Ruchi Soya: A Multibagger for Baba Ramdev, Multi-beggar for investors!

Last Updated: 9th December 2022 - 01:32 pm

A few days ago the share price of Ruchi Soya plunged 5%, since the government announced they would exempt customs duty and agri cess on yearly import of 20 lakh MT each of crude soybean and sunflower oil till March 2024 to cap domestic prices.

The attempt of the government was primarily to contain the commodity inflation in the country. With less custom duty, imports would rise and since the supply would be more, the prices in domestic markets would reduce.

Ruchi Soya: A bumpy ride

So, if you have been following the markets for quite some time, you must know that Ruchi Soya has given a wild ride to the investors.

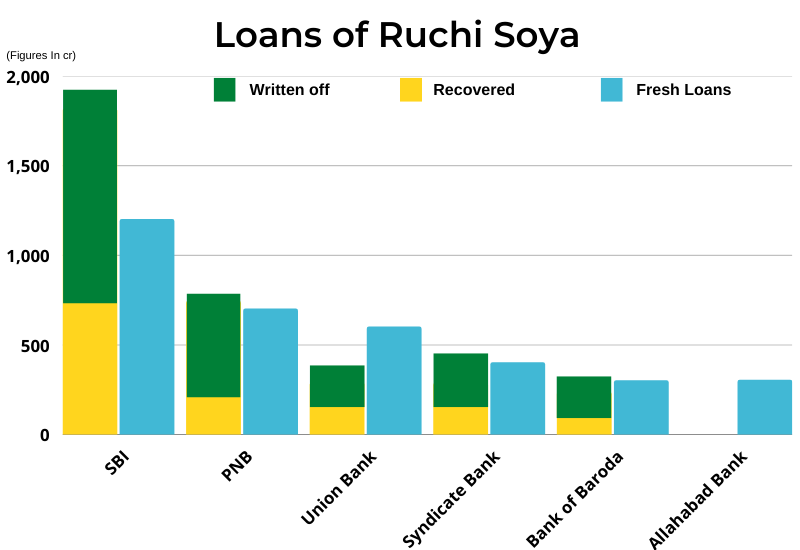

The company was once the largest producer of edible oils in the country. It went bankrupt in 2019 due to its huge debt, but then Baba Ramdev, came just like a Knight in shining armor. Only if stories like this existed today would the world be a better place. The company owed more than 12,000 crores to banks. Major banks like SBI, PNB had given loans to it and had to write off more than 50% of their loans.

With its debt reduced to less than 50%, Our favorite yoga guru agreed to buy the company for Rs. 4350 crore. Now, comes the funny part, he did not buy the company completely in cash, rather he took a loan of 3000 crores from the PSBs to fund this deal, the same PSBs that were selling the stake.

So, Initially they wrote off more than half the debt of Ruchi Soya, then they gave a loan of 3000 crores to fund this acquisition and Baba Ramdev got the 99% of the company with 1000 crores!

But, Wait there’s more, The company came with an FPO, where they offered 20% stake of the company for 4300 crores, approximately the same amount at which Ramdev bought the whole company.

The company got relisted on the exchanges again, but only 1% of the stake was on public float, which means the stock price could have been manipulated easily and that explains for its volatility.

Recently Patanjali Ayurved which is into food, personal care, home care products, has transferred its packaged consumer food division to Ruchi Soya, which contributed around 40% to its revenue and contributed around 4124 crore to the revenue of Patanjali Ayurved in FY20-21. It sold it for pennies (690 crores) to Ruchi Soya.

Rumors are, Patanjali Ayurved plans to come up with an IPO and its consumer food division is considered a weak link by investors because even though it's a growing segment it is capital intensive and has a high gestation period.

Well, Ruchi soya for a lot of investors was a Multibagger, and for a lot Multibeggar. Which one are you ?

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta