Stock in Action: Sun Pharma Advanced Research Company

Last Updated: 24th November 2023 - 09:05 pm

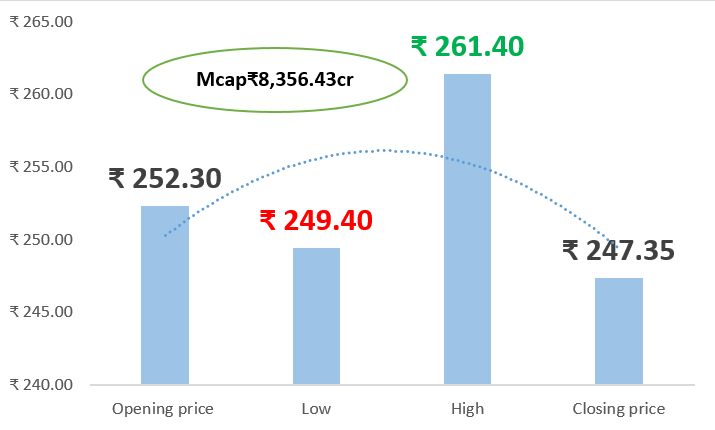

On the final trading day of Sun Pharma Advanced Research Company, the stock exhibited a dynamic performance. Commencing at ₹252.3, it concluded the day at ₹247.35. Throughout the trading session, the stock touched a pinnacle at ₹261.4, with the lowest point reaching ₹249.4.

The company's market capitalization stands impressively at ₹8,356.43 crore. Reflecting on its performance over the past year, the stock's 52-week high and low are recorded at ₹267 and ₹160.5, respectively. Notably, the day's BSE volume stood at 141,935 shares, underlining the market activity surrounding the company's stock.

Probable Rationale behind the Surge:

This upward momentum follows the announcement of a significant agreement regarding the innovative alopecia areata treatment, SCD-153.

Under this ground-breaking development, SPARC has entered into an exclusive licensing agreement with Johns Hopkins University (JHU) and The Institute of Organic Chemistry and Biochemistry of the Czech Academy of Sciences (IOCB) for SCD-153, a pioneering topical drug designed to address hair loss. The agreement encompasses all patents and patent applications associated with SCD-153, controlled by IOCB.

SCD-153, the result of a collaborative effort between SPARC, JHU, and IOCB, marks a significant stride in the field of alopecia areata treatment.

The stock's surge is attributed to the potential of this first-in-class topical drug, which has garnered approval for Investigational New Drug (IND) status from the Drug Controller General of India (DCGI).

SPARC's Chief Executive, Anil Raghavan, highlighted the successful collaboration between SPARC and academic institutions, emphasizing the potential impact of topical SCD-153 in providing a crucial treatment option for clinicians and patients dealing with Alopecia Areata.

The stock's positive response reflects the market's optimism about the prospects of SCD-153 and the company's expanding portfolio in the therapeutic segment, complemented by existing products such as deuruxolitinib.

Investors seem to view this licensing agreement as a strategic move by SPARC, with the licensors being entitled to upfront payments, milestone payments based on regulatory and sales achievements, and tiered royalties on sales. The market's positive reception to this development underscores the potential value that SCD-153 could bring to SPARC, both medically and financially, positioning the company favourably in the competitive pharmaceutical landscape.

Financial Summary:

Strength: Liquidity Position

SPARC maintains a robust liquidity position, despite extended product development timelines that require substantial R&D investments before generating returns. To meet funding needs, the company relies on external borrowing, with repayment obligations around Rs. 75 Cr for FY2023. However, SPARC's liquidity is well-supported by the financial flexibility of its promoters and promoter group.

Being listed on stock exchanges, the company has a proven track record of raising funds directly from capital markets, ensuring continued strong liquidity. Access to capital markets and the promoters' financial flexibility are key factors contributing to SPARC's anticipated strong liquidity position.

Outlook:

Analysts expects SPARC to have a 'Stable' outlook in the medium term. This is because of the management's extensive experience, a strong pipeline in research and development, and effective resource mobilization. The outlook could turn 'Positive' if key products develop faster than anticipated and licensing agreements are completed.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta