Stock in Action – EID Parry 18 December 2024

Range Trading Strategy

Last Updated: 11th January 2024 - 04:10 pm

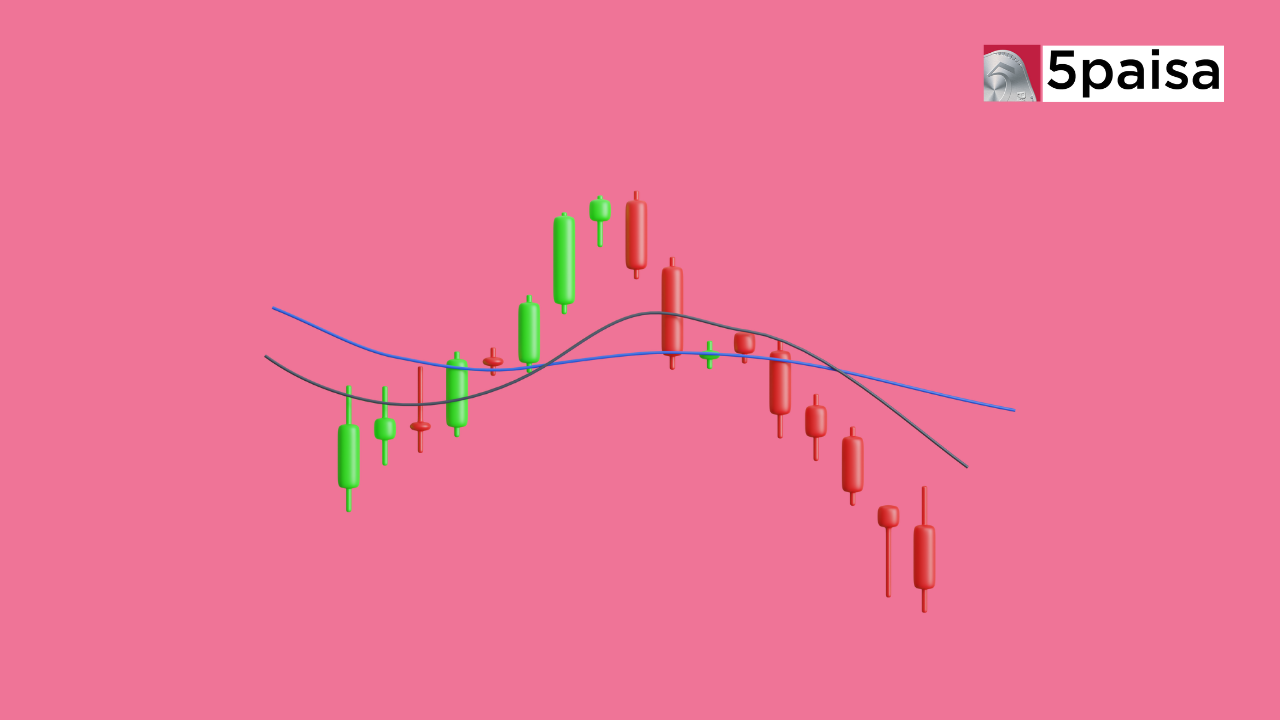

Range trading is a financial market strategy that capitalizes on price variations inside a specific range. Traders use the best range trading strategy to navigate the ebb and flow of asset values by identifying critical support and resistance levels. Unlike trending markets, where assets move in a straight line up or down, range-bound markets exhibit horizontal movement. Traders join and leave positions deliberately at these predefined levels, hoping to profit from recurrent market swings. This sophisticated strategy necessitates a thorough grasp of market psychology, technical analysis, and risk management. Discover the complexities of range-based trading as we examine its ideas and methods in this informative article.

What is Range Trading?

Range trading is a financial method in which traders profit from asset price oscillations within certain bounds. Market players use the best range trading strategy to find established support and resistance levels and profit from recurring price movements within that range. In contrast to trending markets, which demonstrate obvious directional moves, range-bound markets exhibit sideways price activity. Traders purchase near support and sell near resistance to profit from predicted price changes. This approach is based on technical analysis, chart patterns, and a thorough grasp of market dynamics. It is a sophisticated strategy for individuals looking for chances in markets with limited directional tendencies.

Types of Range Trading

1. Horizontal Range Trading

The most basic version includes establishing apparent horizontal support and resistance levels. Traders anticipate price bounces within this range by buying near support and selling near resistance. This approach is based on specific entry and exit positions, with technical indicators being used to validate prospective reversals at certain levels.

2. Diagonal Range Trading (Channel Trading)

Traders use this method to identify a sloping support and resistance channel. The asset price fluctuates within this diagonal band, allowing traders to use trendlines to forecast probable reversals. Traders strive to profit from the predictable price swings inside the channel by buying around the lower trendline and selling near the upper one.

3. Rectangular Range Trading (Sideways Box)

Traders identify a rectangle pattern generated by parallel support and resistance lines. This box-like structure represents a market with restricted upward or downward movement. Traders purchase at the lower and sell at the higher boundaries, expecting price reversals inside the rectangle's borders. This technique lives on price predictability within predetermined boundaries.

4. Expanding Range Trading (Volatility Expansion)

This approach recognizes the volatile nature of markets. Traders are seeing an increasing range with more volatility. They adjust to shifting market conditions rather than depending on established support and resistance levels. Traders negotiate the widening price range, capitalizing on changing market dynamics by buying during low and selling during high volatility.

Each sort of range based trading necessitates a refined grasp of technical analysis, risk management, and the capacity to adjust to changing market conditions. The best approach is determined by market circumstances and a trader's ability to analyze price patterns.

Tips to Manage Risk in a Range-bound Market

Effective risk management is critical in range-bound markets:

• Determine the Clear Stop-Loss Levels: Create exact stop-loss orders based on support and resistance levels. It reduces possible losses if the market moves outside of the range.

• Diversify Positions: Spread investments across various assets to lessen sensitivity to the volatility of a single market.

• Monitor Volatility: Stay tuned into market circumstances and modify position sizing when volatility changes within the range.

• Use Trailing Stops: Trailing stops may safeguard profits and adjust to changing market dynamics while allowing successful trades to run.

• Use Proper Position Sizing: Determine position sizes corresponding to risk tolerance to avoid excessive losses in volatile market circumstances.

Conclusion

Finally, range trading provides a diverse method for profiting from market fluctuations. While its foundations are straightforward, success necessitates a combination of technical competence and agility. Traders who navigate the ups and downs of range-bound markets find opportunities in accuracy, strategy, and a thorough grasp of price dynamics.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Fundamental & Technical Analysis Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta