember when you asked to pay the shopkeeper through your credit card, he said the amount would be higher if you pay through a credit card, and asked you to pay through cash, it was because of the MDR.

Now the question arises, once UPI is linked to a credit card, what happens to the MDR since currently no MDR is being charged from the merchants for UPI.

Also, whenever the MDR is less on a particular card, banks don’t really like that card and try not to push it, as their revenue depends on the MDR, so if the MDR is zero banks don’t have an incentive to promote it.

One major problem that could arise while implementing this policy, could be convincing the merchants to pay, generally, credit cards are used and swiped by people who make high-value purchases at high-end stores, but UPI is present at small shops and with small vendors as well, so it would be a challenge to convince them to pay a fee for the transaction.

The move of RBI is a game-changer for the whole UPI industry, its implementation however would be a challenge for RBI as well as NPCI. Well, this move requires a lot more clarity from the central bank to be implemented, but if RBI has done something, surely it is for the greater good.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta