Stock in Action – EID Parry 18 December 2024

Stock Of The Day – Cochin Shipyard Ltd

Last Updated: 16th April 2024 - 05:02 pm

Cochin Shipyard Ltd. Stock Movement of Day

Probable Rationale Behind Cochin Shipyard Stock Surge

Cochin Shipyard Limited (CSL) has witnessed significant growth & garnered attention due to several strategic initiatives & successful projects. Here are some key factors that likely contribute to recent surge in CSL's stock:

1. Green Vessel Construction & Demand from Europe

- CSL's steel cutting of world's first zero-emission feeder container vessel using green hydrogen as fuel for Samskip positions it as pioneer in eco-friendly shipping.

- Europe's increasing focus on green vessels & commitment to reducing carbon emissions has led to surge in queries from Western European companies seeking green shipping solutions.

- CSL's plan to turn green vessel construction into key earning source aligns well with this market trend.

2. Demand for Replacement Vessels

- average age of existing vessels (approximately 2,500 in number) is approaching 20 years. As these vessels need replacement, newer technologies & lower emission vessels (green or hybrid) are preferred.

- CSL's expertise in ship-building & repair positions it well to meet this demand for modern, environmentally friendly vessels.

3. Financial Performance

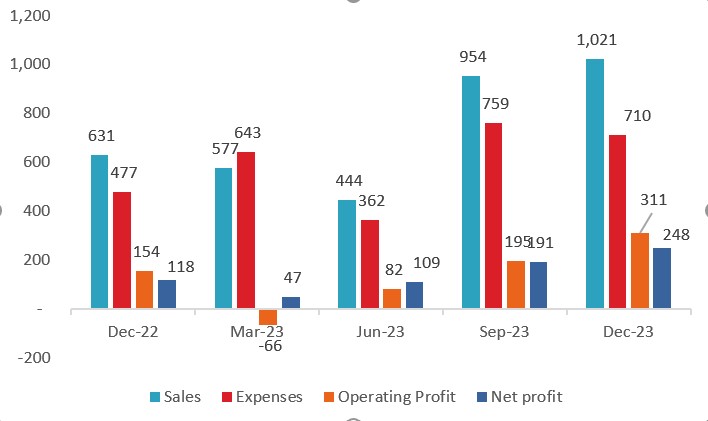

- In Q3FY24, CSL witnessed remarkable 62% increase in turnover, reaching Rs 1,021.45 crore compared to Rs 631 crore in Q3FY23.

- profit after tax for Q3FY24 stood at Rs 248 crore, substantial 109% increase from Rs 118 crore in Q3FY23.

- These strong financial results have bolstered investor confidence & contributed to stock surge.

4. Successful Projects & Credentials

- CSL's delivery of two autonomous electric barges for ASKO Maritime in Norway showcases its capabilities in green shipping.

- Successful construction of Kochi Metro vessels further enhances CSL's reputation in West European green shipping circuit.

5. Master Shipyard Repair Agreement (MSRA) with U.S. Navy

- CSL's recent agreement with U.S. Navy enables it to repair U.S. Naval vessels under Military Sealift Command.

- This collaboration positions CSL as key player in ship repair & maintenance, contributing to its overall growth prospects.

Cochin Shipyard’s Operational Performance

Analysis & Interpretations

1. 62% increase in turnover

2. EBITDA margin of 34%

3. Split of equity shares approved

4. Second interim dividend declared for FY '23

Cochin Shipyard’ Projects & Orders

1. INS Vikrant & ASW SWC projects driving revenue in Shipbuilding & Ship Repair

2. Progress on ASW SWC project with 3 vessels launched & 2 more in advanced stages

3. Received orders for Hybrid SOV for European market

4. Signed ship repair contracts for medium refit of 2 Indian Naval vessels valued at INR150 crores

5. Order book stands at INR21,500 crores with significant orders in defense & commercial sectors

Cochin Shipyard’ Sustainability & Infrastructure

1. Achieved GreenCo Gold rating, showing commitment to environmental sustainability

2. Inaugurated new dry dock project & International Ship Repair Facility by Prime Minister

Cochin Shipyard’ Future Outlook

1. Expecting 15% growth in turnover for FY '25

2. EBITDA margin around 18-19%

3. Ship Repair segment expected to reach INR1,200-1,500 crores in next few years

4. Focused on European market for new orders, especially in wind energy sector

5. Positive outlook on business opportunities, especially in Europe, due to geopolitical factors & increasing demand for green shipping

6. Ship repair market expected to grow significantly, targeting replacement of old vessels with newer, greener technologies

Conclusion

In summary, CSL's strategic focus on green vessel construction, strong financial performance, successful projects, & partnerships with global entities have likely fueled recent surge in its stock value. Investors recognize company's potential as leader in sustainable shipping solutions & repair services.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Fundamental & Technical Analysis Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta