What Is Marubozu Candlestick?

Marubozu is a Japanese word that translates to “Bald”.

As a candlestick without an upper or lower shadow, Marubozu. A Marubozu candlestick has a large, lengthy body and hardly any shadows, making it difficult to miss. This sturdy body denotes a powerful movement in either an upward or downward direction. When a bullish (green/white) Marubozu forms, it means that the price rose steadily from the time it opened until it closed, trying to rise even higher.

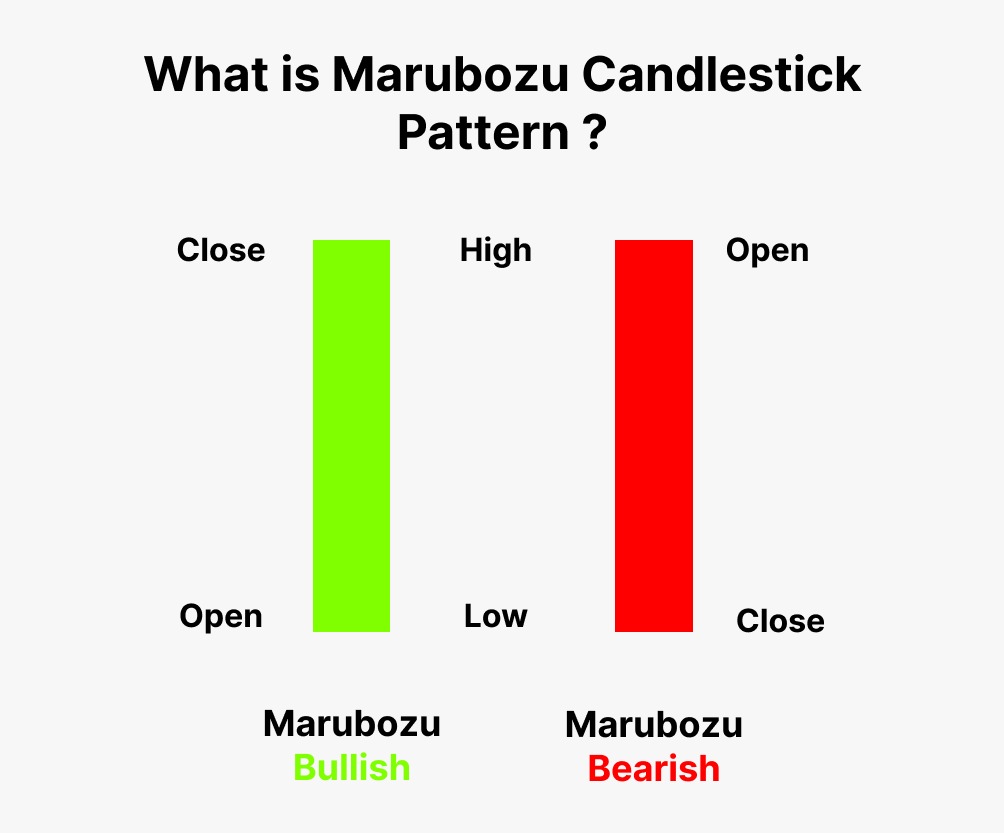

What is Marubozu Candlestick Pattern?

The Marubozu candlestick pattern is a single-candle formation that represents the market’s resolve to move mostly in one direction without significant resistance from the opposing side, forcing a closing at the session’s high or low.

Marubozu comes in two varieties: bullish marubozu and bearish marubozu.

Retaining some trading guidelines:

- Buy power and sell fragility

- Be tolerant of conventions (verify and quantify)

- Find the previous trend

Only the Marubozu candlestick pattern deviates from Rule 3: Look for Prior Trend.

How to Identify Marubozu Candlestick Patterns?

Bullish Marubozu: Open = Low, Close = High

A bullish marubozu shows that the stock has such strong buying demand that market players were willing to purchase it at every price point throughout the day, causing the stock to close to its day’s high.

Regardless of the previous trend, the behavior on marubozu day implies that the stock is now positive and that the sentiment has changed. It is anticipated that a rise in bullishness will follow this abrupt shift in sentiment and that this bullishness will last for the following few trading sessions.

Consequently, a trader should consider purchasing chances when a bullish marubozu appears. The purchase price needs to be close to marubozu’s closing price.

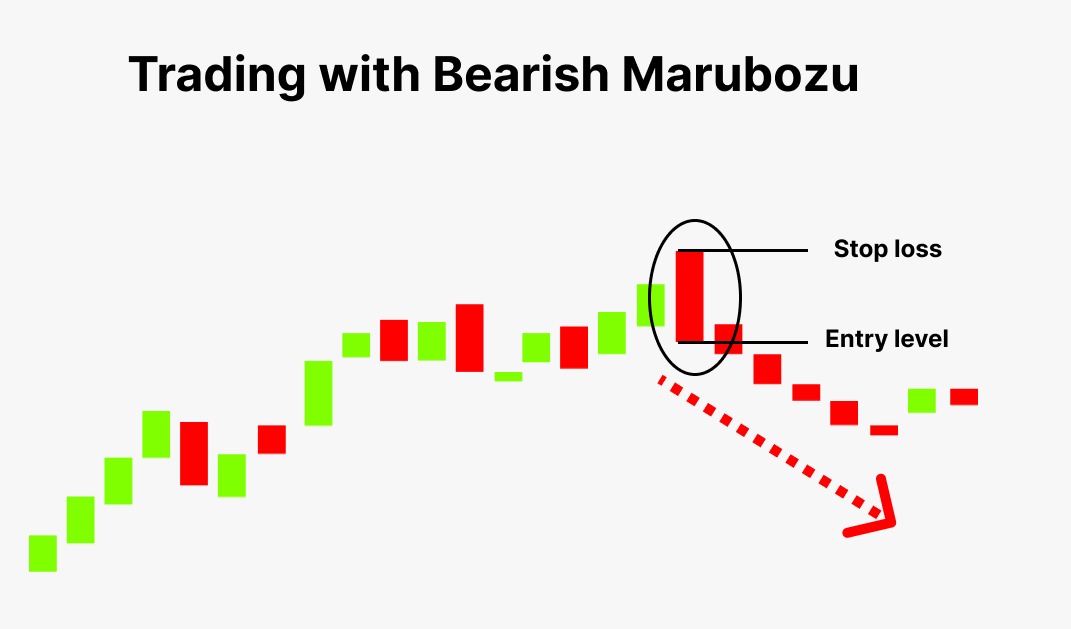

Bearish Marubozu: Rule: “Open equals high, and close equals low”

Whatever the past trend, the behavior on the marubozu day implies that the attitude has shifted and the stock is now bearish, regardless of the prior trend.

Investors should search for opportunities to short.

Example of How to Use a Marubozu Candlestick Pattern?

Interpretation: A Marubozu White Candle is a candlestick that does not have a shadow that extends from its candle body at either the open or the close. Marubozu is Japanese for “close-cropped” or “close-cut.” Other sources may call it a Bald or Shaven Head Candle. Here we can see that a bullish Marubozu is formed at 1820 INR and can see a huge buying interest in TCS so much so that it closed near its high point for the day and it continue for the next few sessions.

The Risk-taker and risk-averse?

Around closing time on the same day, the risk-taker would have started a trade to acquire the shares, only to book a loss the next day.

Because the following day occurred to be a day with a red candle, the risk-averse investor would have refrained from purchasing the stock altogether.

According to the rule, we should only buy on days with blue candles and sell on days with red candles.

The risk-averse trader would purchase the stock the day after the pattern has formed, or the following day.

To adhere to rule number 1, the trader must first confirm that the day is bullish before buying. As a result, the risk-averse buyer can only purchase the stock the following day. The buying price is far higher than the indicated buy price, so the stop loss is rather deep when buying the following day. But as a compromise, the risk-averse trader only buys after double verifying that the bullishness has in fact been established.

The adventurous person would purchase the shares the day the marubozu is established. Needs to confirm Validation is really easy to do. At 3:30 PM, Indian marketplaces close. Therefore, around 3:28 PM, one should determine whether the CMP is roughly equal to the day’s high price and whether the day’s opening price is roughly equal to the day’s low price.

Conclusion

A long, muscular body without any wicks on each side defines the pattern. This is a common Marubozu pattern that, depending on the direction, maybe bullish or bearish. Marubozu open and close are distinguished if there are wicks to either side, and both of these candles are available in bullish and bearish configurations.

The Marubozu candlestick formation is significant because it indicates that the market is now one-sided, and that price movement is likely to keep going in that same direction because there are no signs that a reversal is about to occur.