Explained: Why Nancy Pelosi’s visit to Taiwan riled China and how it may impact India

Last Updated: 8th August 2022 - 07:03 pm

Even as US House of Representatives speaker Nancy Pelosi concludes her one-day Taiwan visit, tensions remain high between Washington and Beijing with both superpowers mobilising their military assets.

To be sure, this is nowhere close to the Cuban missile crisis of October 1962, when the US and the erstwhile Soviet Union had nearly come to the brink of a nuclear war. But it is tense enough to have moved global markets, especially as it comes in the wake of Russia’s ongoing invasion of Ukraine.

While China has threatened dire consequences, for now the world is only speculating on what might happen if the two countries do get into a serious military confrontation.

So, why is China even opposed to Pelosi’s Taiwan visit?

China considers Taiwan to be its territory and thinks that Pelosi’s visit impinges upon its sovereignty. It is, therefore, opposed to the visit.

Could China invade Taiwan like Russia invaded Ukraine?

China has certainly made noises to this effect and has also mobilised its military assets close to the region around Taiwanese waters. But it has so far refrained from taking any overt military action.

But there is a difference between the two conflicts. If China does try and invade Taiwan, the US may have to get directly involved in the confrontation as it has promised as much in the past.

This is unlike Ukraine where the US and other countries of the NATO block did not get into a direct confrontation with Russia as Ukraine is not a NATO member. So, China could find it tough simply to walk into Taiwan.

What stance is India likely to take on this issue?

India would not risk a direct confrontation either with its neighbour China or with the US. Therefore, India is likely to remain largely neutral if hostilities were to break out between the Chinese and the Taiwanese militaries and if the US and perhaps even Japan were to be drawn into a conflict.

Although India itself has fought and lost a war with China and has an ongoing border dispute with its neighbour, which is also close to arch-rival Pakistan, India is likely to keep its business interests in mind and remain equidistant.

Both the US and China remain two of India’s most important business partners and those concerns will weigh heavily on India’s foreign policy.

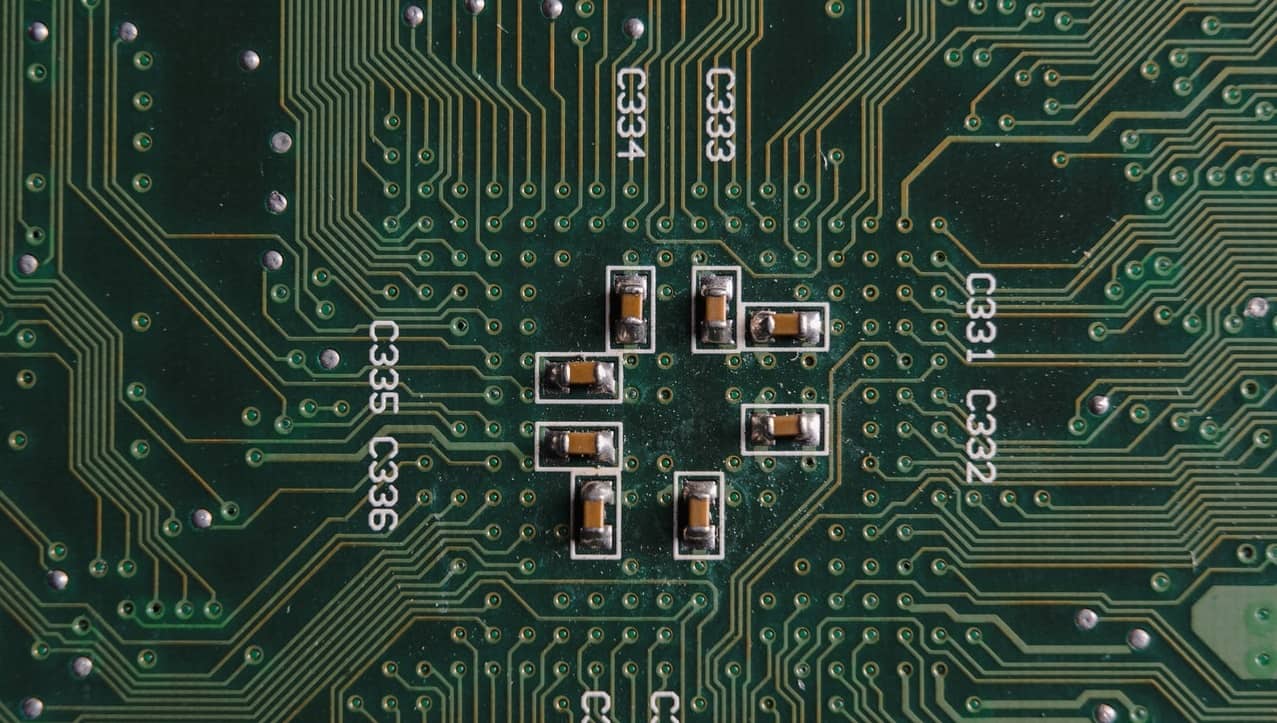

Why could a conflict in Taiwan be potentially disastrous for the global semiconductor industry?

Taiwan is the world’s biggest manufacturer and exporter of semiconductors. Nearly 70% of semiconductor chips are made in Taiwan, with three main companies—the Taiwan Semiconductor Manufacturing Co (TSMC), United Microelectronics Corp and Powerchip Semiconductor—doing most of the manufacturing. Even among these, the lion’s share is with TSMC, which accounts for around three-fourths of the total semiconductor production in Taiwan.

Little wonder, then, that Pelosi met TSMC executives. In fact, the company’s chief has said that his fabrication plants will be rendered useless in case of a war.

So, if there is a conflict, it could further exacerbate the shortage, which has already been plaguing the semiconductor market in the wake of the Covid-induced lockdowns, which caused a massive supply chain disruption.

Could India potentially gain from this situation?

Indeed. In every adversity, there’s an opportunity. And India could be sitting on one, that is literally worth a trillion dollars.

In fact, as the world at large continues to grapple with the acute semiconductor shortage, India could be on the cusp of an unprecedented opportunity if it can grab it.

The shortages were caused first by the coronavirus pandemic and then a supply chain disruption owing to the US-China trade wars, a crippling drought in Taiwan and a fire at Japan’s Renesas Electronics Naka factory. This led to the world literally running out of semiconductor chips that power practically all our electronic devices from smartphones, tablets and computers to our automobiles, trains and airplanes.

The world was witnessing a semiconductor chip shortage even before the coronavirus pandemic hit in early 2020. But as economies began shutting down in the wake of global lockdowns, chip manufacturers began cutting back on production, anticipating a fall in demand.

However, as people took to remote work and staying at home, they began ordering laptops, computers, TVs, gaming consoles, smartphones and other electronic devices to work and to keep themselves entertained. This exacerbated the shortage even further.

How did the chip shortage affect Indian companies?

The chip shortage hit manufacturing across several industries that use electronic components. A case in point is the auto industry, which has been forced to cut back on production. In India, several automakers including market leader Maruti Suzuki had to cut back on production in 2021. Many automakers are still reeling under the impact with delivery periods stretching into several months.

Automakers were not the only ones facing the brunt of the chip shortages. Mobile handset and laptop manufacturers, too, have been at the receiving end.

For instance, billionaire Mukesh Ambani’s Reliance Industries Ltd had to defer the launch of its much-awaited Jio Phone Next smartphone because of the shortage last year. The smartphone was set to launch on Ganesh Chaturthi, but because of a lack of chip availability, the company had to defer introducing it by Diwali, in October last year.

So, what can India do about it?

Experts say that India needs to develop its own chip research and development system and industry. While India did unveil a National Policy on Electronics in 2019, little by way of developing an ecosystem has happened since. Even in countries like Taiwan, companies like TSMC have thrived only with government backing over several years.

Having said that, it is not as if nothing has been done so far. The government has taken several steps in this direction. India is looking to attract global companies to make the chips in the country.

In the Union budget of 2017-18, the Indian government had upped the allocation for incentive schemes like the Modified Special Incentive Package Scheme (M-SPIS) as well as Electronic Development Fund (EDF) to Rs 745 crore, in a bid to help spur semiconductor manufacturing in the country. Later, the union cabinet amended M-SIPS, increasing its allocation further to Rs 10,000 crore.

Moreover, it has also established an Electropreneur Park at Delhi University, to incubate 50 early-stage startups.

So, which Indian companies are looking to enter the semiconductor industry?

Finance minister Nirmala Sitharaman has said in the past that Indian industry should invest in the semiconductor manufacturing business.

Tata Group chairman N. Chandrashekharan said last year the conglomerate was eyeing the semiconductor manufacturing industry. The group hopes the excessive reliance on China and Taiwan for chip manufacturing will end in the years to come, as other countries look to become self-reliant and set up manufacturing facilities.

However, it is an expensive business. It can take anywhere from $3-6 billion to set up a semiconductor wafer fabrication facility.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta