Currency Trading with 5paisa

Brokerage

Flat ₹20 per order

Mutual Fund investments

What is Currency Trading?

Currency trading, commonly known as forex trading, is the buying and selling of currency pairs in the foreign exchange market to earn profits through speculation.

Presently, the currency market, or the forex market, is one of the world's largest and most liquid markets, thereby recording a daily turnover of $ 2 trillion, with quick growth projections.

The primary factor that differentiates forex trading from other types of trading is its liquidity. The purchase and sale of one currency for another to take place simultaneously. This kind of trading is also known as 'Speculative forex trading.'

Currency Trading Pairs for India

Last updated: Jan 4, 2025, 12:00 AM

| Currency | Country | INR Unit | Change | Change(%) |

|---|---|---|---|---|

| Euro | Europe | 88.49 | 18.55 | 26.52% |

| Pound | United Kingdom | 106.76 | 8.93 | 9.13% |

| Yen | Japan | 0.55 | 0.03 | 5.73% |

| Dollar | United States | 85.77 | 21.96 | 34.41% |

5 Reasons to Invest in Currencies with 5paisa

Trading in Forex tends to cater to highly liquid market. There are no hidden prices.

Use web or mobile platform to trade in global currencies from your couch

Study charts, understand market and place quick orders on FOREX market in real time

Learn about currencies at 5paisa school

Execute all orders at Flat fees of ₹20/order

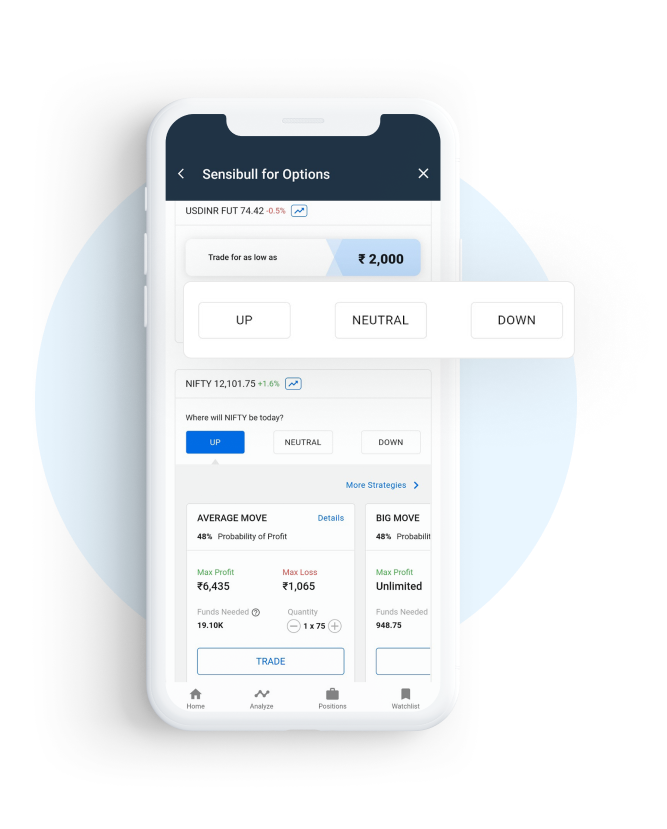

Introducing Sensibull

Just predict up or down, and get limited loss option strategies.

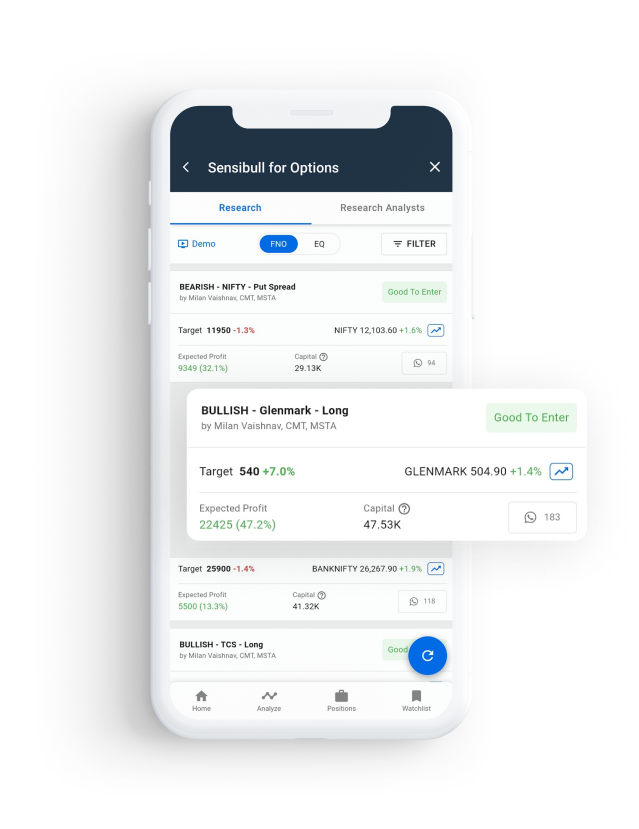

Get expert trade recommendations tailored to your trading goals.

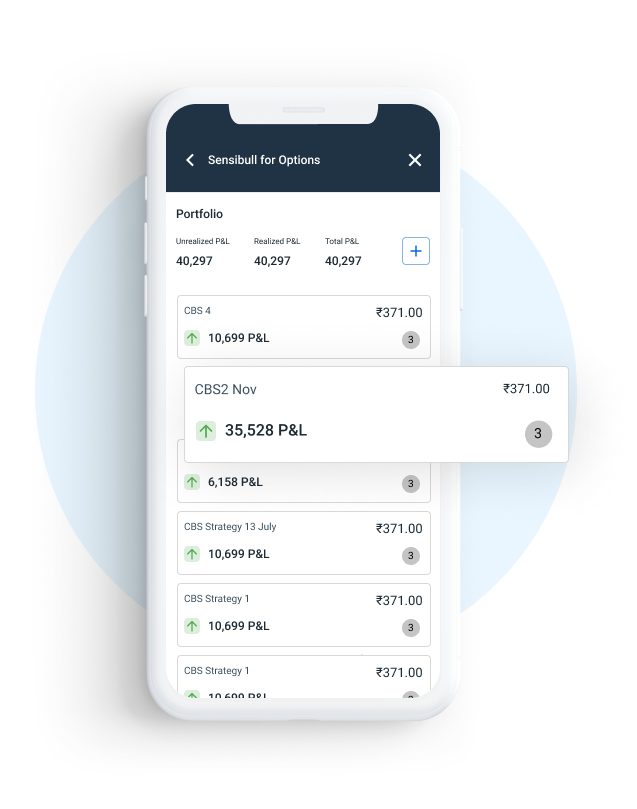

Practice your trading strategies with virtual money before going live.

Regular Account

- Brokerage free tradesX

- Brokerage on equity₹20

- Brokerage on other segments₹20

- Net Banking Charges₹10

- DP Transaction Charges₹12.5

Power Investor

- Brokerage free tradesX

- Brokerage on equity₹10

- Brokerage on other segments₹10

- Net Banking Charges₹10

- DP Transaction Charges₹12.5

Bestseller

BestsellerUltra Trader

- Brokerage free trades100

- Brokerage on equity₹0

- Brokerage on other segments₹10

- Net Banking Charges₹0

- DP Transaction Charges₹0

Fill in your personal details required for account opening & select Derivatives segment while proceeding with your account opening journey.

In addition to the below mentioned list of documents, submit your income proof that is required for trading in derivatives segment.

Post verification, your trading account will be activated and you can start investing in currencies.

FAQs

FOREX is a portmanteau of "foreign exchange." Trading in FOREX market is about buying one currency and simultaneous selling of another in the global marketplace.

Yes, investing in FOREX Market is legal in India.

Yes, in fact, FOREX is considered to be one of the most transparent market globally when compared with any other liquid market.

A cross-currency refers to a currency pair or transaction that does not involve the U.S. Dollar. And RBI does allow cross currency pairs to be traded in the derivatives market in India.

A currency pair is the quotation of two different currencies, with the value of one currency being quoted against the other. For eg USD 1 = INR 72.55.

If you have an online trading account, you don’t need any additional permission to do currency trading. You can buy and sell currency pairs on the NSE or the BSE currency segment.

The Foreign Exchange Market is where participants can buy, sell, or trade on currencies worldwide in pairs. It can be in a structured, regulated exchange or over-the-counter (OTC) platform.

The primary participants of the forex market are forex brokers, commercial banks, legitimate dealers, and currency authorities. While participants may own their trading centers, it is essential to note that the market is spread globally. There are multiple markets in which participants can trade, with close and continuous communication between trading venues.

Like the stock markets, the capital market regulator SEBI regulates Forex trading in India. They ensure that the companies comply with the Foreign Exchange Control Act of 1999. The Reserve Bank of India, also known as the RBI, regulates foreign exchange transactions. In India, you can trade currencies in pairs like the Indian Rupee (INR), US Dollar, Japanese Yen, British Pound, and Euro. Currency trading between EUR/USD is also allowed.

The foreign exchange (forex) market is the world's largest financial market, per the 2019 Triennial Central Bank Survey of FX and OTC Derivatives Markets. The global forex market in 2022 will be worth $2.409 billion ($2.409 trillion). The average daily volume of the forex market is around $6.6 trillion.

Currency trading in India is only allowed in 7 pairs- USD/INR, EUR/INR, JPY/INR, GBP/INR, EUR/USD, GBP/USD, and USD/JPY. Three stock exchanges facilitate forex trading in India- NSE, BSE and Metropolitan Stock Exchange of India- jointly regulated by SEBI and RBI. USD/INR, EUR/INR, and GBP/INR lot sizes are 100 units, and JPY/INR lot size is 1,00,000 units.

No, since there are no physical deliveries like equities in currency trading, a Demat account is not mandatory. You can open only a forex account with any SEBI-registered broker to trade in forex.

Yes, forex trading in India is legal. According to the RBI guidelines - “Resident persons are permitted to undertake forex transactions only with authorised persons and for permitted purposes, in terms of the Foreign Exchange Management Act, 1999 (FEMA).”

NSE Clearing pre-collects the initial margin for all open positions of CM (Clearing member) based on the margin calculated by NSE Clearing-SPAN (Standard Portfolio Analysis of Risk). Next, the CM must collect the initial margin from the TM and respective clients. Similarly, the TM has to collect the advance payment from the customer.

Initial margin requirements are based on 99% value-at-risk over a daily time range. The initial margin is calculated over two days using an appropriate statistical formula for futures contracts where the market settlement amount may be collected after the next day's open. SEBI recommends the method of calculating the Value-at-Risk percentage from time to time.

The total amount of underlying assets per derivative contract is called lot size. For example, forex lot size refers to the total amount of the base currency of a futures or options contract. Indian currency pairs usually trade in a lot size of 1000 of the base currency. Forex trading in India has the following lot sizes-

|

INR Currency Pair |

Forex Lot Size |

|

USD-INR |

$1,000 |

|

EUR-INR |

€1,000 |

|

GBP-INR |

£1,000 |

|

JPY-INR |

¥1,00,000 |

|

Cross-Currency Pair |

Forex Lot Size |

|

EUR-USD |

€1,000 |

|

GBP-USD |

£1,000 |

|

JPY-INR |

¥1,00,000 |

A currency futures is a forward agreement that allows exchanging one currency for another at a future date at a specified purchase price. Spot FX contracts deliver the underlying currency immediately (usually his two days) from the settlement date. The main difference between contracts is when the transaction price is determined and when the physical exchange of currency pairs takes place.

A "gap" occurs when the opening price is higher than the last session's high, known as the gap up, or lower than the previous session's low, known as the gap down. These gaps can be significant for trading as there are usually traders who believe the gaps will be closed relatively quickly. And this allows forex traders to make possible profits as they can better predict the possible short-term direction of the price. Factors leading to a gap include- big news, major financial breakthroughs, and economic/global catastrophes.

You can start forex trading with the 5paisa app quickly by opening an account with us with personal details like your name, age, etc., and uploading the required documents. Post verification, your account will be activated, and you can start forex trading.

Introducing Sensibull

Your one-stop solution option Trading

Easy options

Just predict up or down, and get limited loss option strategies.

Discover India’s most profitable advisors. Trade with real-time alerts on Whatsapp.

Learn to trade futures and options without real money.

Regular Account

₹0

- Brokerage free tradesX

- Brokerage on equity₹20

- Brokerage on other segments₹20

- Net Banking Charges₹10

- DP Transaction Charges₹12.5

Power Investor

₹599

- Brokerage free tradesX

- Brokerage on equity₹10

- Brokerage on other segments₹10

- Net Banking Charges₹10

- DP Transaction Charges₹12.5

Ultra Trader

₹1199

- Brokerage free trades100

- Brokerage on equity₹0

- Brokerage on other segments₹10

- Net Banking Charges₹0

- DP Transaction Charges₹0

Open your Currency Trading Account

in 3 easy steps

Open your account

Fill in your personal details required for account opening & select Derivatives segment while proceeding with your account opening journey

Upload documents

In addition to the below mentioned list of documents, submit your income proof that is required for trading in Derivatives segment

Start currency trading

Post verification, your trading account will be activated and you can start investing in currencies

Frequently Asked Questions

FOREX is a portmanteau of "foreign exchange." Trading in FOREX market is about buying one currency and simultaneous selling of another in the global marketplace.

Yes, investing in FOREX Market is legal in India.

Yes, in fact, FOREX is considered to be one of the most transparent market globally when compared with any other liquid market.

A cross-currency refers to a currency pair or transaction that does not involve the U.S. Dollar. And RBI does allow cross currency pairs to be traded in the derivatives market in India.

A currency pair is the quotation of two different currencies, with the value of one currency being quoted against the other. For eg USD 1 = INR 72.55.

If you have an online trading account, you don’t need any additional permission to do currency trading. You can buy and sell currency pairs on the NSE or the BSE currency segment.

The Foreign Exchange Market is where participants can buy, sell, or trade on currencies worldwide in pairs. It can be in a structured, regulated exchange or over-the-counter (OTC) platform.

The primary participants of the forex market are forex brokers, commercial banks, legitimate dealers, and currency authorities. While participants may own their trading centers, it is essential to note that the market is spread globally. There are multiple markets in which participants can trade, with close and continuous communication between trading venues.

Like the stock markets, the capital market regulator SEBI regulates Forex trading in India. They ensure that the companies comply with the Foreign Exchange Control Act of 1999. The Reserve Bank of India, also known as the RBI, regulates foreign exchange transactions. In India, you can trade currencies in pairs like the Indian Rupee (INR), US Dollar, Japanese Yen, British Pound, and Euro. Currency trading between EUR/USD is also allowed.

The foreign exchange (forex) market is the world's largest financial market, per the 2019 Triennial Central Bank Survey of FX and OTC Derivatives Markets. The global forex market in 2022 will be worth $2.409 billion ($2.409 trillion). The average daily volume of the forex market is around $6.6 trillion.

Currency trading in India is only allowed in 7 pairs- USD/INR, EUR/INR, JPY/INR, GBP/INR, EUR/USD, GBP/USD, and USD/JPY. Three stock exchanges facilitate forex trading in India- NSE, BSE and Metropolitan Stock Exchange of India- jointly regulated by SEBI and RBI. USD/INR, EUR/INR, and GBP/INR lot sizes are 100 units, and JPY/INR lot size is 1,00,000 units.

No, since there are no physical deliveries like equities in currency trading, a Demat account is not mandatory. You can open only a forex account with any SEBI-registered broker to trade in forex.

Yes, forex trading in India is legal. According to the RBI guidelines - “Resident persons are permitted to undertake forex transactions only with authorised persons and for permitted purposes, in terms of the Foreign Exchange Management Act, 1999 (FEMA).”

NSE Clearing pre-collects the initial margin for all open positions of CM (Clearing member) based on the margin calculated by NSE Clearing-SPAN (Standard Portfolio Analysis of Risk). Next, the CM must collect the initial margin from the TM and respective clients. Similarly, the TM has to collect the advance payment from the customer.

Initial margin requirements are based on 99% value-at-risk over a daily time range. The initial margin is calculated over two days using an appropriate statistical formula for futures contracts where the market settlement amount may be collected after the next day's open. SEBI recommends the method of calculating the Value-at-Risk percentage from time to time.

The total amount of underlying assets per derivative contract is called lot size. For example, forex lot size refers to the total amount of the base currency of a futures or options contract. Indian currency pairs usually trade in a lot size of 1000 of the base currency. Forex trading in India has the following lot sizes-

|

INR Currency Pair |

Forex Lot Size |

|

USD-INR |

$1,000 |

|

EUR-INR |

€1,000 |

|

GBP-INR |

£1,000 |

|

JPY-INR |

¥1,00,000 |

|

Cross-Currency Pair |

Forex Lot Size |

|

EUR-USD |

€1,000 |

|

GBP-USD |

£1,000 |

|

JPY-INR |

¥1,00,000 |

A currency futures is a forward agreement that allows exchanging one currency for another at a future date at a specified purchase price. Spot FX contracts deliver the underlying currency immediately (usually his two days) from the settlement date. The main difference between contracts is when the transaction price is determined and when the physical exchange of currency pairs takes place.

A "gap" occurs when the opening price is higher than the last session's high, known as the gap up, or lower than the previous session's low, known as the gap down. These gaps can be significant for trading as there are usually traders who believe the gaps will be closed relatively quickly. And this allows forex traders to make possible profits as they can better predict the possible short-term direction of the price. Factors leading to a gap include- big news, major financial breakthroughs, and economic/global catastrophes.

You can start forex trading with the 5paisa app quickly by opening an account with us with personal details like your name, age, etc., and uploading the required documents. Post verification, your account will be activated, and you can start forex trading.