Tax Payers and Tax Professionals were relieved with the last week’s relaxation where the deadline for filing the tax was extended to 31st December 2021.

But, its always advisable to utilize the time correctly calculate the tax liability and pay the tax dues on time to avoid interest charges this specially is true for taxpayers who file their returns on their own.

Tax Payers should be aware of how incomes from other sources have to be reported in the tax return let us check this out: –

Other Incomes To Be Reported In Tax Return: –

A lot of taxpayers due to ignorance miss reporting their other incomes in their ITR. For instance, many taxpayers ignore reporting their interest income in their returns even though it is fully taxable. A lot of them do not report capital gains because mentioning the details of every transaction is very tedious. There have also been cases where taxpayers have skipped filling in details of the dividends received due to the ignorance that dividends are fully taxable.

Now lets access some of the tax rules one should be aware of while preparing their tax return. The first thing a tax payer has to be aware of is intimating the income tax department of selection of the tax regime he/she is going to use to calculate his/her tax liability.

Salaried taxpayers might have already told their employers about the tax regime they want to go with. Their tax liability would have been accordingly calculated. If not declared, the employer will calculate the default TDS liability as per the old tax regime. However, the employee can make a switch at the time of filing his return.

Calculating Capital Gains:-

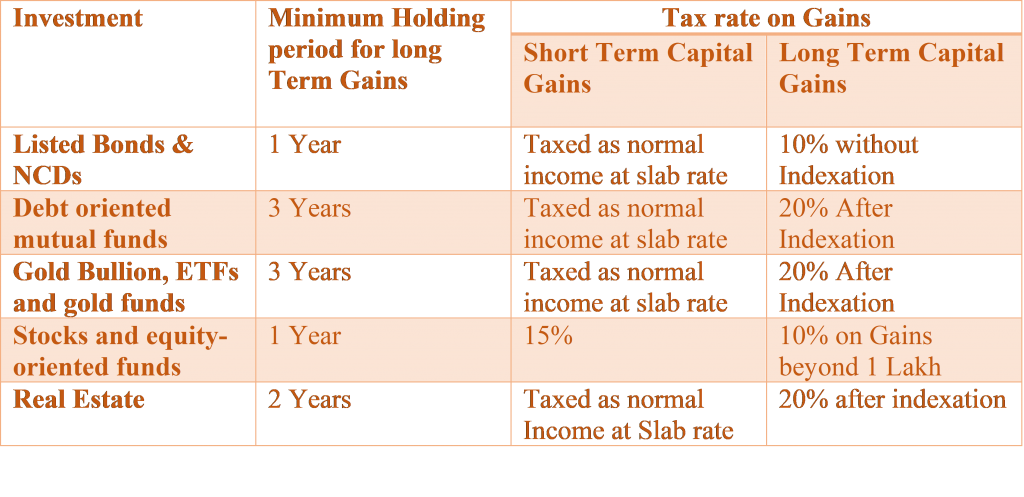

The major concern for a tax payer is calculating capital gains and the tax on such income. With a large number of people taking to mutual funds and stocks in recent years, capital gains are now common. Besides, even long-term capital gains from equity mutual funds and stocks are now taxable beyond Rs 1 lakh, which means a lot more taxpayers are in this net.

Calculating capital gains has been a complicated exercise, because you not only need to maintain records of all transactions but also because there are different tax rates applicable to different instruments. The new income tax filing portal is supposed to auto calculate and pre-fill the capital gains and tax in the tax form for an individual. However, it has not happened yet and all capital gains details have to be filled in the forms manually.

Now Let us Understand how are Capital Gains Calculated

Adding to the complexity is the new rule that requires details of the scrips, buying price, selling price and dates of transactions to be mentioned in the return if the taxpayer has made long-term gains. The tax department has clarified that there is no need to mention scrip-wise details of transactions when reporting short-term gains.

The positive part is that majority fund houses provide investors with a capital gains statement that mentions all the transactions and gains made during the year. These statements not only segregate the short- and long-term gains but also calculate the indexation benefit. A capital gains statement can be quite elaborate, especially if the individual has invested through SIPs and made several redemptions during the year.

Dividends are now taxable

Not a lot of investors know that the dividends they receive from their mutual funds and stocks are now taxable. Till 2019-20, the tax on mutual fund dividends was deducted by the fund house itself, but the dividend distribution tax was removed last year and dividends are now fully taxed as income. Dividends received from stocks will also get the same tax treatment. But one has to ensure he does not count on Form 26AS alone, because companies deduct TDS from dividend payouts if they exceed a limit. Small dividend payments not subjected to TDS will obviously not be mentioned in Form 26AS. Yet, they need to be reported as a part of the tax return.

Interest is also fully taxable

One of the misconceptions for taxpayers is the taxability which arises out of interest income. The interest earned on bank deposits, bonds and some small savings schemes is also fully taxable, but many taxpayers ignore this component while computing their tax liability. Even the interest on savings bank balance has to be reported as “income from other sources” in the tax return.

About Two years ago, the TDS threshold has been raised to Rs 40,000 per year. Even if TDS is not being deducted, one should not assume that he/she can escape tax on interest income. All interest payments usually are reported to the tax department by all financial institution which are paying interest to their customers. One should take a note of the point that not only bank deposits, but even investments in Post Office schemes now require your PAN, and the information on the interest earned ultimately has to reach the department.

Some taxpayers are of the belief that no tax is payable if their bank has deducted TDS on the interest. This is also a misconception. TDS is only 10% of the interest (20% if PAN is not provided). If a taxpayer is in a higher tax slab, he needs to pay additional tax on the interest. Check your interest income for the financial year in the Form 26AS. It will have details of the TDS deducted from interest payments. The income declared in your tax return must match the information in the Form 26AS, else be ready for a tax notice.

It could be a good idea to also report the exempted income such as the interest earned on tax-free bonds, PPF and the Sukanya Samriddhi Yojana in your tax return. You will find it easier to explain the credit of large sums when these investments mature if you have been reporting this income all along.

Clubbing of Income

One common mistake that taxpayers make relates to the clubbing of income. Tax rules say that if money gifted by a spouse is invested, the income from that investment will be clubbed with that of the giver and taxed accordingly. Now lets suppose a case where a property is jointly owned by a couple even though the entire money was paid by the husband. In such cases, the rental income cannot be divided between husband and wife. It will have to be reported as the income of husband alone. Likewise, if there is any income from investments made in the name of spouse or minor children that will also be added to the income of the giver.

Reconciling income and expenses

One has to be aware that the tax department has started examining expenses incurred by taxpayers in the recent years. Rich taxpayers with a net taxable income of more than Rs 50 lakh in a financial year are required to also report details of specified assets such as land, building, movable assets, bank accounts, shares and bonds and the corresponding liabilities against those assets if any. Last year, it introduced a new Section E in the Form 26AS which mentions high-value transactions done during the year. These high-value expenses should be mentioned in the Form 26AS and should match the income you declared in your return. If a person spends Rs 10-12 lakh on his credit card and another Rs 3-4 lakh on foreign travel but declares an income of only Rs 6-7 lakh, the department may want to know how his expenses have exceed his income.