Benefits of Diversification by Investing in Silver ETFs

“Too many people miss the silver lining, because they’re expecting gold.” – Maurice Setter

These words by former English football player, Maurice Setter beautifully underline the significance of identifying and capturing opportunities. Often, we miss good opportunities in a bid to fulfill our very high expectations. Time and again, the two precious metals of gold and silver have proven as a safe haven against uncertain economic cycles and the extreme ebbs and flows seen in capital markets.

Most investors always keep a slot reserved to park gold investments in their overall portfolio. Few, however, understand the benefits of investing in the lesser loved cousin of the yellow metal – Silver. Unlike Gold, Silver has dual purposes.

On one hand, it is a precious metal and provides safety in turbulent times such as the pandemic. On the other hand, it is used extensively across traditional as well as new-age industries. This means, demand for this metal emerges from two sections – consumers and investors.

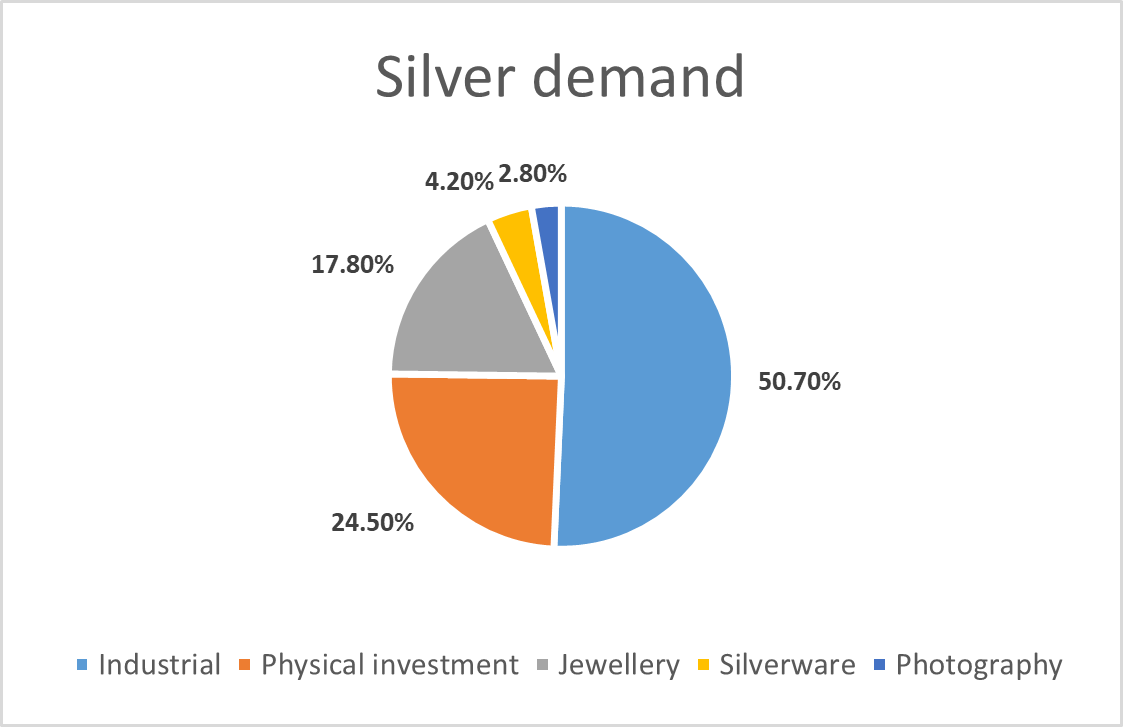

Source: World Silver Survey, 2021

Given its higher industrial usage relative to gold (which is largely used for jewellery and investment purposes), silver is more tied with the economic changes. This means, its demand increases in times of economic recovery. Silver also provides better hedge against inflation than gold. Is it time now to make way for this metal within your investment portfolio? Read on to know the answer to this question.

Traditionally, Indians have purchased silver for two purposes – jewellery and utensils. Experts believe silver can help investors diversify their portfolios. It is more volatile than gold, and hence, investors with high risk appetite should have larger share of silver than gold in their portfolios. In recent times, savvy investors have also started taking exposure to silver via commodity exchanges. These exchanges, though are more suitable for traders rather than investors.

In November 2021, capital markets regulator SEBI gave a nod to the launch of Silver Exchange Traded Funds (ETFs). SEBI also issued operating guidelines for mutual fund houses launching this product. Consequently, several mutual funds launched their own Silver ETFs. With this new product, investing in silver is much easier and hassle-free.

Let us understand all about Silver ETFs in detail.

What is a Silver ETF?

A Silver ETF is can be bought and sold on stock exchanges the same way we buy shares. Under these ETFs, mutual funds invest at least 95% of the total corpus in physical silver or products like Exchange Traded Commodity Derivatives (ETCDs) where silver is the underlying asset.

These funds are benchmarked against the price of silver (based on London Bullion Market Association, Silver daily spot fixing price). The mutual fund houses have to keep the physical silver with a 3rd party custodian and receive an auditors’ report for physical verification of silver at periodical intervals.

What is the Difference Between Physical Silver and Silver ETFs?

|

|

Physical silver |

Silver ETFs |

|

Form |

Silver coins, jewellery, silver bars, etc. |

Paper |

|

Liquidity |

Medium |

High |

|

Cost of storage and insurance |

Highest as it entails storage costs such as locker rent, insurance premium |

Low, as they are held in demat account |

|

Taxation |

High (GST payable at the time of purchase, no credit available while selling) |

Low, as the mutual fund house pays GST while buying silver, avails credit while selling silver |

|

Pricing mechanism |

Based on the market price of silver |

Based on the market price of silver |

|

Safety of silver |

To be ensured by the investor |

To be ensured by the mutual fund house |

|

Value at the time of sale |

Typically, there is some loss in value |

Market linked prices, allowing investors to benefit from real-time movement in prices in just a few clicks |

|

Arbitrage opportunity with gold |

Not available |

Arbitrage is possible between Gold ETFs and Silver ETFs |

Benefits of investing in Silver ETFs:

1) No more worries about purity, theft, storage & liquidity

2) Silver investing is now easier, accessible & transparent

3) Invest through your Demat Account

4) Start with investments as low as ₹100

How are Profits on Silver ETF Taxed?

If these investments are sold before 36 months, the profits so generated are subject to short term capital gains tax and will attract regular income tax as per the slab rates applicable to the investor.

If investments in silver ETFs are for more than 36 months, profits on their sale will be taxed at 20% under long term capital gains tax.

How can you Invest in Silver ETF with 5paisa?

All you need is a demat account with 5paisa to start investing in Silver ETFs. Get in touch with our team for expert advice and guidance on the same.

Also Read:-

Start Investing in 5 mins*

Rs. 20 Flat Per Order | 0% Brokerage