Stock in Action – EID Parry 18 December 2024

Stock in Action - Bharat Heavy Electricals Ltd

Last Updated: 30th January 2024 - 05:29 pm

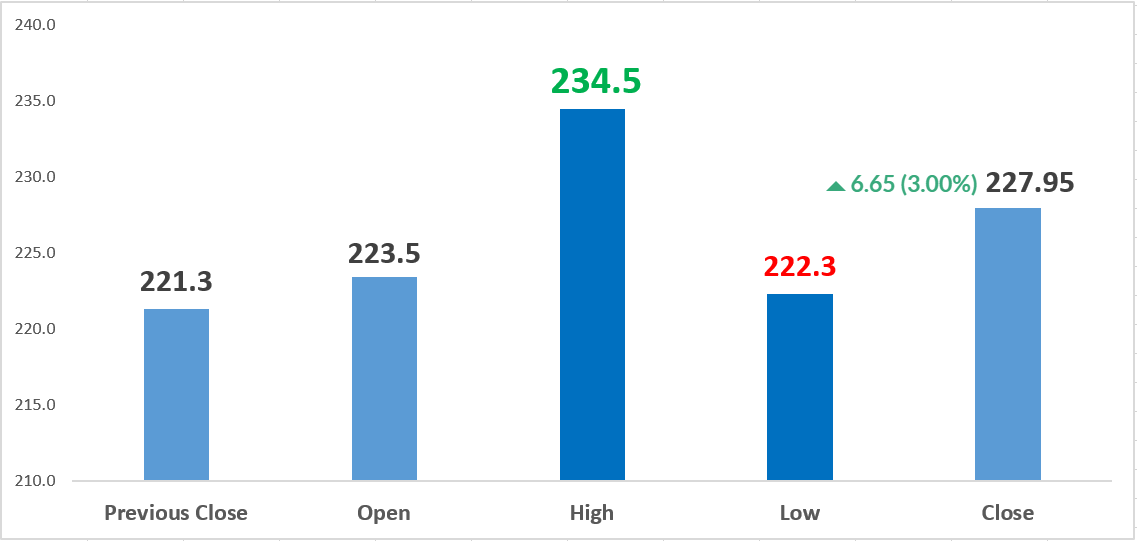

Movement of the Day

Technical Analysis

Positive technical indicators, as highlighted by analysts, suggest strong investor sentiment & potential for further upside in stock.

Technical analysts expressed positivity, citing bullish chart patterns, ongoing uptrends, & potential support levels. Analysts highlighted key indicators such as higher lows on monthly scale, higher highs on weekly scale, & bullish candle on daily scale. Relative Strength Index (RSI) turning upwards further indicates momentum building up.

Probable Rationale Behind BHEL ltd. Surge

Bharat Heavy Electricals Limited (BHEL) has recently experienced significant surge in its stock, reaching 52-week high. This surge coincides with celebration of 75th Republic Day at BHEL in Ranipet, where company's leadership highlighted achievements, recognized employee contributions, & outlined future prospects. Momentum is further fuelled by positive technical analyses, slew of major project wins, & favourable business environment in power sector.

Key Developments

Republic Day Celebrations

The Republic Day celebrations at various BHEL locations across country underscored commitment of company to its employees & nation. Unfurling of national flag, medal presentations, & addresses by top executives showcased sense of unity & purpose within organization.

Strategic Projects & Joint Ventures

BHEL secured substantial EPC order for thermal power project in Odisha, reinforcing its position in power sector. Additionally, joint venture between BHEL & Coal India for gasification signifies strategic collaborations to capitalize on opportunities in evolving energy landscape.

Operational Excellence & Recognition

BHEL's focus on timely execution, quality, & cost optimization is emphasized by Executive Director S. Prabhakar. Company's recent achievements, including business excellence awards, employee recognitions, & environmental initiatives, contribute to its positive image in market.

Major Contract Win

BHEL's recent announcement of bagging contract worth ₹15,000 crores for Talabira thermal power project in Odisha significantly boosted investor confidence. Contract involves engineering, procurement, & construction (EPC) for 3x800 MW power project.

Operational Resilience

BHEL's ability to secure major projects, adapt to changing market dynamics, & focus on operational excellence positions it as resilient player in power sector.

Strategic Collaborations

Joint ventures & collaborations with industry leaders like Coal India reflect BHEL's strategic vision, providing opportunities for diversified revenue streams.

Project Pipeline

The robust project pipeline, including recent large-scale contract win, indicates positive outlook for BHEL, aligning with growth trajectory of power sector.

Conclusion

The surge in BHEL's stock can be attributed to combination of operational resilience, strategic initiatives, positive technical analyses, & major project wins. Company's commitment to excellence, coupled with its ability to secure substantial contracts, positions BHEL favourably in evolving energy landscape. Investors may find confidence in company's strategic direction & its potential to capitalize on emerging opportunities in power sector.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Fundamental & Technical Analysis Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta