RBI policy key takeaways: Lifts repo rate, retains GDP and inflation forecasts

Last Updated: 15th December 2022 - 10:43 am

The Reserve Bank of India on Friday raised the repo rate to 5.4% from 4.9%, taking its main lending rate back to pre-pandemic levels and the highest since August 2019.

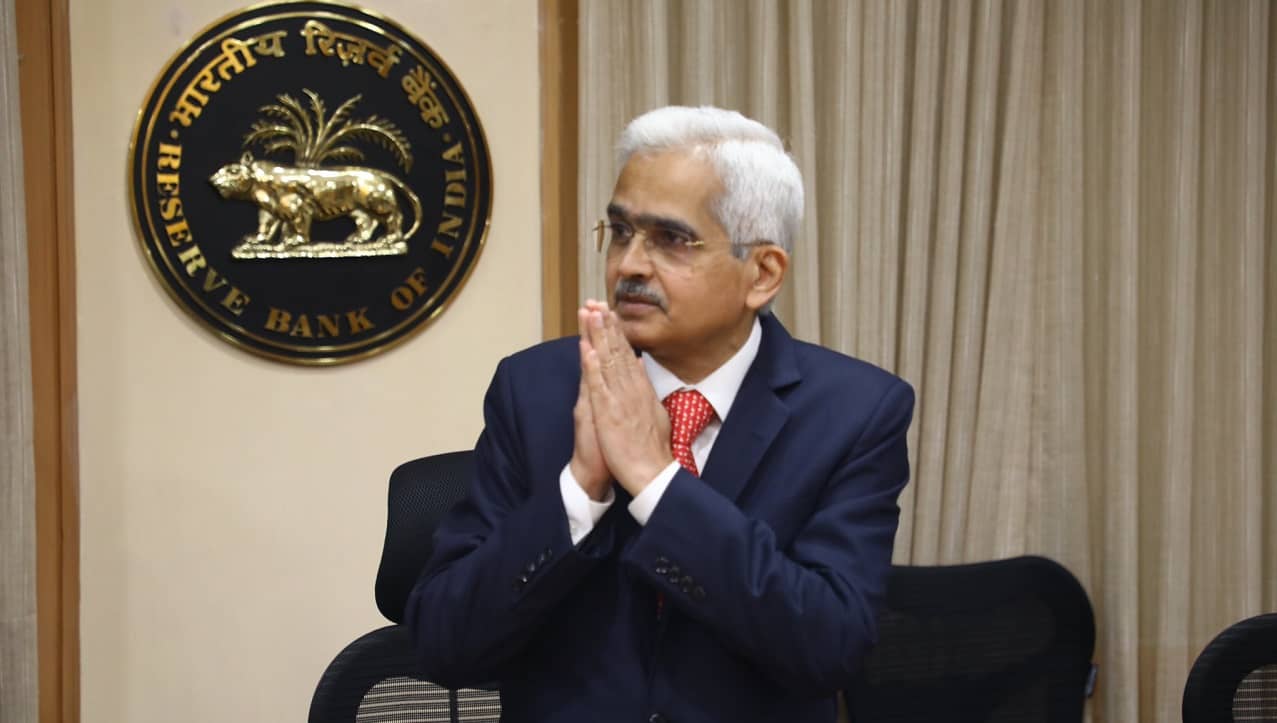

RBI governor Shaktikanta Das said the central bank retained its stance at ‘withdrawal of accommodation’ to ensure that inflation remains within the target going forward, while supporting growth.

“Volatility in global financial markets is impinging upon domestic financial markets leading to imported inflation,” he said. “Inflation is expected to remain above the central bank’s 6% threshold in the second and third quarters of this fiscal year, for which the MPC stressed that sustained high inflation could destabilise inflation expectations and harm growth in the medium,” the governor said.

Das further said that while the consumer price inflation has eased from its surge in April but “remains uncomfortably high and above upper threshold of target”.

Other key highlights of the RBI’s bi-monthly policy statement:

1. The standing deposit facility (SDF) rate adjusted to 5.15%

2. The marginal standing facility (MSF) and bank rate revised to 5.65%

3. India facing $13.3 billion capital outflow over the last few months, Das said

4. Bank credit growth has accelerated 14% as against 5.5% year ago, Das said.

5. Domestic economic activity showing signs of broadening; rural demand shows mix trend: RBI Governor

6. Real GDP growth projection for FY23 retained at 7.2%

7. FY23 CPI inflation projected at 6.7%

• Q2 inflation at 7.1%

• Q3 inflation at 6.4%

• Q4 inflation at 5.8%

• Q1 inflation FY24 at 5%

8. Edible oil prices likely to soften further, Das said.

While Das said that India had been impacted by global factors, finance minister Nirmala Sitharaman said earlier that there was no chance of the country’s economy slipping into stagflation.

"I would like to say there is no question of India getting into stagflation or, what it is called in the US, technical recession," she said, replying to a discussion in the Lok Sabha on the price rise. "There is absolutely zero probability of India slipping into recession."

The Indian rupee, which has been under pressure against the US dollar ever since the Russian invasion of Ukraine sent global crude oil prices soaring, strengthened ahead of the RBI policy action.

Yields on India’s 10-year bonds rose 7 basis points to 7.23% after the rate hike.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta