Why Adani Stocks are falling?

Last Updated: 9th December 2022 - 05:43 am

Since the last two days, Multibagger Adani stocks have plummeted, the company lost around $10.6 billion in Market Cap. All Adani group companies from Adani Ports to Adani Power have witnessed a rally in the past year, making Gautam Adani one of the richest men on the earth.

Why are Adani Shares falling?

The current fall in the Adani group’s shares is attributed to MSCI’s semi annual index review, MSCI India Index, which consists of Large cap and Mid cap stocks from the Indian markets.

MSCI indices, includes securities from 23 nations, we have MSCI India index, which measures performance of large and mid cap companies in India, it has around 106 constituents. Recently they added four new stocks in their index which are Tata Elxsi, Adani Power, Jindal Steel & Power and AU Small finance bank.

Subsequently they decreased the weightage of Adani green in the index after these additions.

MSCI published additions and deletions from its Index last month , while they mentioned the changes in the stocks but they did not mention the changes in the weighting assigned to them, on Tuesday they revealed that they have cut down the weighting assigned to Adani green and due to that the shares of Adani group have plummeted.

Why MSCI affected the Adani group stocks?

Foreign investors generally use this Index to invest in the international markets, because inclusion in this index generally reflects the stability and volatility of the stock. If the weightage of a company is reduced then there is always a possibility of foreign investors withdrawing money.

While this fall may seem like small and appear to be just the everyday volatility in the markets, there are deep rooted reasons why Adani group stocks are highly volatile.

1. Insanely high valuations

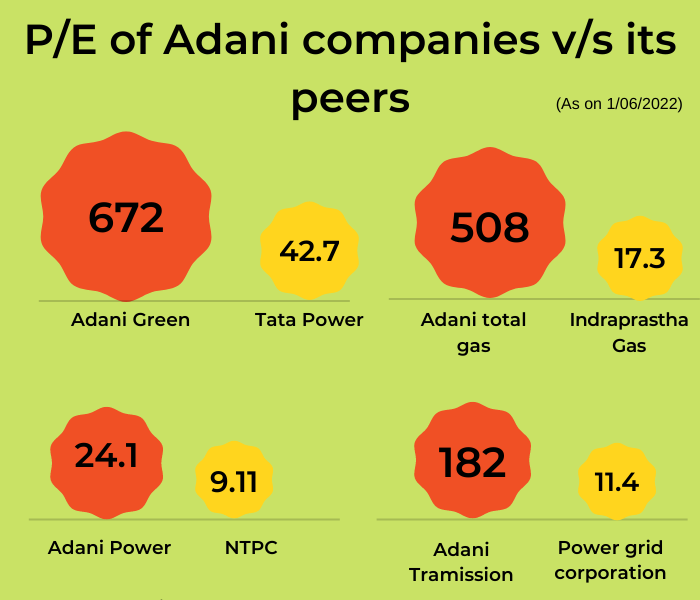

Let’s accept it, Adani stocks have been buzzing in the markets for a long time now, and they have absurd valuations, for example Adani Green even after the fall, is trading at Price/Earning ratio of 672?! While its peer Tata power is trading at a P/E of 42. While the revenue of Tata power is 8x more that the revenue of Adani green! While its profit is thrice that of Adani green.

Adani gas trades at a P/E of 502, while Gujrat gas is trading at a P/E of 30, clearly the valuation of Adani companies is ridiculously high. There is no way the company can justify these valuations, and a ripe correction is expected in these stocks.

2. Dubious Shareholding pattern:

One reason for the high valuations could be its shareholding pattern. Adani company stocks have high shareholding by FPI’s most of these FPI have smaller stakes in the company, as investors aren’t required to disclose their holdings if they don’t cross the 1% threshold limit. These Foreign investors are mainly unknown companies which have major holding in Adani stocks and surprisingly these companies have investments in all Adani stocks and negligible investments outside of them.These suspicious holdings did raise eyebrows in 2020, causing its stocks to fall by 25%.

For example: FPI—Asia Investment Corporation (Mauritius)—is heavily invested in the Adani Group, with 93% of its holdings in Adani companies

FPIs such as Elara India Opportunities Fund, Albula Investment Fund, Cresta Fund, Lts Investment Fund, and Vespera Fund all held a stake in Adani Total Gas as of December 2020, while also holding many other Adani stocks.

High Shareholding by Foreign investors could imply that there are less shares available for trading, and the stock price is influenced easily.

High FPI holding, Insane valuations and less coverage by analyst on the stock is definitely some things investors should consider while investing in Adani stocks, further most of the Adani companies cater to just one sector that is infrastructure, which is highly cyclical in nature, and therefore any downturn would affect all Adani stocks.

These were some of the reasons why Adani stocks have just rallied in the last one year. While the current fall in the market is little, investors should look beyond it. The insane valuations, dubious shareholding pattern, less holdings by DIIs should definitely concern investors.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta