Stock in Action – EID Parry 18 December 2024

Stock in Action - IFCI Ltd

Last Updated: 3rd May 2024 - 03:34 pm

IFCI Ltd Stock Movement of Day

Why IFCI Ltd Stock is Trending?

Industrial Finance Corporation of India (IFCI) stock has been generating significant buzz in market due to its remarkable performance & strategic initiatives. buzzing stock IFCI Ltd, with recent developments & positive outlook, investors are closely monitoring IFCI as potential investment opportunity.

Stock in Trend - IFCI Stock’s Fundamentals

1. Profit Turnaround

IFCI reported significant profit of ₹128 crore, After seven consecutive years of losses, for financial year 2023-24, marking remarkable turnaround. This indicates improved operational efficiency & financial stability.

2. Diversified Advisory Services

IFCI has expanded its operations beyond lending to offer comprehensive advisory services in both government & corporate sectors. It serves as project management agency for various government schemes & offers financial, ESG, & project advisory services to corporate clients.

3. Government Support

With infusion of ₹500 crore by government through preferential issue of equity shares, IFCI's financial position has strengthened. government's increased stake in company reflects confidence in its growth prospects & strategic direction.

4. Market Performance

IFCI stock has witnessed remarkable upward trajectory, nearly tripling in past year. It hit 52-week high of Rs 64.02, indicating strong investor interest & positive sentiment towards company's future prospects.

5. Strategic Partnerships

IFCI's role as key player in government initiatives, such as production-linked incentive (PLI) schemes & capital subsidy schemes, underscores its strategic importance in driving economic growth & development initiatives.

6. Technical Analysis

Technical analysts have identified IFCI stock as overbought, indicating strong bullish momentum. Despite short-term profit booking, analysts remain optimistic about its long-term growth potential, citing key support levels & resistance zones.

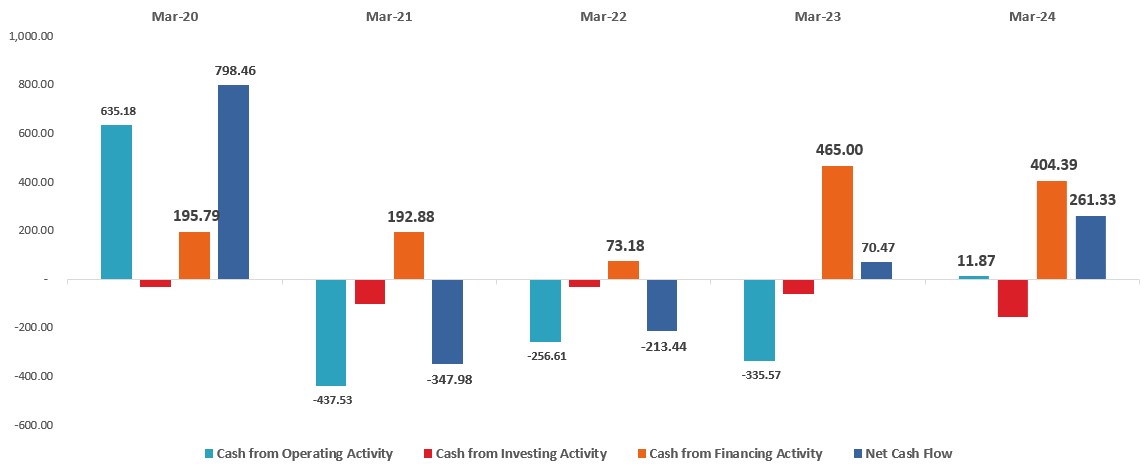

IFCI cash Flow Performance

Analysis & Interpretation

Operating Activities

1. Volatility in Cash Generation: IFCI experienced significant fluctuations in cash from operating activities, ranging from substantial inflows to notable outflows. This indicates fluctuations in company's core business operations & cash generation capabilities.

2. Improvement in Recent Years: Despite volatility, there is notable improvement in cash from operating activities in recent years, particularly from fiscal year 2020 onwards. This suggests potential enhancements in operational efficiency or revenue streams.

Investing Activities

1. Mixed Investment Patterns: Cash from investing activities shows mixed patterns, with periods of both inflows & outflows. This indicates varying investment decisions, including acquisitions, divestitures, & capital expenditures.

2. Negative Trends: In certain years, such as fiscal years 2016 & 2024, cash outflows from investing activities exceeded inflows, indicating substantial investment or asset acquisition activities.

Financing Activities

1. Fluctuating Financing Activities: Cash from financing activities exhibits fluctuating trends, reflecting changes in debt, equity, & dividend payments. This suggests dynamic capital structure management & financing strategies.

2. Recent Positive Trend: In recent years, particularly from fiscal year 2020 onwards, cash from financing activities shows positive trends, indicating successful fundraising activities or reduced debt repayments.

Overall Cash Flow Analysis

1. Operational Stability: IFCI's operating activities exhibit volatility, suggesting need for greater stability & predictability in revenue generation.

2. Investment Strategy: Mixed trends in investing activities highlight importance of balanced & prudent investment strategy to optimize returns & manage risks effectively.

3. Financial Position: Fluctuations in financing activities underscore importance of maintaining healthy capital structure & optimizing financing options to support growth objectives.

4. Improving Cash Position: Despite variability, overall trend in net cash flow shows improvement, indicating potential enhancements in cash management practices & financial performance.

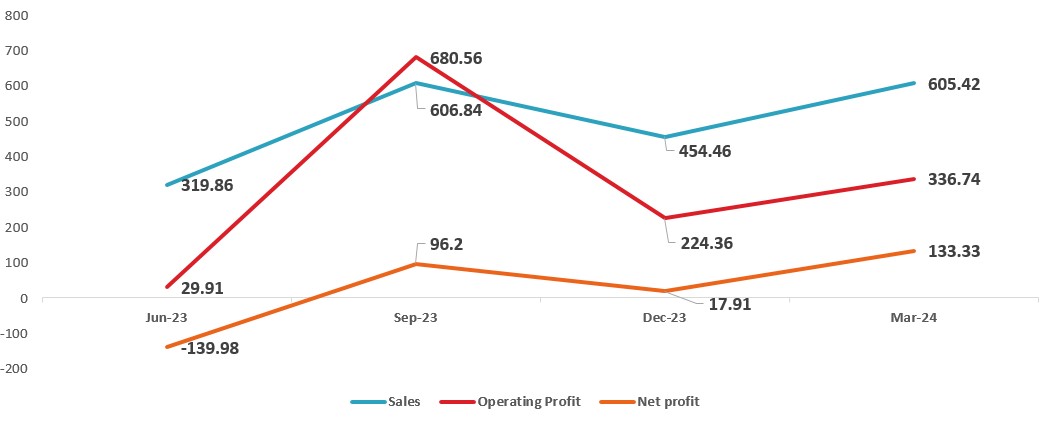

IFCI Quarter Performance

Analysis & Interpretation

Sales

1. Fluctuating Sales: IFCI's sales figures exhibit fluctuating trends over quarters, indicating variability in revenue generation.

2. Peak in September 2023: Industrial Finance Corporation of India witnessed significant increase in sales in September 2023, reaching its highest point during analysed period.

Operating Profit

1. Inconsistent Operating Performance: IFCI's operating profit shows inconsistency, with alternating periods of positive & negative performance.

2. Strong Recovery: Despite fluctuations, there was notable recovery in operating profit from March 2023 onwards, with significant improvements in September 2023 & March 2024.

Net Profit

1. Volatility in Net Profit: IFCI figures reflect significant volatility, with alternating periods of profits & losses.

2. Recovery in Recent Quarters: After experiencing losses in previous quarters, IFCI showed signs of recovery in net profit from December 2023 onwards, with notable improvements in March 2024.

Interpretation

1. Revenue Generation Challenges: IFCI faces challenges in maintaining consistent revenue generation, as reflected in fluctuating sales figures. This may indicate market volatility or operational inefficiencies.

2. Operational Efficiency: Finance industry Player operating profit demonstrates fluctuations but shows signs of improvement in recent quarters, suggesting efforts to enhance operational efficiency & cost management.

3. Profitability Concerns: Volatility in net profit raises concerns about company's profitability & sustainability. significant losses incurred in certain quarters highlight need for strategic measures to address underlying issues.

4. Recovery Signs: Despite challenges, IFCI exhibits signs of recovery in operating & net profit in recent quarters. This indicates potential improvements in business strategies or market conditions.

IFCI Strength

• Company is expected to give good quarter.

• Promoter holding has increased by 1.40% over last quarter.

• Ownership & support from Government of India.

• Diversified resource profile.

• Diversified Revenue Profile.

IFCI Weakness / Risk

• Stock is trading at 2.75 times its book value.

• Company has delivered poor sales growth of -6.78% over past five years.

• Company has low return on equity of -16.6% over last 3 years.

• Persistent Weak Asset Quality.

• Weak Capitalization structure with Negative CRAR.

• Weak Profitability metrics (NPA).

Conclusion

Stock in news i.e. IFCI presents attractive investment opportunity for investors seeking exposure to India's financial sector. With strong turnaround in financial performance, diversified advisory services, government support, & positive market sentiment, IFCI stock holds considerable potential for long-term growth & value creation. Investors should consider fundamentals & market dynamics while evaluating IFCI as part of their investment portfolio.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Fundamental & Technical Analysis Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta