Nifty Outlook - 14 Dec-2022

Last Updated: 14th December 2022 - 12:24 pm

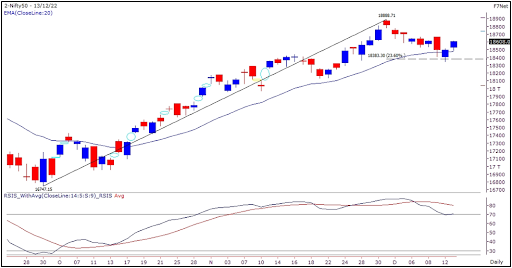

Nifty witnessed some recovery in Monday’s session post the gap down opening and a follow up buying interest was seen in Tuesday’s session as well. The index ended the day above 18600 with gains of over half a percent.

Nifty Today:

The correction in the last one week has retraced the recent uptrend by 23.6 percent. Around this Fibonacci retracement support, the index managed to halt the correction and has pulled back higher in Tuesday’s session. The momentum readings which were highly overbought in both Nifty as well as Bank nifty has cooled off in Nifty, but still remains at elevated levels in Bank Nifty as the banking space has not even witnessed minor price corrections and has infact continued its outperformance. Hence, although the trend remains positive, the risk reward ratio for fresh buying in the banking space is not very favorable. For now, it seems a time-wise corrective phase in the Nifty index with possibility of another leg of upmove in process till 18350 is intact. But it needs to be seen whether any heavyweights other than banking picks up momentum to lift the benchmark higher. The global markets reaction to the FED policy outcome will have an impact on our markets and thus, the event could then lead to a directional move for the near term. For the time being, it is better to focus on a stock specific approach and look for opportunities in pockets with good price volume action.

Market recovers from important support, FED policy outcome awaited

The immediate supports for Nifty are placed around 18440 and 18350 while resistances are seen around 18700 and 18825.

Nifty & Bank Nifty Levels:

|

|

Nifty Levels |

Bank Nifty Levels |

|

Support 1 |

18525 |

43800 |

|

Support 2 |

18440 |

43680 |

|

Resistance 1 |

18650 |

44030 |

|

Resistance 2 |

18700 |

44120 |

- Performance Analysis

- Nifty Predictions

- Market Trends

- Insights on Market

Trending on 5paisa

Market Outlook Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta