Weekly Market Outlook for 18 December to 22 December

Last Updated: 18th December 2023 - 11:07 am

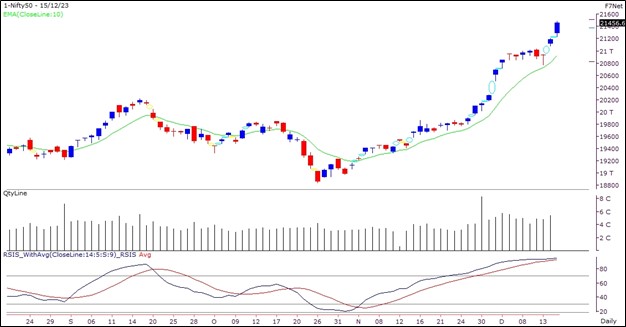

It was a remarkable week for the equity markets as Nifty continued to mark new record highs and positive news flows from the global markets led to a continuation of the buying interest in our markets. Nifty almost tested the mark of 21500 towards the end of the week before closing just above 21450 with weekly gains of over two percent.

Nifty Today:

During the week gone by, our markets witnessed a minor pullback move during mid-week, but the positive news flows from FED’s commentary which hinted at interest rate cuts in next calendar year led to a renewed buying interest in some of the sectors such as IT, Metals and PSU Banks. The Nifty posted highest ever close and the data remains optimistic as the FII’s have been buying not only in the cash segment, but they have formed long positions in the index futures segment as well. Now, the RSI readings on the daily chart of Nifty are in overbought zone, but it is often seen that the upmove continue in such a scenario if the trend is strong. The support from the large cap stocks could lead to a continuation of the upmove in the coming week as well. Hence, traders should ride the trend with a revised stop loss method and lighten up positions only if important supports are breached. However, one can start booking profits in the midcap and the small-cap space as the risk reward doesn’t seem much favorable here from a short term perspective and focus on larger names. The immediate supports for Nifty for the coming week are placed around 21200 and 21070 while the levels to watch on the higher side will be around 21600 and then in 21900-22000 range.

Nifty hits new highs as US Fed signals rate cuts in 2024

Since the indices are trading at all-time high, it is better to ride the trend with a trailing stop loss method and avoid contra trades until any reversal seen. The large cap IT stocks witnessed buying interest post the recent FED commentary as it could lead to a better growth outlook for these stocks. A fresh buying interest could lead to further upmove in this sector which could keep the market momentum intact.

Nifty, Bank Nifty Levels and FINNIFTY Levels:

| Nifty Levels | Bank Nifty Levels | FINNIFTY Levels | |

| Support 1 | 21300 | 47780 | 21400 |

| Support 2 | 21200 | 47600 | 21300 |

| Resistance 1 | 21600 | 48370 | 21620 |

| Resistance 2 | 21650 | 48600 | 21700 |

- Performance Analysis

- Nifty Predictions

- Market Trends

- Insights on Market

Trending on 5paisa

Market Outlook Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta