How Adani created an empire on a pile of debt?

It was quite a day for the Adani group. Creditsights, a Fitch group unit in its latest report said that the Adani group is ”deeply overleveraged”.The report went on to discuss how the company can fall into a spiral of debt trap because of its debt-funded growth ambitions.

As per the report ““The group has been investing aggressively across both existing and new businesses, predominantly funded with debt, resulting in elevated leverage and solvency ratios. This has understandably caused concerns about the group as a whole, and what implications it could have on the group companies that are bond issuers,”

Is it true? Is Adani’s empire standing on a shaky pile of debt and can collapse if the debt is not managed well?

Well, thats what Creditsights believe. And it is kind of true, Adani has been relentlessly foraying into different sectors and raising debt for them.

For instance, in June 2022, Adani raised ₹6,071 crores from a consortium of banks led by the State Bank of India (SBI) for its new copper business.

Additionally, Gautam Adani's group has secured a loan of Rs 12,770 crore for a new international airport at Navi Mumbai. In Aug, it took a loan of more than Rs.41,000 crore to acquire a stake in Ambuja cement.

Due to its expansion spree in just a matter of years, Adani is ruling green energy, ports, cement, airports, and whatnot in India.

He has become the world’s fourth richest man. According to a report, Adani group has overtaken Ambani group to become the second largest group as per market capitalization in India. It is just behind Tatas. While it has taken generational wealth and decades for Tata and Ambani to reach here, Adani has done it in just a few years.

And what is really behind his confounding rise? The rise is due to his business strategies:

Good ties with the government:

Post the privatisation reforms, some businesses in India were managed under PPP public-private partnership, under which the private company would manage the business and share some profit with the government. In 2019 the government decided that managing airports was a cumbersome task, and put out a tender asking for private companies to operate, develop, and manage airports in India. They decided to operate airports under the PPP model and leased out 8 airports. Out of these 8, guess how many airports Adani bagged? They bagged 7 out of 8 airports.

Moreover, the ministry leased 3 airports at almost 1/3 times their actual value. According to a report,the ministry leased the airports at Rs. 500 crores to Adani group, while the actual value was estimated to be Rs. 1300 crores

Whenever government privatizes a sector, Adani is a beneficiary. Be it ports or airports Adani is the bidder and the winner.

The affair of Modi and Adani is an unspoken yet accepted truth. Adani’s ties with the government have been of strategic importance to all its businesses. If you observe closely government has a say in most sectors Adani operates. Therefore, having good ties with the government has certainly helped Adani.

Unlimited access to debt:

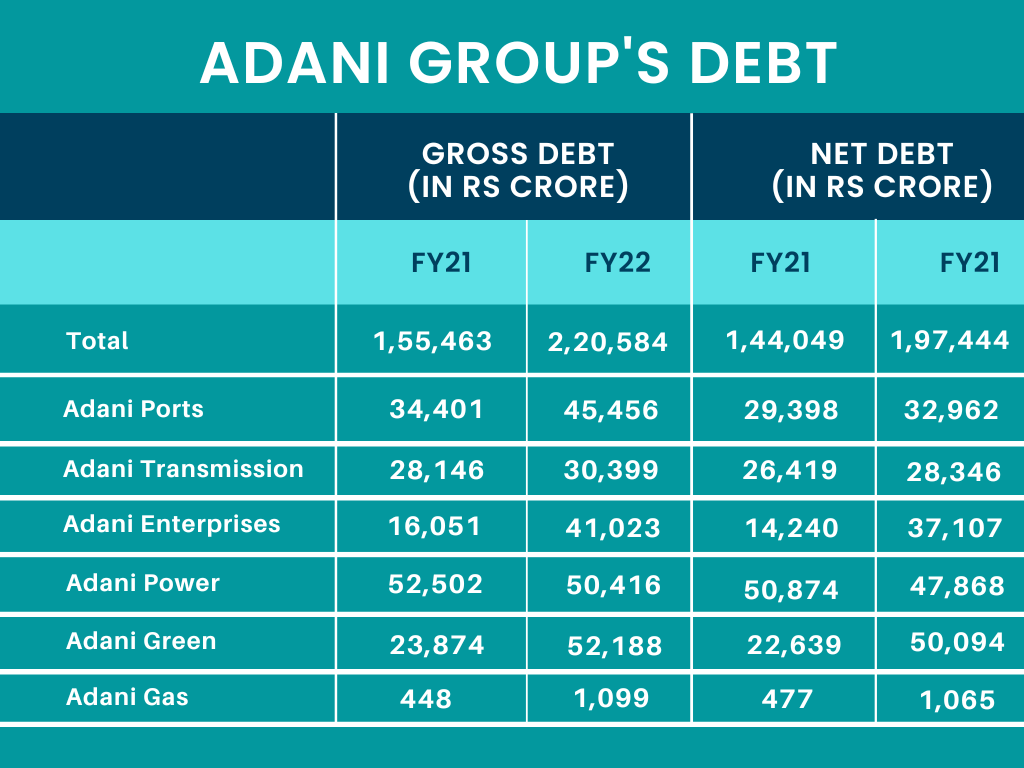

In FY22, Adani group’s debt stood at Rs. 2.2 trillion, it has increased by a whopping 42% in the last one year.

The company’s liquidity position is being questioned as it had cash and bank balance worth Rs. 26,989 crores, while its debt was more than Rs. 2 trillion.

Even after a pile of debt, and grim liquidity position Banks and Financial institutions aren’t hesitating on extending loans to the group primarily because of the “Adani” brand and the spectacular performance of Adani stocks on the stock exchange.

Valuation game:

Adani stocks trade at insanely high valuations! For instance, Adani Green is currently trading at a P/E of 769, while its peer Tata Power is trading at a P/E of 34. Adani gas is trading at a P/E of 747, its competitor Indraprastha gas is trading at a P/E of 17, while the revenue of both the companies stood approximately the same at Rs. 3000 crores in 2022, the valuation gap was huge.

In fact, the insanely high valuation has little to do with the financial performance of the company, rather it is due to investor expectations of the company's growth in coming years.

The company has bagged huge tenders and licenses from the government and due to that investors expect a jump in profits.

Another reason for these ballooned-up valuations could be its shareholding structure. As per a report in Economic times, FPI that have invested in Adani stocks are largely unknown names and have the majority of their stakes in Adani group stocks only. Post the allegation NSDL froze the accounts of 3 such companies. It was believed that since the shareholding was concentrated in a few hands, it was easy to manipulate the stock price.

Adani has taken huge bets to build his empire and these bets have made him one of the richest men on earth but these bets backfire on the giant conglomerate if there is even a slight slowdown in the infrastructure sector as 6 out of 7 of its listed companies operate in the infrastructure sector.

Well, it is for time to tell, if Adani will dethrone Ambani in all the sectors or if Ambani will keep its empire.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Tanushree Jaiswal

Tanushree Jaiswal

5paisa Research Team

5paisa Research Team

5paisa Research Team

5paisa Research Team