Stock in Action – EID Parry 18 December 2024

Stock in action – PNB Housing Finance Ltd

Last Updated: 19th January 2024 - 03:23 pm

Movement of the Day

Analysis

1. Pivot Levels: The Classic Pivot Levels suggest key support at 814.78 and resistance at 871.72, with the pivot point at 836.87. Fibonacci Pivot Levels align with the Classic levels, emphasizing a pivotal point at 836.87. Camarilla Pivot Levels indicate a tight range, with 817.97 as potential support and 837.13 as resistance.

2. Price Performance: The stock has shown impressive price performance, gaining 9.85% in the last week, 5.32% in the last month, and a notable 55.18% over the past year. The YTD performance stands at 9.66%, reflecting a positive trend.

3. Volume Analysis: The volume analysis depicts a substantial increase in trading activity today, with 44L shares traded. This is notably higher than the 1-week and 1-month averages of 22.66% and 14.45%, respectively. The elevated volume suggests heightened market interest and participation.

Probable Rationale behind the Surge

PNB Housing Finance Ltd. has witnessed a positive market sentiment and a surge in share prices, reflecting investor confidence. This report aims to explore the potential rationale behind this surge based on available information and market dynamics.

Key Highlights

1. Net Interest Margin Expansion

Experts expectation of a 20 basis points expansion in net interest margins (NIM) over the next two years to 4.4% in FY26 contributes positively to the optimistic outlook. This is attributed to decreasing borrowing costs and a slight expansion in yields.

2. Strategic Transformation

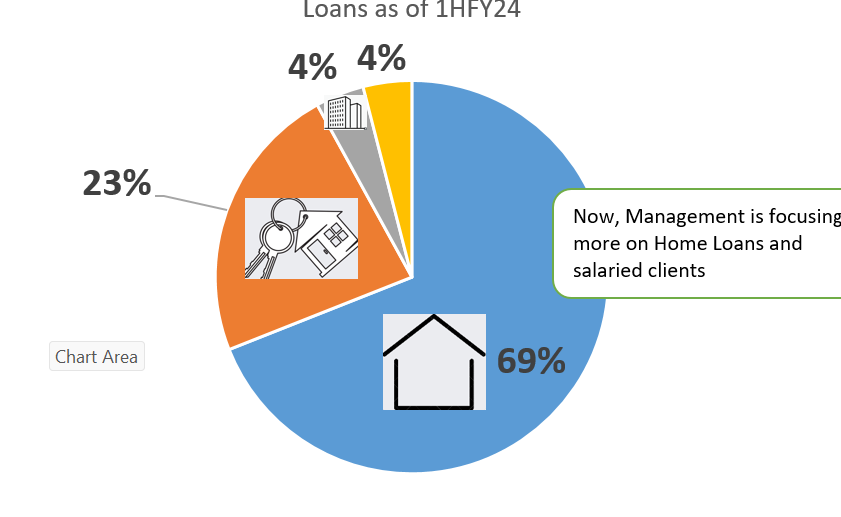

Over the past two years, PNB Housing Finance has strategically transformed its business model, focusing on the retail prime and retail affordable segments. The reduction of the corporate loan book to around 4% of the Asset Under Management (AUM) mix indicates a shift towards more stable and consumer-centric portfolios.

3. Rights Issue Boost

The completion of a rights issues in April 2023, raising around Rs. 25 billion, has strengthened the company's financial position and garnered confidence capital. This move has positioned PNB Housing Finance for a potential credit rating upgrade from rating agencies.

4. Branch Expansion

The company's branch network has shown a significant expansion, growing from a stagnant 100 branches to 200 by September 2023, with a further target of 300 branches by March 2024. Experts believes that branch additions will drive healthy growth in retail loans.

5. Diversification and Risk Mitigation

PNB Housing Finance has diversified its loan book, with a focus on the retail segment, particularly in prime and affordable verticals. This diversification is expected to contribute to a Compound Annual Growth Rate (CAGR) of around 18% in loans over FY24-26.

PNB Housing Finance’s Financial Outlook

1. Earnings Growth

Experts expects a healthy Compound Annual Growth Rate (CAGR) of 25% in Profit After Tax (PAT) over FY24-26, with a projected Return on Equity (RoE) of 14% by FY26.

2. Valuation

The stock is currently trading at 1.1 times the FY26E price/book value. The risk-reward ratio is considered favourable for further re-rating in the valuation multiple, reflecting investors' confidence in the company's execution in the retail segments.

3. Upgrades and Ratings

Credit Rating Upgrade: India Ratings and Research (Ind-Ra) upgraded PNB Housing Finance's non-convertible debentures (NCDs) to 'IND AA+' from 'IND AA' with a stable outlook. The upgrade is attributed to factors such as a granular loan book, robust capital buffers, improved asset quality, and a diversified resource profile.

Why?

1. Significant Player in Housing Finance Space

2. Equity infusion of around ₹ 25 billion

3. Completion of Granularisation of Book

4. Probable Rationale

The surge in PNB Housing Finance's stock price can be attributed to a combination of positive factors, including the expected NIM expansion, strategic business transformation, successful rights issue, branch network expansion, and the credit rating upgrade. The company's focus on retail segments and risk mitigation measures has resonated well with investors, reflecting in the upward trajectory of its market performance.

Conclusion

The surge in PNB Housing Finance's stock is driven by a combination of strategic initiatives, positive financial outlook, and favourable market conditions. Investors seem to respond positively to the company's efforts in transforming its business model and its potential for sustained growth in the retail lending space. As the company continues its expansion and executes its growth strategy, it remains a noteworthy player in the NBFC and housing finance sector.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Fundamental & Technical Analysis Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta