Weekly Outlook on Natural Gas - 07 June 2024

Weekly Outlook on Copper - 12th September 2022

Last Updated: 9th December 2022 - 09:23 am

The copper prices gained 3.1% during the week after unionized workers at Chile’s Escondida, the world’s largest copper mine, voted to go on strike over safety concerns.

COPPER-WEEKLY OUTLOOK

The premium of LME cash copper over the three-month contract jumped to $129 a tonne on Thursday, the highest since last November, showing near-term tightness in LME inventories. LME copper stocks have shed 22% over the past four weeks to 102,725 tonnes, the lowest in five months.

Chinese government officials said that the country would likely increase its pace of stimulus measures in the third quarter, after the economy barely expanded in the second quarter. However, the metals demand outlook was clouded by persisting COVID curbs in China.

LME Copper witnessed a sharp move from $7615 to $8012 during the last week but failed to sustain above the $8000 mark, and closed at $7851 with 2.5% gains. On the daily timeframe, the price has reversed from the lower Bollinger Band support and moved above the 50-Days Simple Moving Average. While the weekly candle ended within the prior week, candles suggest indecisiveness. Overall, the copper has support at $7645 and $7515 while resistance is at around $8035/ $8280.

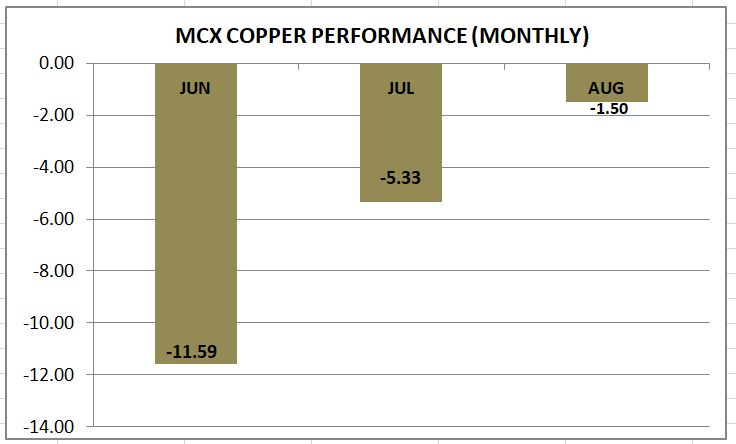

MCX Copper performance of last three months:

The MCX copper price has pulled up from the prior week's low but traded below the breakdown of the Bearish Flag pattern and the 50-Days SMA that suggests bearishness for the short term. However, a momentum indicator RSI witnessed a positive crossover that supports the pullback move. An indicator CCI has also reversed from oversold territory. So, based on the above mixed parameters, the pullback moves may continue till Rs. 670/675 levels. However, on the higher side, it has a resistance at around Rs. 685 levels. While, on the downside, the crucial support is at Rs. 630. For the coming week, traders can look for buying only above Rs. 660 for the immediate target of Rs. 670/675.

Important Key Levels:

|

MCX COPPER (Rs.) |

LME COPPER ($) |

|

|

Support 1 |

630 |

7645 |

|

Support 2 |

615 |

7515 |

|

Resistance 1 |

685 |

8035 |

|

Resistance 2 |

710 |

8280 |

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Commodities Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta