Straddle Strategy

5paisa Research Team

Last Updated: 04 Dec, 2024 04:15 PM IST

Content

- What is straddle strategy?

- How To straddle?

- Why do you need a straddle?

- What Is a Long Straddle?

- How does one earn profits in straddle strategy?

- Conclusion

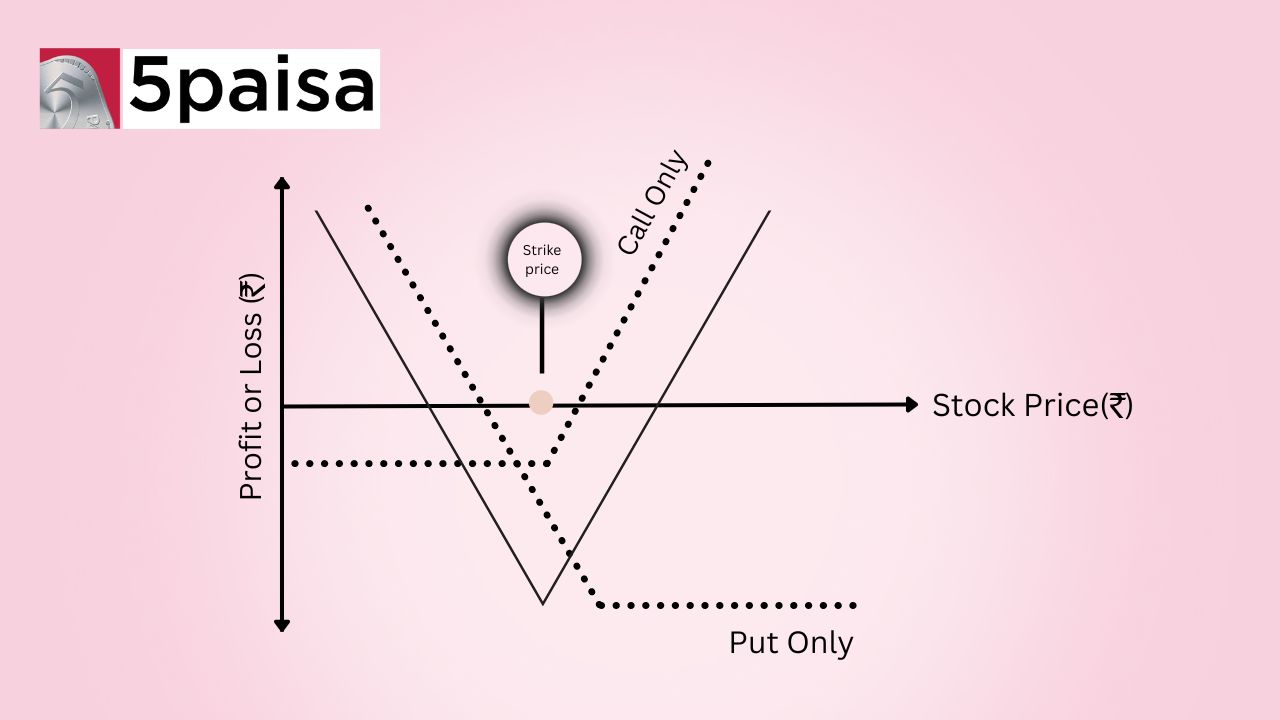

A straddle is a neutral options strategy in which you buy both a put option and a call option for the same underlying securities with the same strike price and expiration date.

A trader will profit from a long straddle when the price of the asset rises or falls by more than the total cost of the premium paid from the strike price. Profit potential is essentially limitless as long as the underlying security's price surges dramatically.

Let's take a look at what is straddle strategy and how it can be used to benefit you.

What is straddle strategy?

A straddle strategy is a strategy used to hedge risk. The word "straddle" means to cover or spread across. It is often used regarding the spread of bets but can also refer to the spread of one's own risk or to spread values or ideas. So what is a straddle strategy? What is it used for, and how can it be incorporated into your business?

How To straddle?

Straddles are complicated in a lot of ways. First, you have to have the right contract. You need to be able to trade stocks and options simultaneously. You need to do a lot of things to benefit from a straddle. You need to be able to do so much to do a straddle. It's a lot more complicated than what people think.

You have to have the right stocks and options. You have to have the right trading knowledge. You have to do a lot before you can do a straddle. It's not just going out there and buying stocks and options. It's not just going out there and buying stocks and doing whatever you want to do. It's a lot more complicated. It's a lot more complex than that.

Why do you need a straddle?

Market prices can sometimes change drastically and quickly. This is why it's important to create a "straddle" in your portfolio. A strategy like this works by buying call options at a certain set price and putting options at a different price. This way, you will always have a profit no matter how the market moves.

You should purchase at the market price to have the best outcome when creating a straddle. This way, you will gain the most money and the least risk. When the market reaches the options price you purchased, you will cash in on your profit. Remember to

keep an eye on the market and keep your strategies updated to ensure the highest profit and least risk.

What Is a Long Straddle?

A long straddle strategy is purchasing both a call option and a put option with the same strike price and expiration date. Depending on the outlook for the stock price, it can be executed for a net credit, a net debit, or a limited risk debit. The objective of the strategy is to profit from a large move in the stock price.

How does one earn profits in straddle strategy?

The Greeks are consistent with a long straddle or "long synthetic option." The question is, how do you place a profit in a straddle? If you have a hold on the underlying stock, then you have to have a higher strike price than the stock's current market price.

You also have to have a strike price that is lower than the stock's current market price. This can be confusing to some traders because you have to have two prices that react differently to the stock. However, "if you can calculate the bet, you can place a profit in a straddle."

Conclusion

The straddle strategy is a risk-neutral strategy that is used in options trading. The advantages of this strategy are that it can be applied in any type of market. In addition, it offers unlimited profit potential as well as limited risk. It is a neutral strategy because it is not affected by the different market trends. The strategy is suitable for both the short and long term. We hope you found this blog useful. Don't forget to mention them in the comments section if you have any questions!

More About Derivatives Trading Basics

- Notional Value

- Guidance to Futures and Options Trading in the Stock Market

- Covered Call

- What Is Put Writing?

- Delta Hedging

- Credit Spread

- Currency Options

- Options Hedging Strategy

- Options And Futures: Understand The Functioning, Types and Other Factors

- Options Trading for Beginners: A Comprehensive Guide For You

- Best Options Trading Courses: Things To Know About

- Short Strangle: How Does It Work In 2023

- Butterfly Option Strategy

- Options Selling

- What Are Stock Options: A Complete Guide 2023

- What is the Call and Put Option?

- What are Futures and Options?

- What is Implied Volatility?

- Open Interest in Options

- What is Strike Price?

- What Is a Call Option?

- What is a Put Option?

- How to Choose Best Stocks for Option Trading?

- Options Trading Tips

- How to Trade Options?

- Types of Options

- Understanding Various Options Trading Strategies

- What are Options?

- What is Put-Call Ratio?

- What is Margin Money?

- What is an Open Interest?

- Call Options Basics and How it Works?

- The Simplest Guide to Futures Pricing Formula

- What are Bullish Option Strategies?

- What are the Various Types of Derivatives?

- What is Bermuda Option?

- What are Swaps Derivatives?

- What is an Index Call? Overview of Index Call Options

- What is Forward Market?

- What is Option Volatility & Pricing Strategies for Advanced Trading

- What is Settlement Procedure?

- What is Margin Funding?

- Derivatives Trading in India

- Difference Between Equity and Derivatives

- What are Currency Derivatives?

- Derivatives Advantages & Disadvantages

- What are Forward Contracts?

- Difference Between Forward and Futures Contract

- How to Trade in Futures and Options?

- What is Meant by Futures in Trading?

- Stock Index Futures

- Stocks vs Futures

- What Are Exchange Traded Derivatives?

- Futures Contract: Meaning, Definition, Pros & Cons

- What is Options Trading?

- What is Derivative Trading?

- What is Futures Trading?

- What are Derivatives?

- Straddle Strategy

- Options Strategies

- Hedging Strategy

- Difference Between Options and Futures

- Derivatives Trading Strategies Read More

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.