Nifty Outlook - 13 Dec-2022

Last Updated: 13th December 2022 - 11:21 am

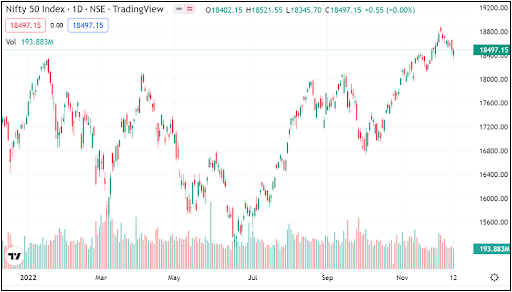

Taking Cues from the U.S. markets and the SGX Nifty, our markets started the day on a negative note. However, the market participants took this gap down as a buying opportunity and the markets recovered from the lows and consolidated within a range. The index finally ended tad below 18500 without much change to Friday’s close.

Nifty Today:

Our markets have seen some correction in last one week which seems to be because of some profit booking on long positions. FII’s have unwound some of their long positions due to which their ‘Long Short Ratio’ has recently declined from 75 percent to around 57 percent. However, the index has retraced the recent upmove from 16800 to 18880 by 23.6 percent. The market breadth has not deteriorated much and thus, it would be crucial to see if the index recovers from this retracement support. The banking index has managed to hold well as it has shown a relative outperformance and has supported the benchmark as well. Hence, 18450-18350 would be seen as an immediate support range for the index and till this holds, traders can look for stock specific buying opportunities. On the higher side, 18600-18700 would be seen as immediate resistance.

Nifty recovers from opening lows, stock specific buying seen

During the week, the U.S. Federal Reserve will be announcing their policy outcome and how the global markets react to the same will be the crucial event to watch out for.

Nifty & Bank Nifty Levels:

|

|

Nifty Levels |

Bank Nifty Levels |

|

Support 1 |

18380 |

43420 |

|

Support 2 |

18280 |

43205 |

|

Resistance 1 |

18570 |

43800 |

|

Resistance 2 |

18630 |

44000 |

- Performance Analysis

- Nifty Predictions

- Market Trends

- Insights on Market

Trending on 5paisa

Market Outlook Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta