Stock in Action – EID Parry 18 December 2024

Stock in Action – Trent Ltd

Last Updated: 18th April 2024 - 05:03 pm

Trent Ltd stock Movement of Day

Probable Rationale Behind Stock Surge

Trent Ltd., retail arm of prestigious Tat Group, has recently unveiled three new store formats in Hyderabad, marking significant expansion in its retail footprint. newly opened stores include Zudio, Westside, & Star Bazaar, catering to diverse range of consumer needs from fast fashion to hypermarket essentials.

Strategic location of these stores at GS Centre Mall, Punjagutt Circle, in heart of Hyderabad, reflects Trent Ltd.'s commitment to enhancing customer experience & capturing larger market share in one of India's key metropolitan areas.

1. Diversification & Market Penetration

- Trent Ltd. has diversified its retail offerings by introducing multiple store formats under one roof, catering to different consumer segments. This diversification strategy is aimed at capturing broader customer base & increasing revenue streams.

- With addition of new outlets, Trent Ltd. strengthens its presence in Hyderabad, high-potential market known for its growing consumer base & purchasing power.

2. Strong Financial Performance

- Trent Ltd. reported remarkable two-fold rise in consolidated net profit for third quarter ended December 2023. This impressive performance was driven by robust sales momentum & improved margins, indicating operational efficiency & effective cost management.

- Company's strong financial performance reflects its ability to adapt to changing market dynamics & capitalize on emerging opportunities in retail sector.

3. Expansion & Growth Prospects

- Opening of new stores underscores Trent Ltd.'s commitment to expansion & growth. With total of 232 Westside stores, 545 Zudio stores, & 5 Star Bazaar locations across India, company continues to expand its retail footprint & strengthen its position in market.

- Trent Ltd.'s joint ventures with global fashion brands like Zara & Massimo Duttia further enhance its product portfolio & appeal to discerning consumers, providing avenues for sustained growth & profitability.

4. Investor Confidence & Market Response

- Positive market response to Trent Ltd.'s expansion initiatives are evident from surge in its stock price. Shares of company traded significantly higher, reflecting investor confidence in company's growth prospects & financial performance.

- Stock's upward trajectory is supported by strong fundamentals, including robust earnings growth, strategic expansion plans, & favourable outlook for retail sector in India.

Financial Health of Trent Ltd

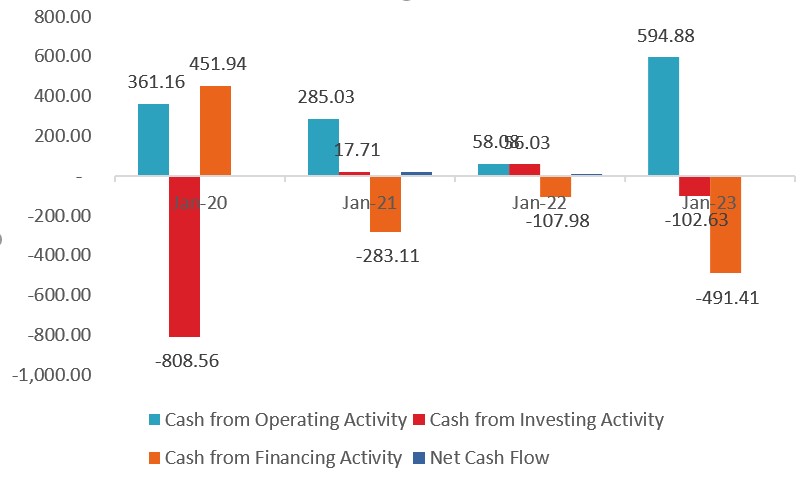

Financial Analysis of Trent Ltd.'s Cash Situation

Trent Ltd.'s cash flow from operating activities, investing activities, & financing activities provides valuable insights into company's financial health & management of its cash resources over past decade.

1. Cash from Operating Activities

- Trent Ltd. witnessed fluctuations in cash from operating activities over years, with significant increase from FY 2019 to FY 2020, followed by substantial rise in FY 2023. This indicates improved operational efficiency & stronger cash generation capabilities.

- Positive trend in cash from operating activities reflects Trent Ltd.'s ability to generate cash from its core business operations, driven by factors such as revenue growth, cost optimization, & effective working capital management.

2. Cash from Investing Activities

- Cash flow from investing activities shows varying trends, with notable negative figures in FY 2015, FY 2020, & FY 2022. These negative cash flows indicate significant investments made by company in capital expenditures, acquisitions, or other long-term assets.

- However, Trent Ltd. managed to generate positive cash flows from investing activities in FY 2021 & FY 2023, possibly through divestments or better management of investment portfolios.

3. Cash from Financing Activities

- Trent Ltd. experienced fluctuations in cash flows from financing activities, with both positive & negative figures across different fiscal years. Notably, company generated substantial cash inflows from financing activities in FY 2015 & FY 2020, primarily attributed to debt financing or equity issuances.

- Negative cash flows from financing activities in subsequent years may indicate debt repayments, dividend payments, or share buybacks, reflecting company's efforts to optimize its capital structure & manage financial obligations.

4. Net Cash Flow

-Net cash flow represents overall change in Trent Ltd.'s cash position after accounting for cash flows from operating, investing, & financing activities.

- Despite fluctuations in individual cash flow components, Trent Ltd. maintained positive net cash flow in most fiscal years, indicating its ability to generate cash inflows to cover its cash outflows & maintain healthy liquidity position.

Trent Recent Operational Performance Quarterly

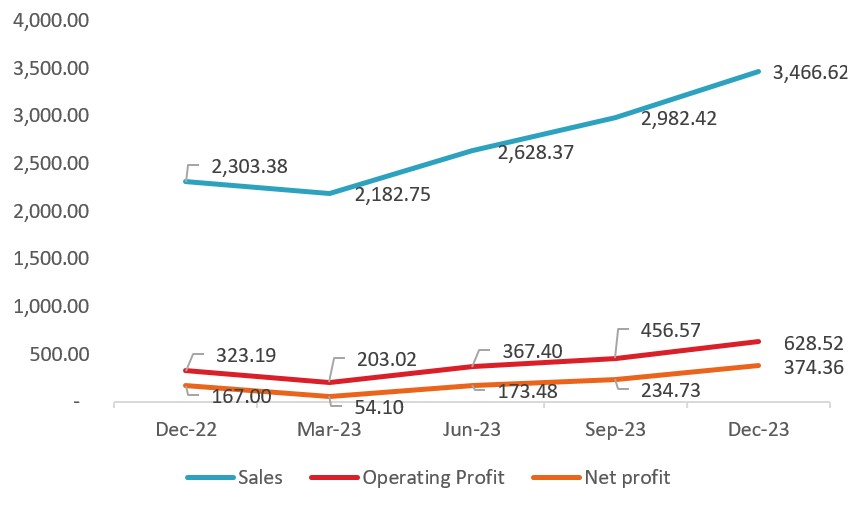

Financial Performance Analysis of Trent Ltd.

Trent Ltd.'s financial performance, as reflected in its sales, operating profit, & net profit figures, exhibits both growth & variability over past several quarters.

1. Sales

- Trent Ltd. experienced steady growth in sales from September 2021 to December 2023, with notable increase in revenue over successive quarters.

- Company's sales trajectory reflects its ability to capture market demand & effectively execute sales strategies, possibly driven by factors such as expansion of store network, product innovation, & customer engagement initiatives.

- Consistent growth in sales demonstrates Trent Ltd.'s resilience in navigating market dynamics & capitalizing on opportunities for revenue generation.

2. Operating Profit

- Despite fluctuations, Trent Ltd. has generally maintained positive trend in operating profit, indicating its ability to generate profits from core business operations.

- Peak in operating profit during June 2023 reflects significant improvement in operational efficiency & profitability, possibly attributed to cost optimization measures, revenue growth, or favorable market conditions.

- Trent Ltd.'s ability to sustain & enhance operating profit over time underscores its effective management of operational challenges & focus on driving profitability.

3. Net Profit

- Trent Ltd.'s net profit demonstrates variability over analysed period, with fluctuations in profitability across quarters.

- While company experienced significant increase in net profit during December 2023, there were periods of minimal or negative net profit, such as March 2022 & September 2022.

- Factors influencing net profit variability may include fluctuations in operating expenses, non-recurring expenses, tax implications, & other extraordinary items impacting bottom line.

In conclusion, Trent Ltd.'s recent expansion & strong financial performance position company for continued growth & value creation. introduction of new store formats, coupled with its successful retail strategy & market presence, reinforces investor confidence & drives stock's upward momentum.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Fundamental & Technical Analysis Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta