Stock in Action – Tanla Platforms Ltd.

Last Updated: 13th December 2023 - 06:33 pm

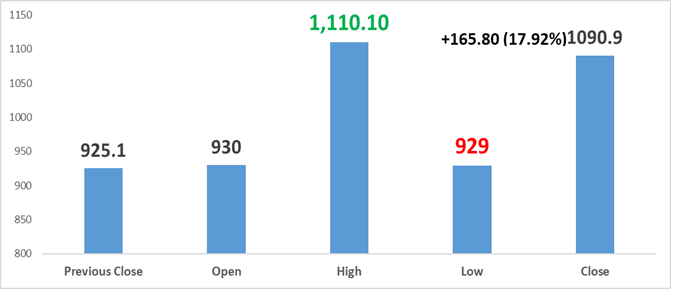

Movement of the Day

Technical Analysis

1. The counter was above the simple moving averages (SMAs) of five, ten, twenty, thirty, fifty, one hundred, one hundred fifty, and two hundred days.

2. The relative strength index (RSI) for the counter after 14 days was 60.79.

3. Oversold is defined as a level below 30, while overbought is defined as a number beyond 70.

The stock is looking bullish, taking cues from strong sentiments from the benchmark indices.

Rationale Behind the Tanla Platforms Ltd Surge

Tanla Platforms, under the astute leadership of Chairman and CEO Uday Reddy, has marked an impressive trajectory in the second quarter, reporting robust financials and setting a milestone with quarterly revenue surpassing the ₹1,000-crore mark. This surge has been fueled by strategic domestic price increases and key acquisitions, positioning Tanla as a formidable player in the Communication Platform as a Service (CPaaS) sector.

1. Domestic Price Increases Fueling Growth

Mr. Uday Reddy anticipates a period of significant growth in the third quarter, building upon the gains from domestic price hikes implemented in the second quarter. These strategic increases resulted in a noteworthy ₹35 crore gain for Tanla. The impact is expected to be more pronounced in the upcoming quarter, with a full three months of the price adjustments factored in. This forward-looking perspective instills confidence in Tanla's growth trajectory.

2. Strong Q2 Financial Performance

Tanla reported a stellar revenue growth of 18.5% in the second quarter, reaching ₹1,008.60 crore. This remarkable achievement marks the first time the company has crossed the ₹1,000-crore quarterly revenue milestone. The growth is attributed to a 7% increase in organic revenue and an impressive 27% uptick in the digital platforms segment. Profits surged by 29.1% year-on-year, reaching ₹142.50 crore for the July-September quarter, signaling operational efficiency.

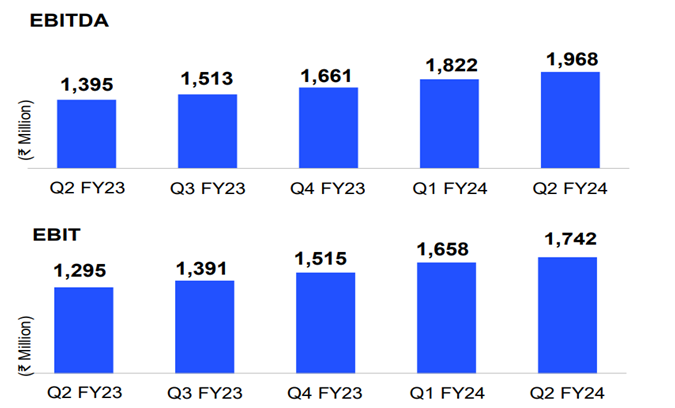

Operating income

1. EBITDA margin was at 19.5% in Q2, up 312 bps YoY.

2. Amortization of intangible due to VF acquisition was ₹28 Mn

Strong cash flow generation

Days of Sales Outstanding up by 7 days to 75 in Q2. ValueFirst operates at slightly higher DSO days contributing to increase.

3. Share Price Surge Post Q2 Earnings Report

In the aftermath of Tanla Platforms' second-quarter earnings report, the company's shares experienced a robust 5% surge in trade. This surge indicates strong investor confidence and positive market sentiment surrounding Tanla's growth prospects. The market has responded favorably to the company's impressive financial performance and strategic initiatives.

4. Strategic Acquisitions Strengthen Market Position

Tanla Platforms strategically expanded its reach through the acquisition of ValueFirst India for ₹346 crore, positioning itself as India's third-largest CPaaS provider. The acquisition also includes ValueFirst's West Asia business. Mr. Reddy highlighted that ValueFirst India substantially contributed to Tanla's revenue growth, generating an additional ₹100 crore at the consolidated level. The acquisition has not only expanded Tanla's market presence but also demonstrated its commitment to tapping into emerging markets.

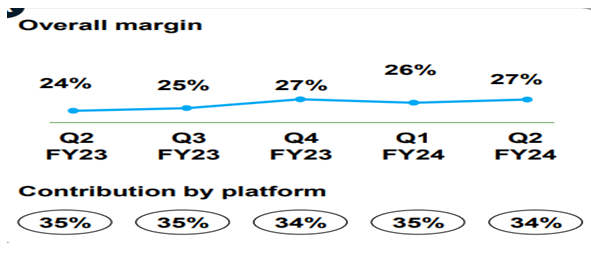

Digital Platform gross margin contribution to total at 34% (Source: IP)

Enterprise business

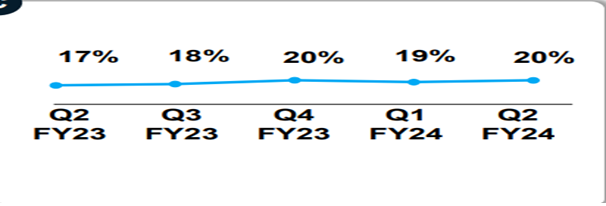

Enterprise Communications gross margin at 20% in Q2 (Source: IP)

Positive Outlook

Positive Outlook for Tanla's Future Growth

In the recent quarter, Tanla Platforms demonstrated a commendable 10.7% quarter-on-quarter revenue growth, primarily propelled by the strategic acquisition of ValueFirst. While the organic growth remained steady, the enterprise business faced a temporary setback due to a decline in promotional traffic. However, the platform segment exhibited robust growth of 8.4% quarter-on-quarter, notably driven by the Over-The-Top (OTT) platform, specifically WhatsApp.

Despite a temporary dip attributed to the National Long Distance (NLD) price hike effective August 23, leading to a volume decline, there is optimism that the situation will normalize. Looking ahead, Tanla anticipates substantial growth in the Enterprise business, fueled by the following factors:

1. Transactional SMS Traffic Surge: The growth in transactional SMS traffic, particularly driven by UPI and OTP, is expected to play a pivotal role in driving the Enterprise business to new heights.

2. NLD Price Hike: The recent NLD price hike, while initially impacting volumes, is projected to contribute positively to future growth as the market adjusts.

3. Market Share Expansion with ValueFirst: The strategic acquisition of ValueFirst positions Tanla to gain significant market share in the Enterprise segment, providing a strong catalyst for growth.

Conclusion

Tanla Platforms' bullish momentum is underpinned by a confluence of factors – strong domestic price increases, stellar financial performance in Q2, a significant surge in share prices, and strategic acquisitions. The company's proactive approach in adapting to market dynamics and capitalizing on growth opportunities positions it as a compelling investment choice. Investors are advised to closely monitor Tanla Platforms as it navigates the evolving landscape of the Communication Platform as a Service sector.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta