- Home

- Derivatives

Derivative Trading Simplified.

Futures & Options trading - at your fingertips!

Derivatives

For all trades

Pricing

Account Opening

Mutual Funds

Commission

We bring to you fair and honest pricing

Explore PricingFutures and Options Trading

powered by technology

FnO 360

5Paisa's dedicated platform for Derivatives Trading

Advanced Order

- Quick Reverse Quickly reverse your positions at one go whenever your view changes

- 1-Click Rollover Carry forward your Futures position efficiently on one click

- VTT Create pending orders for days until your price target is reached

- Bulk Order Tick and place multiple orders at one go

- Derivatives Strategies Execute option strategies using Algos

Analyse Options

- OI Analysis Analyze options data with the help of OI graphs

- Multiple Option Chain View multiple option chains for multiple stocks simultaneously

- Option Chain with Greeks Analyze option using greeks

- Intraday Buildup Analyze OI Buildup

Trader-friendly Interface

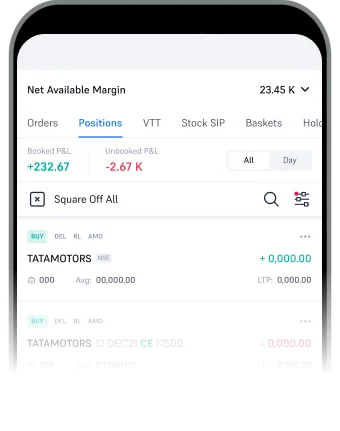

- Upfront live P/L Live P/L upfront on the page

- Sleek order form Easily understand and place your orders with confidence

- Watchlist Customized watchlist specifically for derivatives trading

- Ticker tape Ticker tape for Futures quotes

Power Packed Data & Tools

- Lightweight charts Analyze the market trend with precise information to make smart decisions

- IndiaVix chart Keep track of the volatility at all times

- FII/DII activity Check the FII/DII data for multiple time frames

- FnO Momentum Get to know which stocks are trading in what range

- Screener See which stock is getting the most attention in the market

- News Get market news right at your fingertips

Advanced Trading

- OI Analysis Analyze options data with the help of OI graphs

- Multiple Option Chain View multiple option chains for multiple stocks simultaneously

- Option Chain with Greeks Analyze option using greeks

Analyze Options

- OI Analysis Analyze options data with the help of OI graphs

- Multiple Option Chain View multiple option chains for multiple stocks simultaneously

- Option Chain with Greeks Analyze option using greeks

Trader-friendly Interface

- Upfront live P/L Live P/L upfront on the page

- Sleek order form Easily understand and place your orders with confidence

- Watchlist Customized watchlist specifically for derivatives trading

- Ticker tape Ticker tape for Futures quotes

Power Packed Data & Tools

- Lightweight charts Analyze the market trend with precise information to make smart decisions

- IndiaVix chart Keep track of the volatility at all times

- FII/DII activity Check the FII/DII data for multiple time frames

- FnO Momentum Get to know which stocks are trading in what range

- Screener See which stock is getting the most attention in the market

- News Get market news right at your fingertips

Developer APIs

Build your own trading terminal

Free of cost APIs

Client Libraries

High performance and scalability

Plethora of APIs

Many more features for ultimate Traders’ Delight

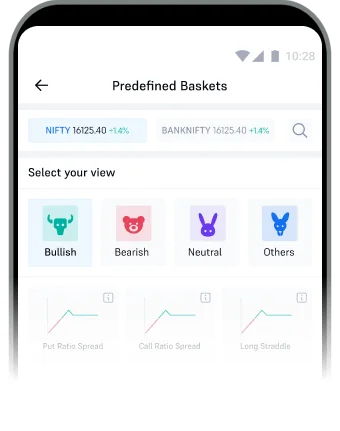

Advisory

Get Advisory on Derivative contracts for Intraday, short term, Baskets and Expiry day. Basket advisory gives you a whole basket which can be executed on one click.

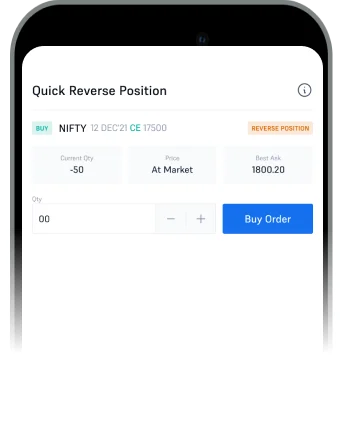

Quick Reverse

When market outlook changes, quickly reverse your long position into short position and vice versa at one click.

Basket Order

Place upto 10 different orders at one go with basket orders. Baskets also help you in executing your strategies and get margin benefit by hedging your positions.

Analyze your positions

Quickly analyze your position with analyze button. Get to know your maximum possible loss, profit, breakeven points and much more all at one click

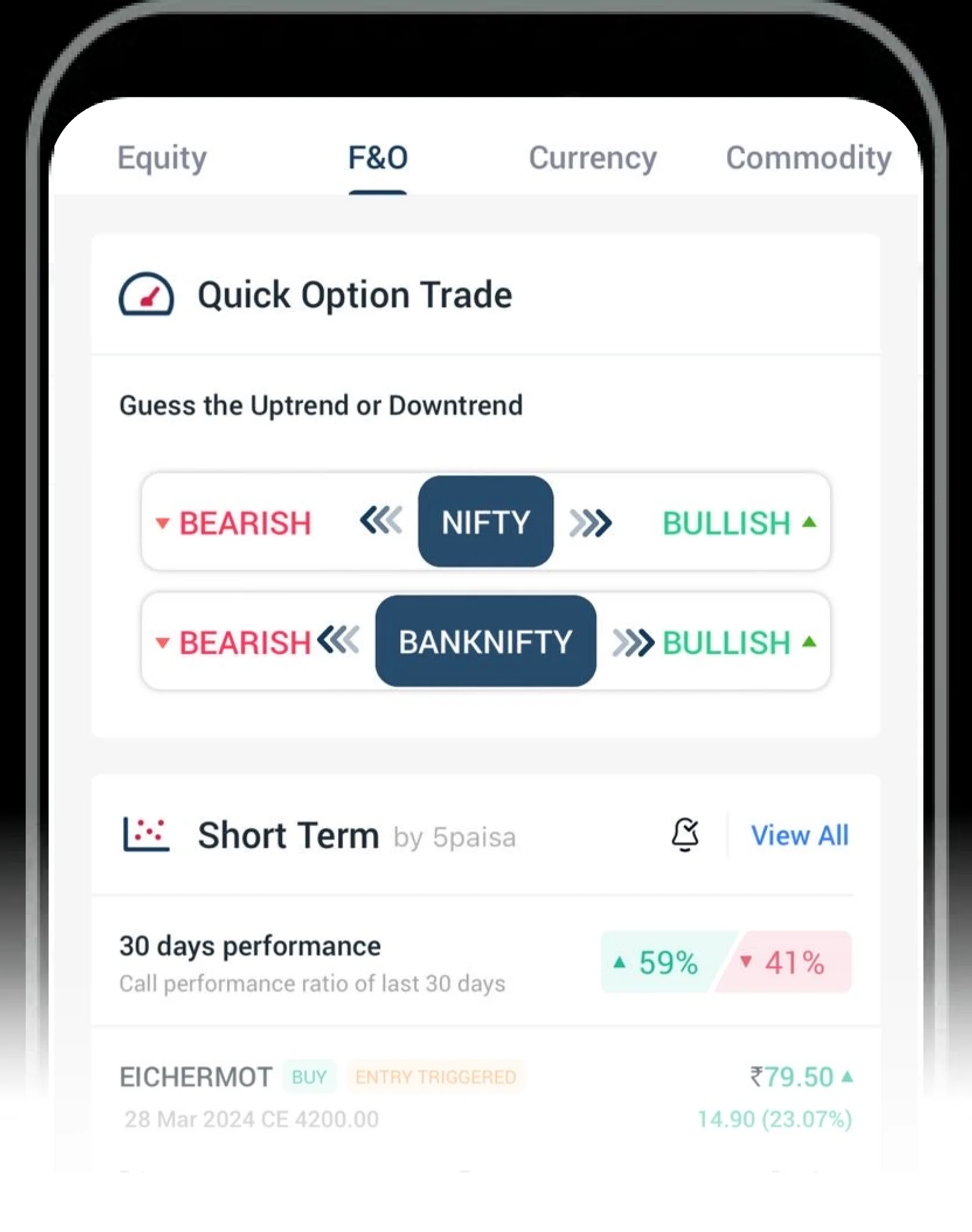

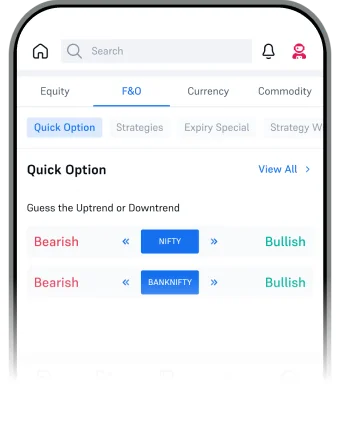

Quick Option

Trade your view with quick option trade. Get predefined option trades on a single swipe according to your market outlook.

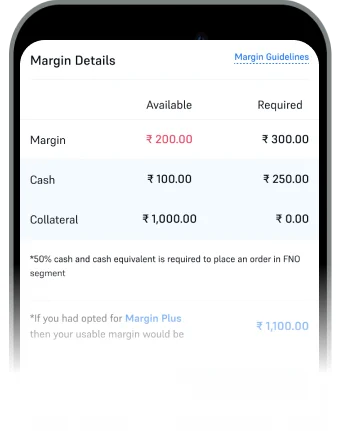

100% Collateral Benefit

No need to maintain 50% cash margin for your FnO trades. With 'Margin Plus', get margin funding at the lowest interest rate starting @ 0.03% per day*, 0% interest on Intraday Funding.

100% Collateral Benefit

No need to maintain 50% cash margin for your FnO trades. With 'Margin Plus', get margin funding at the lowest interest rate starting @ 0.03% per day*, 0% interest on Intraday Funding.

Advisory

Quick reverse

Analyze Your positions

Basket Order

Quick Option

Learn Derivatives with

Your Journey in Derivatives Trading starts here

This is your ticket to financial independence

through Derivatives trading. Be a part of

Finschool to watch or read any of our course,

blogs, dictionary and many more to become a

pro Derivatives trader

-

Total Videos

42

-

Total Courses

32

Futures and Options Trading Explained

Top Benefits of availing MarginPlus are?

- Zero cash margin requirement for Intraday trades across all segments, no interest charged.

- No need to maintain 50% cash margin in F&O (Lowest in the industry starting @10.95% p

- Avail upto 100% cash margin funding for cash delivery orders starting @ 0.045% per day.

- Real time activation of MarginPlus while placing orders across segments.

- Increase your ROI on short term trades with the help of funding.

Type of Funding charge |

Charges |

|||

|---|---|---|---|---|

| Intraday Rates (All Segments) | 0.00% | |||

| Overnight Rates for F&O Segment |

|

|||

| Rates on Delivery Cash Segment(MTF) |

|

What is Futures and Options Trading?

Derivatives trading is a big thing in the stock market today. Future and options are also derivatives of stock trading using a contract and at a later date. Trade futures contracts deal in stock through a contract executed between two parties wherein the stock's price is predetermined. Similarly, options trading is also a method of making a contractual deal on selling stock later at a fixed price.

However, there is one fundamental difference between futures and options trading. While a trade futures contract must necessarily be executed at the stipulated date (meaning that the sale must happen towards the purchaser), in options trading, the buyer has the right but is not obligated to buy the agreed trade derivative. It would appear that options trading is a tad safer than futures trading, with the buyer retaining the right to reject the trade if stock prices are not favourable on the date of the contract.

Futures and Options trading is, more often than not, utilized as an effective method of hedging by market professionals. Deciding the derivative price beforehand and executing a contract helps them seal the sale price if the stock price does not seem to be rising.

With that said, this mode of trading comes with its risks. When a futures and options trader assumes a position on a stock and deals a contract on that value, the price is sealed – if the stock sways opposite, the traders stand to shoulder massive losses.

Who Should Invest in Futures and Options ?

Futures and options trading isn't for everyone since it requires deep knowledge of the stock market dynamics and an intuitive idea of where a stock price would go in the next few months or days. There are three kinds of professionals who typically participate in f&o trading. Let us see who they are.

- Hedgers

- Speculators

- Arbitrageurs

Hedging is a trading strategy that aims at reducing the underlying risk in the financial derivatives being traded. By limiting the volatility in stock prices by trading f&o, hedgers can make profits when the conditions of their stock are not favourable. However, when the price of the concerned stock increases during the contract period, hedgers who deal in futures are likely to incur heavy losses. Here, those who trade in options may save their investment by not going through with the purchase.

These professionals buy and sell their futures options based on a forecasted stock price pattern. Speculators keenly observe stock behaviour on the market and predict a rise or fall. If a stock is predicted to rise, speculators purchase it at a lower price to sell it later when the value is higher, and vice versa.

These professionals work on the big picture of future option trading. By dealing in high volumes, arbitrageurs attempt to offset the profits and losses in f&o trading to a positive difference and consequently cash in on risk-free profits. These professionals have a keen eye for trading and benefit from the market's inefficiencies.

Advantages of Futures and Options Trading

Trading in futures and options exposes investors to highly lucrative market environments that work in multiplied profits based on the decided margin. Professionals who wish to reduce the risks associated with market volatility are the ones who engage in futures and options trading; however, someone wishing to gain more exposure in this market can also plunge in at his own risk. Futures and options do present a very chance of high returns. However, for the unversed, the losses are high too.

Advantages of Futures Trading

- Based on the stock price moving in the predicted direction, a futures contract holder can profit in direct multiples of the decided margin with the futures broker depending on future and options in share market.

- Price fluctuation is not very drastic, owing to the high volume of futures floating in the market, making these investments very liquid.

- With futures trading, brokers charge very low commissions and brokerage.

Advantages of Options Trading

- Options trading is cost-efficient. Compared to buying stock directly, the investor can get more leverage and higher volume when trading in the same stock options if he selects the right call.

- Options have lesser risk than futures, given that it is not compulsory to go through with the purchase in case prices are not favourable.

- Options have a higher percentage return on investment than trading stock directly, which appeals to many seasoned investors.

- Options provide investors with alternatives to achieve investment goals by ways other than direct trading, which accelerates profits.

Types of Futures and Options

- Stock Futures: Derivative contracts from underlying stock are called stock futures.

- Index Futures: Futures contracts trading on an entire market index are index futures.

- Currency Futures: Futures contracts that trade currencies against each other are currency futures.

- Interest Rate Futures: Futures trading on debt instruments are called commodity futures.

- Commodity Futures: Trades in future options based on agricultural, metals, and others are commodity futures.

Types of Options

Options are basically of two types: Call and Put. Let's understand them in detail.

Call Option

Put Option

An options contract has a strike price that must be traded when the stipulated date arrives. A call option gives the buyer the right to buy the underlying asset at the terms of the contract signed. However, the buyer is not obligated to go through with the purchase.

Put options are in stark contrast to call options. These options give the seller the right but not the obligation to sell the option at the strike price in the contract.

Frequently Asked Questions

Derivatives are financial securities, which do not have an independent value. They rely on the value of an underlying asset. Futures and options are two types of derivatives in the capital market.

There are mainly four types of derivative contracts. They are –

- Future Contracts

- Forward Contracts

- Option Contracts and

- Swaps

There are four kinds of participants in a derivatives market. They are Hedgers, Speculators, Arbitrageurs, and Margin Traders.

Exchanges follow a stringent margining system for all future and options contract. Margin Requirements for each segment is different. You may click here for the details.

Though futures are most often associated with commodities, there are other segments as well where futures are available. Apart from Commodities, Futures are available in Index, Stock, Currency and Interest rate.

Forward contracts and Future contracts are similar in nature.

They both allow traders to buy or sell the specific type of asset at a given price at a given time. While a forward contract is a private and customizable agreement that settles at the end of the agreement, a futures contract has standardized terms and is traded on an exchange. Besides, a Forward Contract is usually traded over-the-counter, while in the case of a futures contract the prices are settled on a daily basis until the end of the contract.

Trading on MCX platform takes place on all days of the week (except on Saturdays, Sundays and trading holidays declared by the Exchange). Market timings are as under:

Currency Market –

USD INR, GBP INR, EURO INR & JPY INR Monday to Friday: 9:00 am to 5:00 pm

Commodity Market –

Monday to Friday: 9:00 am to 11:30 pm (up to 11:55 pm on account of day light savings typically between every November and March of the following year)

| Agri-commodities | Monday to Friday | 09:00 am to 05:00 pm |

| Other commodities (such as Bullions, Metals and Energy) | Monday to Friday | 09:00 am to 11:30 pm |

To trade in F&O with 5paisa, you need to activate F&O by submitting your required documents like income proofs. If you already have a trading and Demat account with 5paisa, you do not have to bear any further charges for activation of MCX segment i.e. Commodities segment. If you wish to activate your commodity segment, we request you to process the same from the below mentioned path:

Step 1: Go to www.5paisa.com and click to login

Step 2: Enter Credentials

Step 3: Click on Client code mentioned on the top right corner

Step 4: Click on Client code on the top right side of your page >> Select Profile >> My Segments >>Personal details.

Step 5: Click on the option across segment not selected, select the F&O Segment (F&O includes MCX and Currency derivatives too for the new requests).

Open Free Demat Account in mins