Best Small Cap Funds for 2024

Last Updated: 24th April 2024 - 06:24 am

Small cap equity funds invest in small listed companies in the stock exchange. These funds primarily focus on investing in stocks issued by smaller companies in terms of market capitalization. These funds are mandated to allocate a minimum of 65% of their assets to equities and equity-related instruments of small-cap companies, allowing the remaining 35% to be diversified across larger-cap or mid-cap companies, debt instruments, or cash equivalents.

Top Small Cap Stocks Stocks to Buy

Understanding Small Cap Mutual Funds

As per regulatory standards outlined by SEBI, Small Cap Equity Funds are mandated to allocate a substantial portion of their assets toward small-cap company stocks. These companies typically fall below the market capitalization of the 250 largest entities traded on Indian stock exchanges.

Growth Potential:

One intriguing facet of these funds lies in their ability to identify undervalued small-cap prospects. Early investment in high-growth small-cap companies often leads to significant growth when these companies thrive.

High returns

The funds invest in small, high-growth companies, so they can offer higher returns than large or mid cap funds. Over time, they might give you better returns than other types of investments. But here's the catch: they mainly put their money into smaller companies (around 65%), which means they come with some extra risks.

High Volatility

Small-cap stocks are highly volatile. When their is volatility or uncertainty in market these stocks are affected the most. For ex. In Covid 19, when the market witnessed a historic fall in March 2020, these were the most affected stocks.. So, expect some real highs and lows if you're in these stocks through these funds.

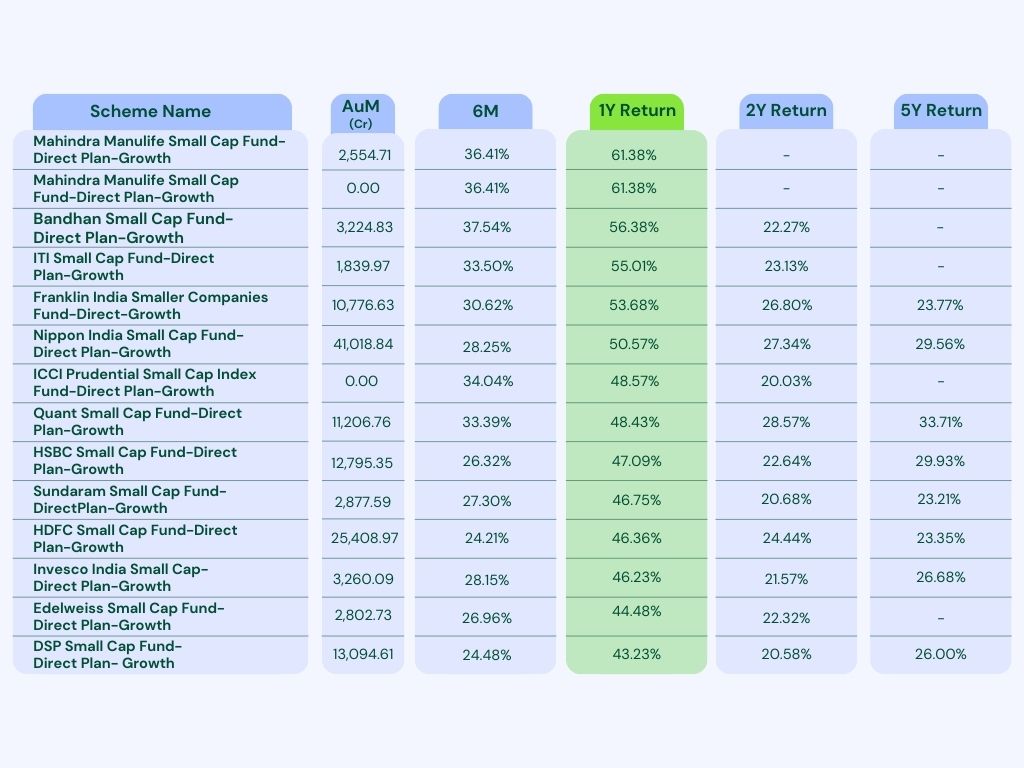

Top Small Cap Mutual Funds in India in 2023

Small Cap funds in India delivered impressive returns in 2023. Here are the funds that stood out in terms of performance. However, past performance isn't a guarantee of future success.

Please remember, this information is for educational purposes and not intended as investment advice. It's crucial to conduct thorough research or consult with a financial advisor before making any investment decisions.

Before You Jump In

Check the Risk

These funds are riskier since they invest in small companies and can be less stable. Investing in them is like backing a new kid rather than a seasoned pro.

Potential Gains: These investments can offer bigger rewards because they focus on smaller firms that are likely to grow rapidly. However, past performance is not an indicator of future performance.

Long-Term Thinking: These funds are like planting a seed and watching it grow. Smaller companies often take time to show their full potential.So invest in these funds only if you have long investment horizon. If you looking for fast returns then these might not be for you.

Who's Steering: Check the fund managers qualification and past experience as it would provide you an insight into his fund management style and capabilities. As they say, you bet on the jockey and not on horse, here as well you need to ensure the fund manager is competent and his fund management style aligns with your investment goals.

Keep an Eye on Expense ration: All funds charge a fee for fund management that is called expense ratio.Pay attention to the expense ration as higher expense ratio means lower returns and vice versa.

How to select the right small cap fund

Your Money Goals: Think about what you want from your investment – do you want steady growth or some regular income?

Your Comfort with Risk: Small cap funds are highly volatile in nature, therefore they are only suitable for investors that have high risk appetite. Consider investing in these funds only if you have a high risk tolerance.

Past Performance: Before investing always check the past performance of a mutual fund.

While checking the past performance its prudent that you check the rolling returns and not just the historical returns.

Spread the Load: Look for funds that are well diversified and have investments spread across multiple categories as it can minimize the risk.

The Risks Involved

Volatility: These stocks can be quite a ride, so they're not for everyone.

Trading Challenges: Buying and selling these stocks might not be as straightforward as the big ones because they're not traded as often.

Higher Risk of Failure: Smaller companies might struggle more during tough times because they don't have as many resources.

Also read about: Best Flexi Cap Funds for 2024

In Short:

Small Cap Mutual Funds offer potential for growth, but they also bring some uncertainty. They can pay off well, but it's smart to spread your money across a few different ones to make sure you're not putting all your eggs in one basket.

- 0% Commission*

- Upcoming NFOs

- 4000+ Schemes

- Start SIP with Ease

Trending on 5paisa

Mutual Funds and ETFs Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta