Weekly Outlook on Natural Gas - 07 June 2024

Gold Price Forecast for the week

Last Updated: 16th December 2022 - 05:45 pm

Gold price has extended its losses in the Asian market after U.S. Federal Reserve Chair Jerome Powell said the central bank is fully committed to bringing prices under control, adding that the central bank would take any necessary move to restore price stability. Now, the investors are expecting an aggressive interest rate hike in the coming month, which could dent the yellow metal prices.

On the COMEX division, overall, the yellow metal is range bound, trading below $1840 per ounce over aggressive Fed rate hike expectation & recession fears. Geopolitical tensions & rising concerns of economic slowdown are likely to support yellow metal. Gold has support at $1825 & $1816, while resistance is at $1852 / $1865 levels.

On the domestic front, MCX Gold price has traded in a narrow range with Symmetrical Triangle patterns on the daily timeframe. Also, movement below 100 SMA & Middle Bollinger Band suggests probability of further selling pressure in the near term.

The momentum indicator RSI (14) shifted below the 50 mark and Stochastic witnessed a negative crossover, which is an indication of a downward trend for the short term. So based on the above aspect, a follow up move below 50500 could drag the prices towards 50150/49800 levels. However, on the upside, 51200 would act as immediate resistance for the counter. Traders are advised to trade cautiously for the coming week and look for a sell on rise strategy from a short term perspective.

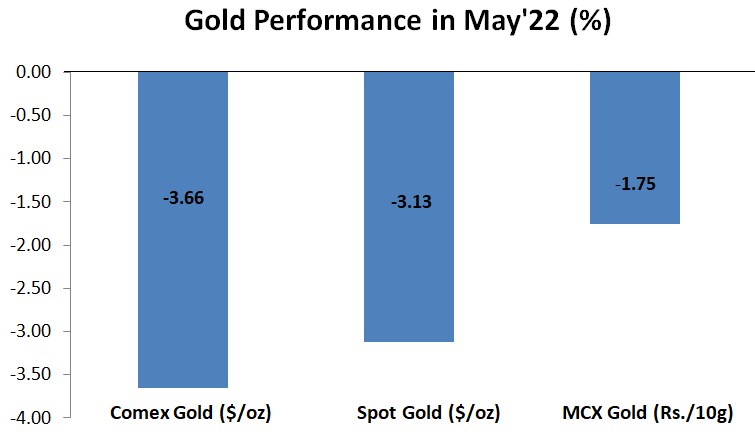

Gold prices in the international exchanges witnessed downtrend during the month of May’22 owing to easing the fear of recession, economic uncertainty and aggressive rate hike expectation to control stubborn inflation. The above chart showcases, there has been a decline of 3.66% and 3.13% in Comex Gold future and Spot Gold respectively by the end of May, while MCX Gold prices have traded lower by 1.75% in May '22.

Important Key Levels:

|

|

MCX GOLD (Rs.) |

COMEX GOLD ($) |

|

Support 1 |

50150 |

1825 |

|

Support 2 |

49800 |

1816 |

|

Resistance 1 |

51200 |

1852 |

|

Resistance 2 |

51790 |

1865 |

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Commodities Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta