Why ICICI bank has become the sweetheart banking stock of investors?

Do you know, what is the most underrated aspect of business analysis?

It is “Management analysis”

Have you heard off, “Bet on the jockey not on the horse”?. Well,it is true for stock picking, more than anything else.

As investors, we often overlook the management aspect of a business and underestimate its ability to impact the share price. Today we’ll discuss one company, whose fate changed entirely after a change in its management.

I am talking about ICICI bank, India’s second-largest private bank. For decades, it was overlooked by investors and never commanded a valuation similar to those of its peers like HDFC or Kotak. But, my friend, the tables have turned now, and the bank has recently garnered a lot of attention.

For instance, the share price of ICICI bank was approximately Rs. 240 in Jan 2008, and it reached close to Rs. 310 in Jan 2018. Its share price just grew by a CAGR of 2.3% in ten years and that too at a time, when share prices of its peers like SBI and HDFC grew by leaps and bounds.

Now, the mutual funds are hoarding its stock, retail investors are going gaga over it. Its share price has gone up by 22% in the last six months, while NIFTY50, the benchmark index has gone up by just 4%.

So, what is new with ICICI?

The “Management”!

Sandeep Bakhshi: The Saviour

In 2018, India’s second-largest private-sector bank was in tatters, after the infamous Chanda Kocchar episode. The CEO of the company stepped down from her position in 2018 after she was accused of corruption and misconduct, for extending loans (which turned into NPA later) to the Videocon group. The ICICI Bank MD and CEO was accused of giving Videocon a loan in exchange for personal gain.

Well, it wasn’t just the corporate governance issues, that were haunting the bank. In 2018, the whole banking sector was reeling from the IL&FS crisis. The collapse of the infrastructure giant led to a debt market crisis, where non-bank lenders and real estate developers started defaulting on their loans.

The bank had piles of bad loans and its gross NPA in FY2018 stood at 8.84%, the highest since its inception.

All its stakeholders had lost faith in the bank. Post the Chanda Kocchar episode, Sandeep Bakhshi was bought in as an interim COO and was appointed as the bank's CEO for three years. Since Bakhshi was an insider of ICICI, many believed he would do little in changing the bank.

Little did they knew of his crisis-handling abilities. Bakhshi has been a go person for the banking giant when it comes to handling crises. It was in 2008, during the global financial crisis when the bank first called Bakhshi because it was facing high delinquencies. After his efficient handling of the crisis, he was entrusted with the ICICI Prudential Life corporation.

Changing the gear

Three years on, Bakhshi, who prefers to stay low-key, has brought a lot of change to the company. The most prominent change he bought was in the loan book of the company. He shifted their focus from project lending to retail lending, transaction banking, and corporate banking.

The change in loan portfolio has provided ICICI cushioning against the pandemic-induced slowdown in the economy.

In an analyst call, he mentioned that his focus would be on “granularity, transaction banking, and improvement in the credit rating profile”

The shift has not only increased its profits but has also decreased its NPAs, because supply chain, working capital loans are much safer than long-term loans. Even if they turn into NPAs, their sheer size is such that it doesn’t impact the bank a lot.

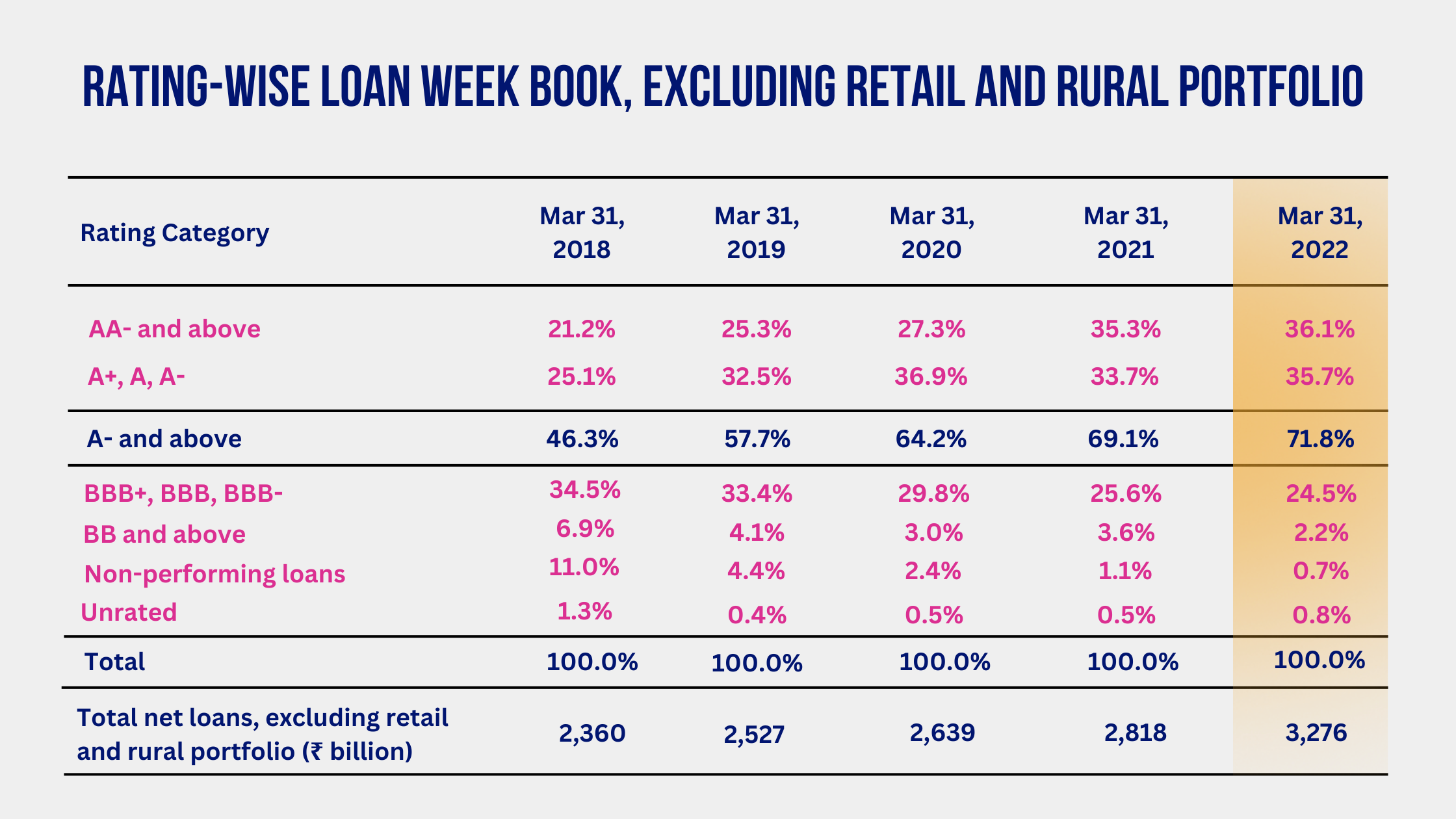

Moreover, he has also reduced the bank’s exposure to risky loans and improved the asset quality. For instance, In 2018, only 46% of its loans were given to companies rated A- and above. While in 2022, over 71% of its loan book comprised of loans rated A- and above.

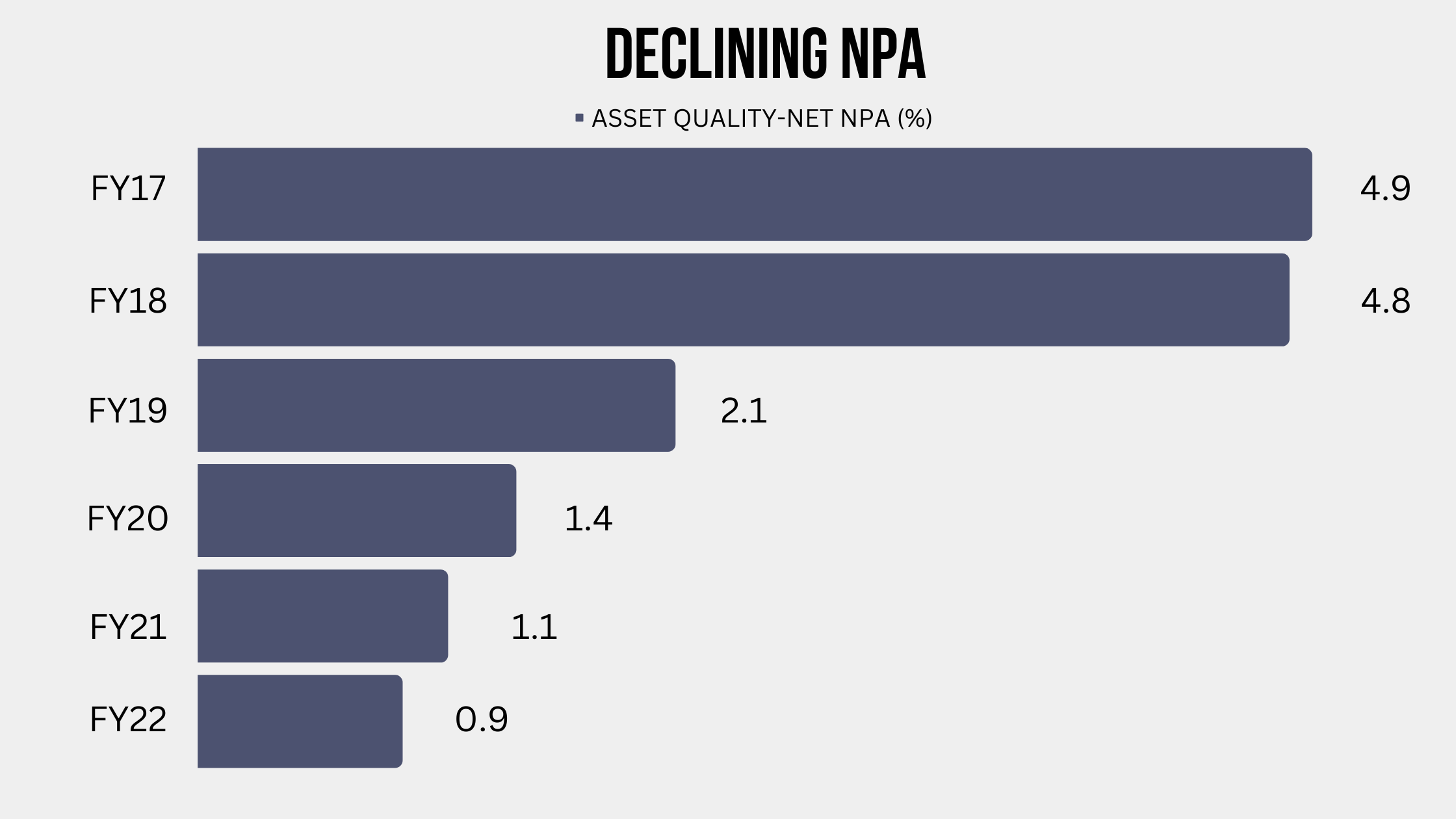

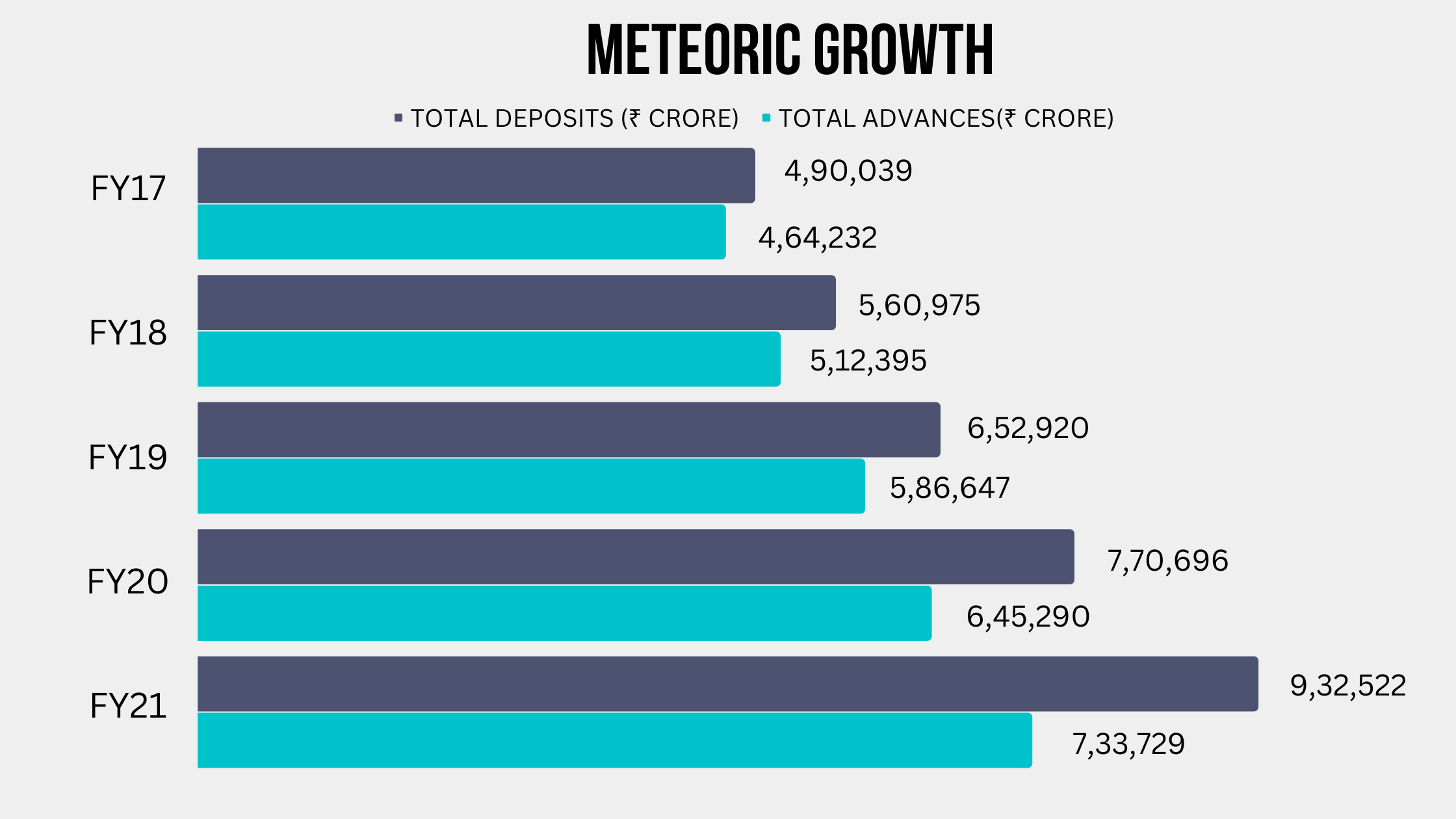

Bakhshi has managed to improve the asset quality and has bought down the net NPA from 4.8% in FY 2018 to 0.8% in FY 2022. Also, Bakhshi has not comprised on growth and profitability to improve the asset quality as its total advances grew at a CAGR of 13.79% between 2018 and 2022.

Moreover, its net interest income, the core income of the bank which is total interest received-total interest paid grew at a CAGR of 19.89% in the same period.

Bakhshi has not only brought a change in the asset quality of the bank but has also successfully strengthened its technology and improved its profitability.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Tanushree Jaiswal

Tanushree Jaiswal

5paisa Research Team

5paisa Research Team

5paisa Research Team

5paisa Research Team