What Is an Underwriter?

5paisa Research Team

Last Updated: 31 Dec, 2024 05:10 PM IST

Content

- What Is An Underwriter?

- What Does An Underwriter Do?

- Functions Of Underwriters

- Different Types Of Underwriters

- Underwriters Vs. Agents And Brokers

- Conclusion

An underwriter can work for financial institutions such as mortgage companies, stock exchanges, insurance companies, and banks. They are mainly interested in gathering all available information regarding the financial standing of the companies, precisely estimating the risk involved, and assisting them in deciding whether or not to accept a new contract.

In this blog post, we will provide a comprehensive understanding of the underwriter meaning and underwriting meaning in finance by exploring the role of underwriters, the different types of underwriters, and the intricacies involved in the underwriting process.

What Is An Underwriter?

An underwriter is a key member of the financial industry who plays a critical role in assessing and evaluating risk. They work for various financial organisations, including mortgage, insurance, loan, or investment companies, and their primary task is to assume the risk of another party for a fee. Underwriters use their specialised knowledge and expertise to determine whether to approve a loan or issue an insurance policy, which could be a significant financial commitment.

To make informed decisions, underwriters must have a deep understanding of their specific field of expertise. They carefully analyse an applicant's financial history and other relevant factors to assess the risk involved. Underwriters must also ensure that their company's interests are protected and that the contract will be beneficial in the long term. If the underwriter's assessment reveals that the contract is too risky, they are accountable for any losses incurred by their organisation.

What Does An Underwriter Do?

Underwriters play a crucial role in assessing and evaluating risk for various financial organisations such as mortgage, insurance, loan, or investment companies. They use their specialised knowledge and expertise to decide whether a contract is worth the risk. The specific information an underwriter assesses is subject to the case they are reviewing. As an example, a health insurance company's underwriter examines the health risks associated with applicants, whereas a loan underwriter evaluates aspects such as credit history.

To make informed decisions, underwriters review an applicant's information, which includes age, current health condition, past medical, and family history. They enter this data into underwriting software, which determines the premium amount and terms they should apply to the policy. The software also assesses whether the policy involves too much risk to proceed further.

An underwriter's job is complex and requires them to determine an acceptable level of risk based on their risk assessment. They may need to conduct research and gather a large amount of details when assessing complicated situations. Overall, underwriters are essential financial professionals who ensure that their company's interests are protected while also making beneficial decisions for all parties involved.

Functions Of Underwriters

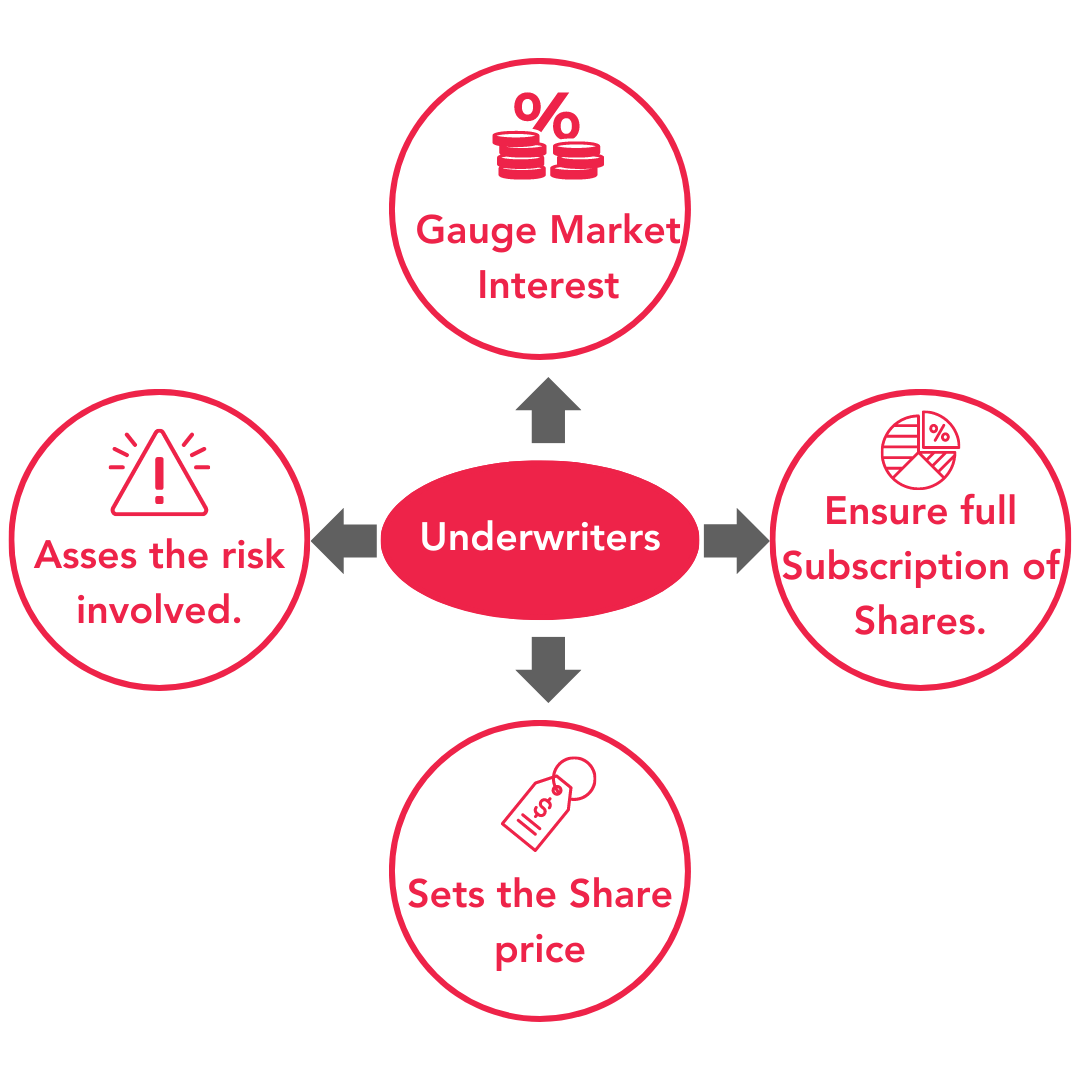

As a crucial part of the financial industry, underwriters perform various functions to ensure the safe and profitable distribution of risks. These functions include:

1. Risk Selection

The first function of an underwriter is to select the risks that the insurer will accept. This involves gathering factual information from the applicant and evaluating it to determine whether the risk is acceptable. Underwriters rely on lists of acceptable and prohibited risks to help them make these decisions.

2. Classification and Rating

Once a risk has been accepted, the underwriter assigns a classification and rating to it. This involves assigning the risk to a specific group or class and assigning a rate based on the level of risk. Insurers may have their own classification and rating system, or they may use a system provided by a rating bureau.

3. Policy Forms

After determining the acceptability of an applicant and assigning the proper classification and rating, the underwriter issues an insurance policy. It is essential for the underwriter to have knowledge about the various policy types that exist and have the ability to adapt the policy format to match the requirements of the applicant.

4. Retention and Reinsurance

The final function of underwriting is retention and reinsurance. The underwriter determines the level of risk that the insurer can retain and secures reinsurance for the remaining risk. This helps to protect the insurer from undue financial strain in the event of a loss.

Different Types Of Underwriters

In the financial industry, there are four distinct types of underwriters, each with their unique roles and responsibilities:

1. Insurance Underwriter

Insurance underwriters evaluate the risk involved in insuring properties such as homes, cars, or drivers, as well as individuals seeking life insurance policies. Their main objective is to determine whether the insurance contract is profitable for the insurer by assessing whether the applicant satisfies the criteria necessary to qualify for the policy. Based on their evaluation, they determine the type of policy for which the applicant is eligible and provide a detailed breakdown of what the policy entails for the individual's particular situation.

Insurance underwriters possess extensive knowledge about insurance risks and are adept at avoiding them. They employ their risk assessment skills to decide whether to provide insurance coverage to an individual and under what conditions. In typical cases, underwriting is executed via an automated system, which functions similarly to a quoting system, capable of determining whether an applicant satisfies the insurer's specific coverage requirements.

2. Mortgage Underwriter

The role of mortgage underwriters is to evaluate the risk involved in approving a mortgage application, even if the applicant has a good income and credit score. This is because buying a home is considered a risky venture, and the underwriter needs to conduct a comprehensive risk assessment to determine whether the loan is feasible for the applicant.

To determine the applicant's risk, the underwriter reviews various factors, such as the company's mortgage history, the applicant's credit score, income stability, debt-to-income ratio, savings, and other essential criteria. Furthermore, the underwriter evaluates external factors that may affect the loan, such as the property's value and type, to ensure the mortgage terms are equitable for everyone involved.

In the event that the mortgage application is denied, the applicant can file an appeal. However, this process can be protracted and usually necessitates a considerable amount of evidence to overturn the decision.

3. Loan Underwriter

Loan underwriters, like their counterparts in mortgage underwriting, evaluate the risk associated with approving a loan application, such as for a car loan, with the goal of ensuring the safety of all parties involved. To assess the risk of lending funds to a borrower, large financial institutions often rely on a combination of underwriting software and human underwriters. This approach is commonly used by both small and large banks. Additionally, in situations where business loans are involved, underwriters may be required to provide their expertise to multiple financial institutions, depending on the size of the business.

4. Securities Underwriter

Securities underwriters specialise in working with initial public offerings (IPOs). Their primary responsibility is to evaluate the risk associated with an investment, in order to determine an appropriate price for the IPO. Typically, these individuals are employed by investment banks or other specialised firms.

The sales period is one of the most significant risks involved in securities underwriting. If the security fails to sell at the suggested price, the investment bank becomes responsible for the difference. To make well-informed decisions regarding pricing and sales, securities underwriters must possess a thorough understanding of market trends, financial statements, and other relevant indicators.

Underwriters Vs. Agents And Brokers

When it comes to financial products that require the oversight of an underwriter, such as insurance policies, mortgages, loans, or securities, there is usually also an agent or broker involved in the process. These intermediaries are typically the first point of contact for the customer, and they play a crucial role in selling the product and facilitating the underwriting process.

Agents and brokers are essentially salespeople that are responsible for explaining the product to the customer, gathering their information, and submitting the application to the underwriter for evaluation. They may also be responsible for relaying the underwriter's final decision to the customer.

However, while agents and brokers can provide valuable guidance and insight into the underwriting process, the underwriter in finance has far more decision-making power. The underwriter's evaluation of the customer's financial situation and risk factors ultimately determines whether the application is approved, denied, or accepted with specific terms and conditions.

In some cases, agents and brokers may have a basic understanding of the company's underwriting policies and procedures, which can help them provide more accurate information to the customer. However, the underwriter has the final say, and their decision is based on a comprehensive analysis of the customer's financial background, credit history, and other relevant factors.

Conclusion

Understanding the role of underwriters is critical in various financial situations, and underwriting in finance is a complex process that requires careful evaluation of an individual's financial and health status. By knowing the underwriter meaning and the various complexities involved in the process, you can make better-informed decisions when it comes to your finances. It's essential to ask questions and clarify any doubts during your talks with your broker, agent, or the company in general to ensure you have a clear understanding of the underwriting process.

More About Generic

- Consolidated Fund of India: What is it?

- TTM (Trailing Twelve Months)

- What is a Virtual Payment Address (VPA) in UPI?

- Best Swing Trading Strategies

- What Is FD Laddering?

- What Credit Score is Needed to Buy a House?

- How to Deal with Job Loss?

- Is 750 a good credit score?

- Is 700 a Good Credit Score?

- What is Impulse Buying?

- Fico Score vs Credit Score

- How to remove late payments from your credit report?

- How to Read Your Credit Card Statement?

- Does Paying Car Insurance Build Credit?

- Cashback vs Reward Points

- 5 Common Credit Card Mistakes to Avoid

- Why Did My Credit Score Drop?

- How to Read a CIBIL Report

- How Long Does It Take to Improve Credit Score?

- Days Past Due (DPD) in CIBIL Report

- CIBIL Vs Experian Vs Equifax Vs Highmark Credit Score

- 11 Common Myths about CIBIL Score

- Tactical Asset Allocation

- What is a Certified Financial Advisor?

- What is Wealth Management?

- Capital Fund

- Reserve Fund

- Market Sentiment

- Endowment Fund

- Contingency Fund

- Registrar of Companies (RoC)

- Inventory Turnover Ratio

- Floating Rate Notes

- Base rate

- Asset-Backed Securities

- Acid-test Ratio

- Participating Preference Shares

- What is Expenses Tracking?

- What is Debt Consolidation?

- Difference Between NRE & NRO

- Credit Review

- Passive Investing

- How To Get Paperless Loans?

- How To Check CIBIL Defaulter List?

- Credit Score Vs CIBIL Score

- National Bank for Agriculture and Rural Development (NABARD)

- Statutory Liquidity Ratio (SLR)

- Cash Management Bill (CMB)

- Secured Overnight Financing Rate (SOFR)

- Personal Loan Vs Business Loan

- Personal Finance

- What is Credit Market?

- Trailing Stop Loss

- Gross NPA vs Net NPA

- Bank Rate vs Repo Rate

- Operating Margin

- Gearing Ratio

- G Secs - Government Securities in India

- Per Capita Income India

- What is Term Deposit

- Receivables Turnover Ratio

- Debtors Turnover Ratio

- Sinking Fund

- Takeover

- IMPS Full Form in Banking

- Redemption of Debentures

- Rule of 72

- Institutional Investor

- Capital Expenditure and Revenue Expenditure

- What is Net Income

- Assets and Liabilities

- Gross Domestic Product (GDP)

- Non-Convertible Debentures

- Cost Inflation Index

- What Is Book Value?

- What Are High Net Worth Individuals?

- Types of Fixed Deposits

- What Is Net Profit?

- What is Neo Banking?

- Financial Shenanigans

- China Plus One Strategy

- What is Bank Compliance?

- What Is Gross Margin?

- What Is an Underwriter?

- What is Yield To Maturity (YTM)?

- What is Inflation?

- Types of Risk

- What Is the Difference Between Gross Profit and Net Profit?

- What is a Commercial Paper?

- NRE Account

- NRO Account

- Recurring Deposit (RD)

- What is Fair Market Value?

- What Is Fair Value?

- What is NRI?

- The CIBIL Score Explained

- Net Working Capital

- ROI - Return on Investment

- What Causes Inflation?

- What is Corporate Action?

- What is SEBI?

- Fund Flow Statement

- Interest Coverage Ratio

- Tangible Assets Vs. Intangible Assets

- Current Liabilities

- Current Ratio Explained - Examples, Analysis, and Calculations

- Restricted Stock Units (RSU)

- Liquidity Ratio

- Treasury Bills

- Capital Expenditure

- Non-Performing Assets (NPA)

- What is a UPI ID? Read More

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Frequently Asked Questions

An underwriter evaluates risk by analysing various factors, such as the applicant's financial history, credit score, income, employment status, and other relevant information. The underwriter's job is to determine the level of risk associated with the applicant and whether the company should accept or reject their application.

There are different types of underwriters, including insurance underwriters, investment bankers, mortgage underwriters, and loan underwriters. Each type of underwriter specialises in assessing risk for a particular type of financial product or service.

An underwriter can provide valuable guidance and expertise to a company preparing for an initial public offering (IPO). They can help the company determine the optimal amount of money to raise, the type of securities to issue, and can help market the IPO to potential investors. Additionally, using an underwriter can increase the likelihood of a successful IPO.

The primary risk associated with being an underwriter is underwriting risk, which refers to the potential loss to the insurer or underwriting firm due to faulty underwriting. This risk can negatively impact the solvency and profitability of the insurer or firm. Additionally, underwriters may be exposed to legal and reputational risks if they are involved in underwriting transactions that later prove to be problematic or fraudulent.