Algorithmic Trading Strategies

Last Updated: 13th July 2023 - 10:40 am

Algorithmic trading, or algo trading, refers to automating the process and decision-making through the use of computers so that a trade is executed faster, efficiently, accurately and in bulk.

Essentially, algo trading involves using logic that is simulated on a computer to execute trade. Let us try to understand this through an example.

Trader A buys a particular share every time it goes above a certain level – let us say above the x-day moving average. But there are many other traders who also understand the theory that this stock breaks out fast every time it crosses the x-day moving average. So, they too want to buy the stock at that level. Trader A, knowing the demand, puts the theory in computer instructing it to buy the stock. Since the manual interference has been eliminated, Trader A is able to execute buys at a much faster rate before other traders join the queue. This is a simplistic example of an algorithmic trade.

In other words, algo is just a preset instructions – if x event happens, then do this (buy/sell this stock or option or futures). When a trade is done directly from computers using such a model it becomes algorithmic trading.

In the US, algo trading is now said to account for nearly 70% of all securities market trade, up from 10% in early 2000s. In India, this figure now stands around 50% of total trade orders on the BSE and the NSE, according to a report prepared by the National Institute of Financial Management.

Key algo trading strategies

In the 1980s and 1990s it was common for traders to follow prices at different exchanges for the same stock. They would buy a stock from say the Calcutta Stock Exchange knowing it was selling there for a few paise less than Mumbai and then sell it in on the BSE. This arbitrage trade was one of the first trading strategies adopted by algo traders. So, instead of manually following the prices, all they had to do was instruct the computer to keep checking price of a stock on different exchanges. The moment the computer would see an arbitrage opportunity, it would execute the trade.

Computer simulation then went through much more sophistications as the advantage that the algo trading gave them was enormous.

Here are some of the common algo trading strategies:

Trend Following

Technical analysis has always been part of stock or other securities trading. When this is plotted on a computer for auto execution, it is called a Trend Following Strategy. This involves using technical analysis indicators, such as moving averages, trend lines, or oscillators and then taking entry, size and exit decisions, if needed.

It is important to have risk management build alongside trend following strategies. This typically involves setting stop-loss orders to limit potential losses if the trade goes against the expected trend or setting parameters to lock in profits at desired levels.

Arbitrage

The arbitrage strategy involves taking advantage of price differences of a dual-listed security or from securities that are being traded on the futures market. The computer is instructed to execute a buy/sell trade on its own when such arbitrage opportunities emerge.

The strategy involves algorithms that have codes to identify such opportunity, execute high-speed trade, ensuring that they buy at a lower price and sell at a higher price almost simultaneously or similar strategy if this involves futures market.

However, with many traders getting on the algo platform, such arbitrage opportunities disappear fast, hence the key here is speed. The risk in arbitrage strategy would be if the computer is slow in executing the second leg of the trade.

Index Fund Balancing

There are two separate strategies involved here:

a) Using a computer program to maintain the portfolio in line with an index, saving on expenses of hiring a professional for mimicking indices.

b) Index Funds have to buy or sell their portfolio stocks according to changes in the index. There is some time gap in this execution. If the computer can identify such likely trades by Index Funds, it can buy/sell in anticipation and make a profit.

Mean Reversion

This strategy involves the chances of a stock moving back to a particular level after a dip or a rise. Using a mathematical model and historical movements, an algo trader can calculate such levels and input those in their algorithm. Whenever a stock moves out of the that set zone, the computer executes the trade to buy or sell the stock.

Execution-based strategy

The execution-based strategy in algorithmic trading utilizes automation and predefined rules to execute trades systematically and with discipline, optimizing the trade execution process. This methodology proves advantageous, especially for institutional investors and large traders aiming to execute trades efficiently without causing significant market impact. By implementing this strategy, traders gain better control over their trades, benefit from enhanced speed, and contribute to improved price discovery, ultimately leading to favourable trading outcomes.

Position sizing

The goal of position sizing is to allocate an optimal amount of capital to each trade, considering the potential profit and loss and aiming to maximize returns while managing risk. This helps traders maintain a consistent approach to risk management and avoid overexposure to any single trade.

Volume-Weighted Average Price

If a trader wants to execute bulk trade for a stock, this strategy will break the trade into smaller volumes to ensure that the executed price is closest to the historical volume-weighted average price, or VWAP. It provides valuable insights into market trends, price efficiency, and can help traders make informed trading decisions.

Time-Weighted Average Price

The idea of this strategy is to break and time a large order so that the average price is closest to the time-weighted average price, or TWAP. The idea is to execute a large order through different time intervals to ensure uniform distribution.

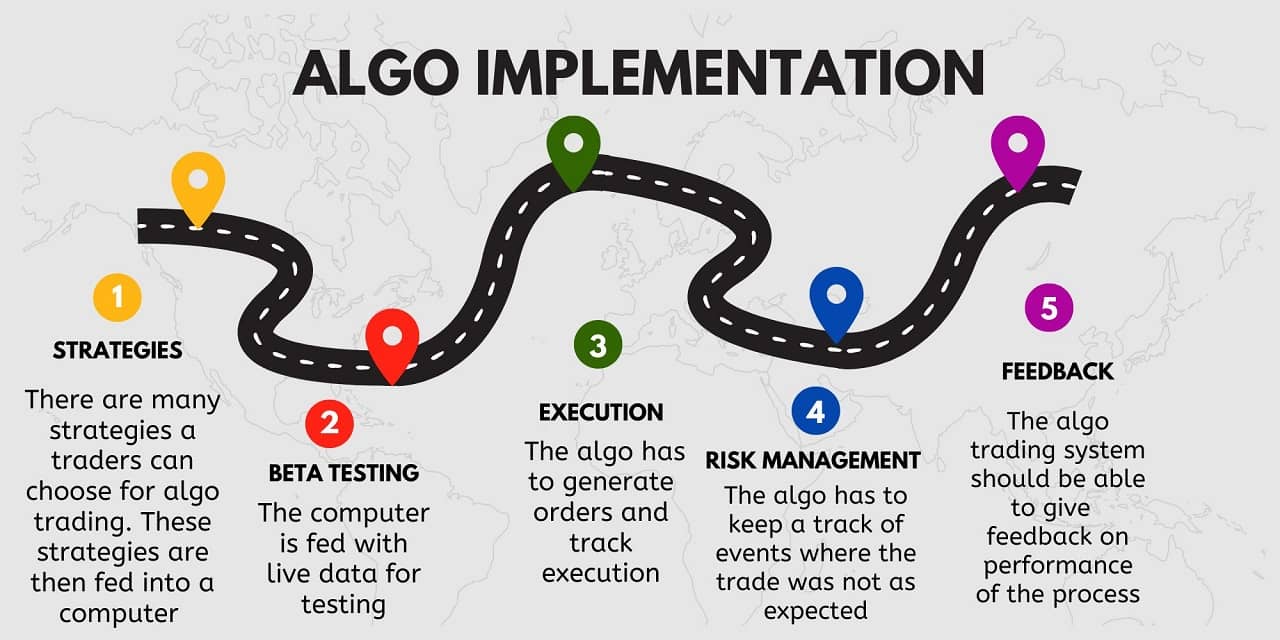

How algorithmic trading works

The main idea of using algorithmic trading is to eliminate the manual intervention to help execute trades faster. Here’s an overview of how algorithmic trading works:

1. Strategy – As we have seen above there are many strategies a trader can choose for algo trading or even develop a new one on own. These strategies are then fed into a computer and tested over time or using historical models before being put to use.

2. Monitoring – Once the strategies are put in place, the computer is fed live data to keep track of markets to see when any of trades are to be executed.

3. Order generation – As soon as the event put in strategy is reached, the computer generates trade orders at a fast pace.

4. Execution – The computer has to also keep track if the trade was executed or not, in full.

5. Risk management or stop-loss – The computer has to also keep a track of events in which the trade that as been executed partly is not leading to desired result. In such cases, the computer has to execute stop-loss strategies.

Where are algo trading strategies used?

There are many uses of algo trading including to take advantage of arbitrage opportunities, executing complex trade orders, minimising effect of bulk trade on a price of a security, risk management, automated changes in stop-loss levels, taking smart and dynamic hedging positions in all kinds markets, including options, forex, bonds etc.

Advantages and Disadvantages of Algorithmic Trading

Algorithmic trading is fast and efficient, but it does come with its own sets of cons, too.

Advantages of Algorithmic Trading:

1. Algo trading helps traders execute trade within milliseconds, making the whole process superfast. It also makes the process efficient by eliminating manual mistakes such as fat finger that have caused loss of billions of rupees in the past.

2. A trader has the chance to execute trades at the best price possible due to different models that the computer will use to analyze the price.

3. Humans can be circumspect when executing a trade despite facts pointing to other direction. For example, ego may creep in when executing stop loss. Algo trading being devoid of emotion removes the impact of these human interventions.

4. Order confirmation is faster as trade is executed at prices that are most likely to get a buyer or a seller.

Disadvantages of Algorithmic Trading:

1. If the coding to calculate levels to buy sell are not entered properly it can lead to massive losses.

2. Algo trading can sometimes lead to increased volatility.

3. Algo trading requires fast computers and sophisticated software, leading to high cost.

4. SEBI has been increasingly taking tough position on algo traders as this can disadvantageous to small retail traders.

Conclusion

Algo trading is gaining wider acceptance worldwide and traders and investors will have to learn to live with it. It has added liquidity to the securities market. At the same time, it has also led to some volatility.

Choosing the right algorithmic trading strategy and the best algo trading software are key to being successful in this trade. One should also take up algo trading courses before getting into high-frequency trading.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team

Sachin Gupta

Sachin Gupta