Cable and Wire Stocks Decline for Second Session Amid Aditya Birla Group's Market Entry

Torrent Pharmaceuticals in Advanced Talks to Secure $7 Billion for Cipla Acquisition

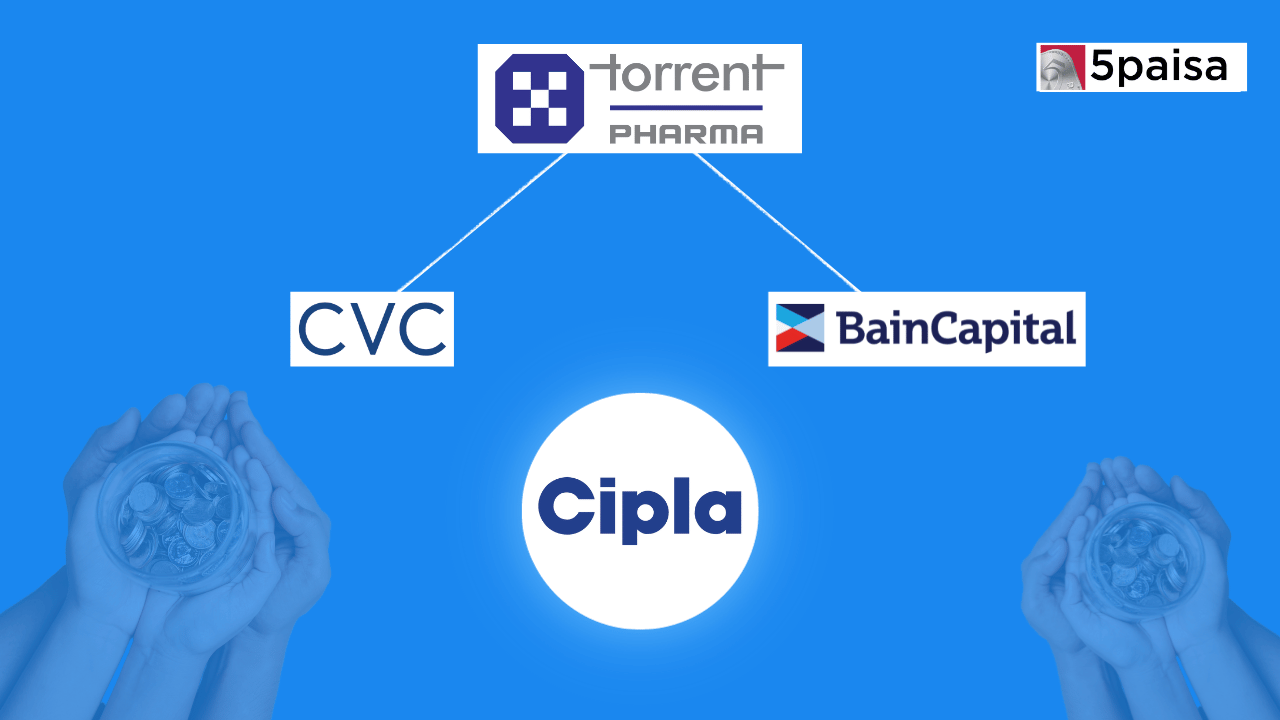

Torrent Pharmaceuticals Ltd is actively engaged in discussions with CVC Capital Partners and Brookfield to assemble a consortium and raise substantial funds for an ambitious acquisition endeavor. The company is set to acquire its rival, Cipla, and has embarked on a mission to secure a whopping ₹60,000 crore (approximately $7 billion) acquisition financing package. This potential acquisition financing deal has captured the industry's attention, given its colossal scale and significance.

The Consortium Formation

Torrent Pharmaceuticals is leaving no stone unturned in its pursuit of financing options to support this monumental acquisition. The primary focus currently lies in discussions with CVC Capital Partners, a European buyout fund, to secure an investment likely to fall within the range of $1.2-1.5 billion. As per the report, CVC Capital Partners is emerging as the frontrunner for this initiative, although discussions with Bain Capital are still ongoing.

Mezzanine Debt with Brookfield

Simultaneously, Torrent is exploring an alternative avenue with Brookfield to raise mezzanine debt in the range of $1-1.2 billion (approximately ₹8,300-9,000 crore). This innovative approach involves structuring the debt as share-backed promoter financing, leveraging the substantial 71.25% promoter ownership held by the Sudhir and Samir Mehta family. This strategy establishes a non-disposable undertaking (NDU), enabling the use of shares as collateral for loans, thereby allowing share sales, unlike traditional share pledging, which restricts share transactions.

Flexible Funding Approach

While the exact funds required have not been finalized, Torrent is actively exploring various avenues to secure the necessary resources and aims to conclude this funding process by the end of September. If discussions with other capital sources, including domestic shadow banks and mutual funds, do not yield the intended results, both CVC and Brookfield have indicated their capacity to increase their commitments up to $2.25 billion and $1.5 billion, respectively. This flexibility underscores their unwavering determination to secure the required funds for the acquisition.

Equity and Banking Participation

Torrent Pharmaceuticals is looking to raise a minimum of $750 million to as much as $2.25 billion through equity, factoring in the uncertainty surrounding the open offer's subscription. The participation of both Bain Capital and CVC in the consortium could significantly influence the final outcome.

Several renowned international banks, including Standard Chartered Bank, Barclays, MUFG (Mitsubishi UFJ Financial Group), Citi, and Morgan Stanley, are concurrently involved in arranging a senior debt facility expected to range from ₹30,000-32,000 crore (approximately $3.8 billion), with a three-year tenure. This facility will be structured based on the cash flows generated by both Torrent and Cipla, reflecting a significant financial arrangement associated with the acquisition plans.

Torrent Pharmaceutical in Talks with Apollo for $1 Billion Loan to Fund Cipla Bid

As per the report, Torrent is in preliminary talks with Apollo Global Management, aiming to secure a loan of up to $1 billion as part of its ambitious plan. This move comes in the wake of a broader financing goal, with Torrent seeking to secure an impressive $3 billion to $4 billion in total to support its bid for Cipla, its significantly larger rival.

As of March 2023, Apollo Global Management stands as one of the world's largest asset managers, overseeing a substantial $438 billion in credit and $101 billion in private equity. Their commitment to the Asian market was underscored by the opening of an office in Mumbai the previous year. Apollo has also been proactive in extending loans, with loans of approximately $2.5 billion issued to several entities, including Mumbai International Airport and JSW Cement.

As per the analysts, Cipla could be valued as high as $7 billion, marking a potentially historic milestone as India's largest pharmaceutical deal to date. Notably, Cipla's founding family has expressed their keen interest in divesting their 33.4% holding in the company. Such a move would not only attract potential investors but would also trigger an open offer for an additional 26% of Cipla, as per Indian regulatory requirements.

Expert Insights

Nomura commented on the acquisition, highlighting the substantial debt and equity dilution required for the transaction. With the robust cash flows of both Cipla and Torrent and Torrent Pharma's high promoter stake, it appears that the deal can be consummated. Nomura also estimates that Torrent could potentially raise approximately ₹10,000-20,000 crore of debt, with an additional ₹20,000-40,000 crore equity infusion from PE investors and other stakeholders.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

02

5paisa Research Team

5paisa Research Team

03

5paisa Research Team

5paisa Research Team

04

5paisa Research Team

5paisa Research Team

Indian Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.