Will Zepto, Dunzo and Blinkit kill Dmart?

Online delivery businesses have been the talk of the town recently. During the pandemic, when people were afraid to step out of their homes and everyone wanted the groceries and food at their doorsteps,the food delivery and grocery delivery business took the center stage.

Be it new age start ups by young entrepreneurs like Zepto,Dunzo or established giants like Reliance, Amazon, Flipkart all of them want a pie of the Quick commerce boom.

Is quick commerce just a fad because of covid or is here to rule and replace the kirana shops? Also, are giants like Dmart and Jiomart are also catching the quick commerce train? Let’s find out!

How are Quick commerce companies Quick?

Had a breakup? Get a double chocolate icecream delivered in 10 minutes! Craving for a bowl of maggie? It will get delivered in lesser time than it actually takes to cook maggie!

Quick commerce companies deliver groceries in just 10 minutes? Wonder how do they do it?

Quick commerce companies have these “dark stores” located between 1.5 km - 4 km the area where they deliver. As soon as an order is received the rider and the packer is informed about it. The rider reached the location, in the meantime the packer in the store is informed about the order and tells it exactly where the products are stored in the dark store. Since the packer already knows, it saves a lot of time which would have been wasted while looking for the item. Also, the products are located in dark stores in such a way that save up time. Like the most ordered products biscuits,noodles,icecream are stored in the front, while products that less frequently ordered would sit on the back!

Quick commerce happens when you can make the most out of technology and logistics.These dark stores are strategically located by identifying consumer buying patterns, frequency and demographics.

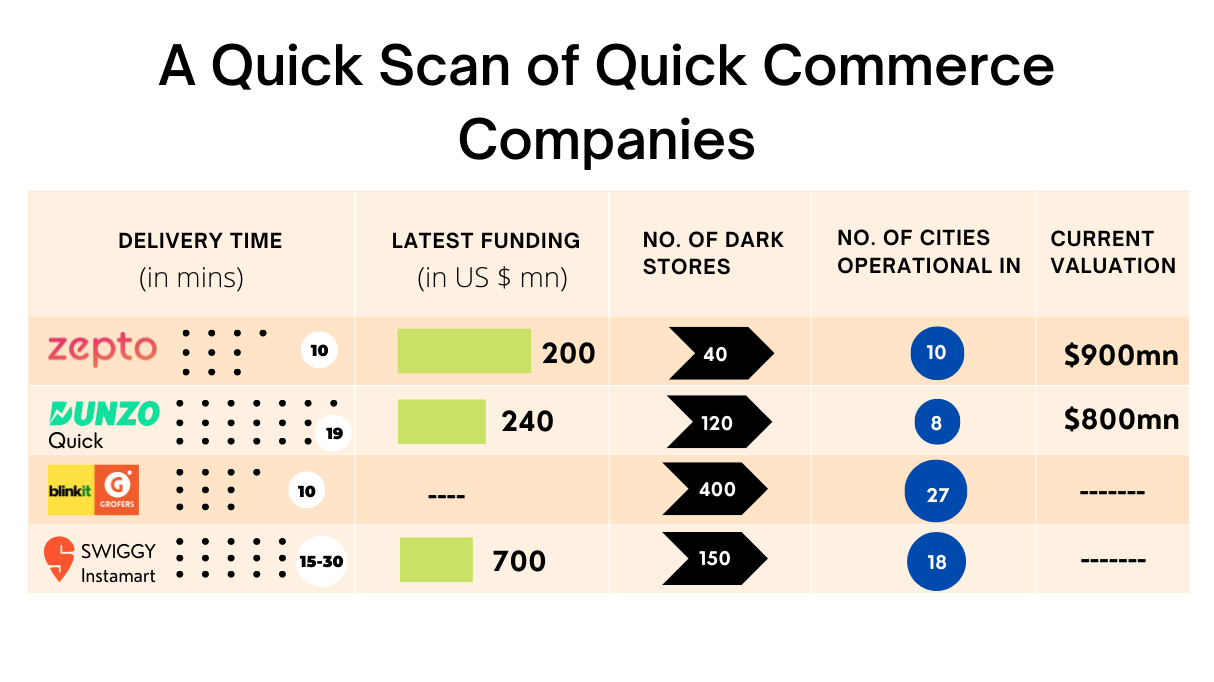

Google and Reliance backed Dunzo, Zepto, Zomato backed Blinkit, Swiggy’s Instamart have forayed into the space and provide delivery of groceries in 10 mins - 40 mins. VCs have gone gaga over these quick commerce companies and have invested millions in their promise of growth!

For instance, Zepto which promises to deliver groceries in under 10 minutes raised $200 mn in May this year and is valued at $900 mn now. The company posted an eye popping 800% growth Q-o-Q in revenue recently.

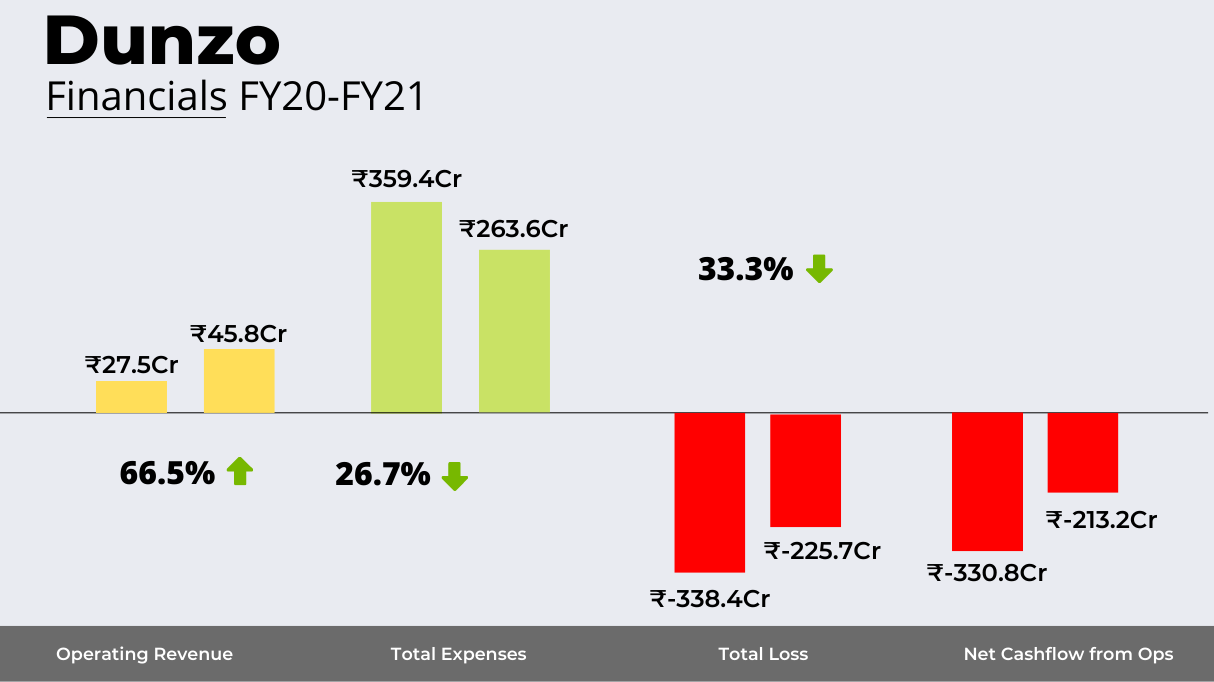

Next we have Google and Reliance backed Dunzo, the company started by providing concierge services but now derives 85% of its revenue from delivering groceries. The company recently raised $200 million from Reliance Retail and is now valued at $775 million.

Swiggy reportedly is investing $700 million into its grocery delivery business Instamart. These quick commerce companies operate.

Just like food delivery start-ups quick commerce companies also face the rock and hard place choice of growth and profitability.

Profitability is a far-fetched dream for these companies because of the inherent nature of their business. Let’s understand how!

So, broadly there are two types of profits, first is gross profit which is basically selling price minus cost price of the products. The gross profit margin in the case of grocery items like chips, and biscuits is paper thin. For instance Dmart, the supermarket chain had an operating profit margin of 10% in June 22 quarter.

The gross profit margin does not include the salary of staff, administration expenses, etc. So, if these companies have to be profitable, either they have to decrease the cost by giving fewer discounts or by increase the revenue by charging delivery charges.

But with fierce competition in the industry, these companies neither have the ability to charge delivery charges nor they can offer products at higher prices.

Another problem with Quick commerce companies is that their radius must be less than 500 metres if they have to make 100% of their deliveries in 10 minutes. In order to accomplish this, they will need many more dark stores. The company has to open a lot of dark stores because one store can cater to a smaller area. Opening up of new dark store would increase the fixed costs dramatically.

Therefore, these companies neither have the power to charge more, nor they can reduce their cash burn.

Will they beat retail chains like D mart?

The looming question is will these quick commerce companies kill the mainstream retail chains. Maybe not! Typically there are three types of shoppers

Unplanned purchasers—for example, someone who comes home late at night and then decides what to eat (most people plan their groceries at the start of the month; or they add to the cart over the week and order over the weekend, to build the basket for free delivery.)

Emergency—a light bulb burns out and you need a replacement right away; or you need something quick for guests.

Meat is one of those impulse purchases. People usually decide whether or not to eat meat in the morning. The use case here, too, is not delivery in 10-15 minutes, but delivery in 60-90 minutes.

Three types of these purchases are made on quick commerce apps, while people generally make planned purchases by visiting the retail chains.

A February 2022 Survey by LocalCircles indicates that 71% of the households used q-commerce platforms to either order daily use items such as milk, bread, eggs, curd, fruits, and vegetables, etc.

They also ordered indulgence items such as soft drinks, ice creams, chocolates and paan. Though, only 29% of the surveyed households used q-commerce for ‘all their grocery’ purchases.

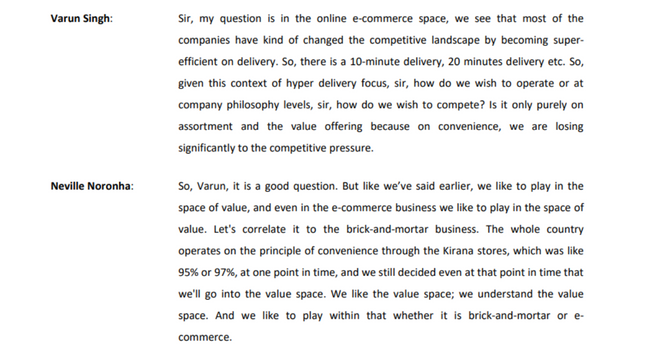

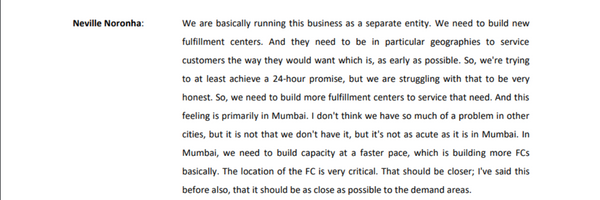

Clearly, retail chains are still ruling. Also, it isnt like the retail giants have not taken note of the ongoing quick commerce boom. D mart with its Dmart ready operates an e-commerce platform wherein customers can get their groceries delivered at home in one or two days. It has a subsidiary Avenue e-commerce limited through it operates its e-commerce platform.

(Source: Avenuesupermart concall July 2022)

The revenue of the company stood at Rs. 1667 crores for FY22, it increased Y-0-Y by a whopping 110%!

(Source: Avenuesupermart concall July 2022)

Though D mart ready does not provide 10 min delivery, it offers groceries at lucrative prices.

Quick commerce companies surely have spoiled the customer with their convenient, lightning fast services but will the customer pay when they start charging for their services? If not, how will survive when the VC funding dries up?

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Tanushree Jaiswal

Tanushree Jaiswal

5paisa Research Team

5paisa Research Team

5paisa Research Team

5paisa Research Team