An iron condor is an options strategy that consists of four strike prices, all with the same expiration date, two puts (one long and one short), and two calls (one long and one short). When the underlying asset closes between the intermediate strike prices at expiration, the iron condor makes the most money. In other words, the objective is to profit from the underlying asset’s low volatility.

The iron condor utilizes both calls and puts instead of just calls or just puts and offers a similar reward to a standard condor spread. The butterfly spread and iron butterfly are both extensions of the condor, which is also known as the iron condor.

Introduction:

An iron condor is a defined risk, directionally neutral strategy that gains from the underlying’s trading in a range through the options contract’s expiration. In a single transaction with the same expiration, it consists of a short vertical put spread and a short vertical call spread.

A bullish or bearish bias can be added to an iron condor, which is a delta-neutral options strategy that performs best when the underlying asset does not change much.

A long put that is further out of the money (OTM) and a short put that is closer to the money, as well as a long call that is further OTM and a short call that is closer to the money, make up an iron condor, which is similar to an iron butterfly in that it has four options with the same expiration.

The potential profit is capped at the premium paid, and the potential loss is capped at the difference between the call and put strike prices, less the net premium paid

What is an iron condor?

Due to the wings’ protection against big changes in either direction, the iron condor strategy’s upside and downside risk are kept to a minimum. Its potential for profit is constrained by the restricted risk.

The trader’s desired outcome for this technique is for all of the options to expire worthless, which can only happen if the underlying asset closes at a price between the middle two strike prices at expiry. If the trade is profitable, a fee will probably be charged to close it. The loss is still minimal even if it fails.

Understanding an iron condor?

In order to reduce risk, a short strangle with long options that are bought further out-of-the-money (OTM) is known as an iron condor. This is a fantastic approach to gain exposure to stock without having a directional position, just like with a strangle. Benefits include time passing and any drops in implied volatility. It is also a way to possibly play a non-movement and a contraction of volatility leading up to earnings.

Call and put options are used in the iron condor option strategy. In total, there are four alternatives, all of which have the same expiration date.

Here are the steps you must follow in order to build an iron condor.

– Sell a put that is out-of-the-money

– Sell a call that is out-of-the-money

– Purchase a second out-of-the-money put.

– Purchase a second out-of-the-money call.

As you can see, the iron condor method utilizes four trading legs. A bear put spread and a bull call spread are two of the four components of this strategy.

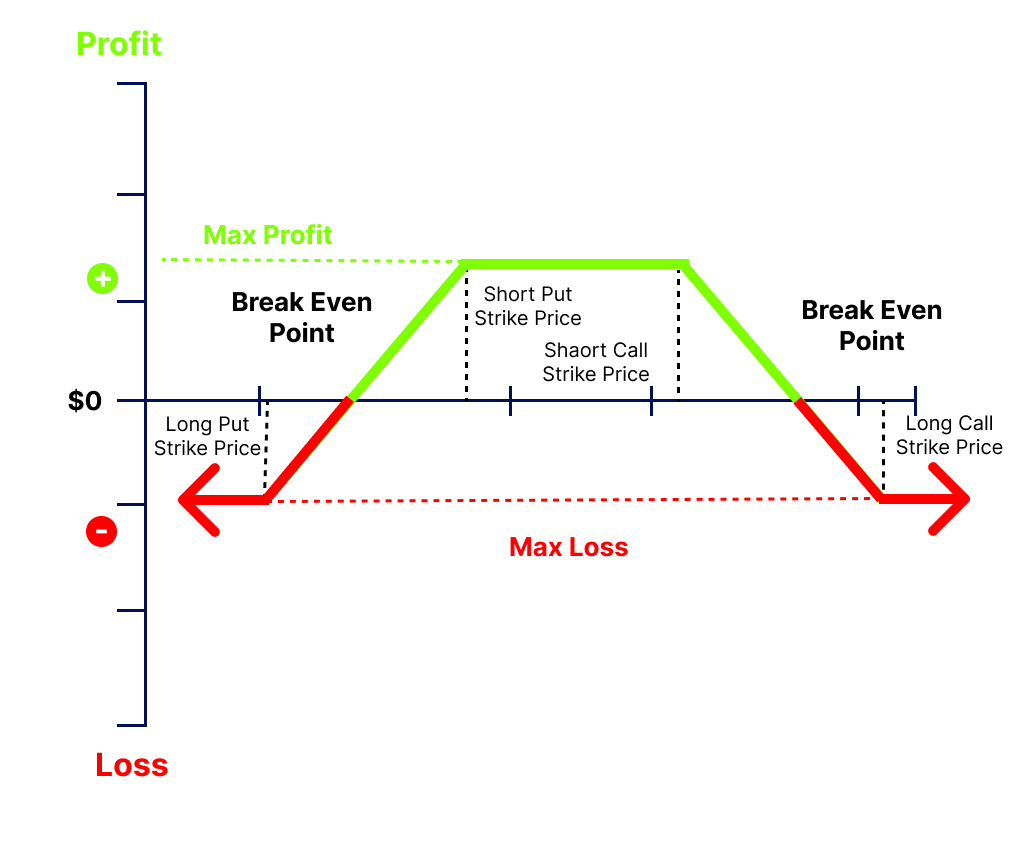

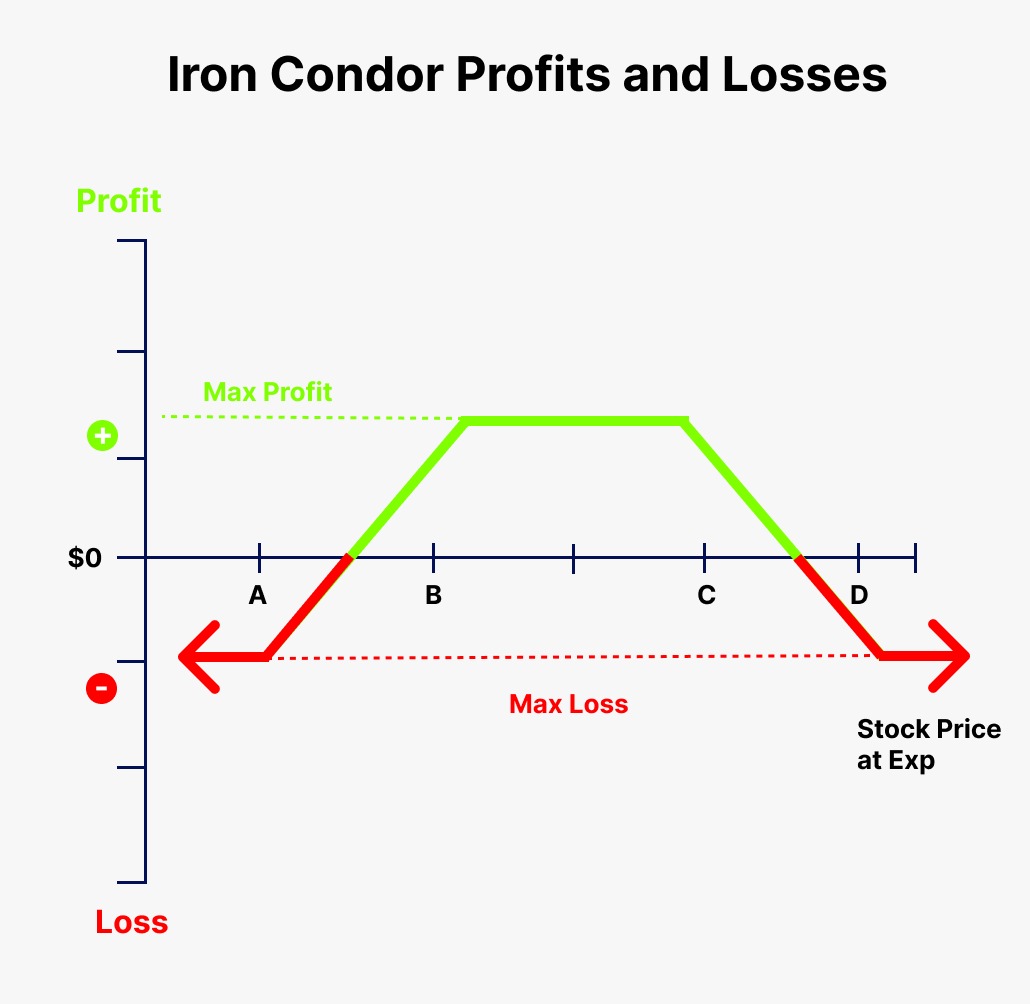

An iron condor profits and losses?

Iron condors are known risky bets with a maximum profit and loss potential. Since our long options hedge the risk in our short options in the event that the spread moves ITM, the maximum profit is capped at the credit obtained up front, and the maximum loss is restricted to the breadth of the widest spread being ITM at expiration, minus the credit received.

The net credit gained when establishing the four-leg options contracts represents the iron condor’s greatest profit potential. When the underlying settles between the trade’s short strikes at expiration, when all options expire worthless, the maximum profit is realized. However, iron condor traders are not required to hold the strategy until expiration. If, for example, they see a 50% profit where the spread is trading for 50% of the credit received up front, they can simply route the opposite order or “buy back” the iron condor using the same strikes and expiration cycle to close the trade.

Example of an iron condor?

Consider a corporation that is trading in February at Rs. 50. To use the iron condor strategy, sell the following or buy the following. The lot size for each option is 100 shares.

– You invest Rs. 40 in one March put option with a strike price of (at a cost of Rs. 50)

– You invest in one March call option with a Rs. 60 strike price (at a cost of Rs. 50)

– You market one March put option with a 45 rupee strike price (for a price of Rs. 100)

– You market one March call option with a Rs. 55 strike price (for a price of Rs. 100)

Therefore, your initial benefit is Rs. 100. (since you received Rs. 200 for the options sold and paid Rs. 100 for the options bought).

Here is what will happen at expiry if the underlying stock’s price closed somewhere between Rs. 45 and Rs. 55. Consider a 52 rupee stock price upon expiration.

Option 1 would be pointless as it provides you the option to sell for 40 rupees (instead of Rs. 52)

Option 2 would be useless as it provides you the option to purchase for Rs. 60. (instead of Rs. 52)

Option 3 would expire worthless because the buyer would have the option to sell for Rs (instead of Rs. 52)

Option 4 would be pointless since it would provide the customer the option to purchase at Rs (instead of Rs. 52)

Overall, if you use the iron condor approach in this case, you will still have the initial profit of Rs. 100.

On the other hand, you would suffer a loss if the stock closes below Rs. 45.

Conclusion

For experienced traders who have been active in the market for some time, the iron condor option strategy is the finest choice. Additionally, since you want all four of your options to expire worthless, the iron condor approach performs best if you anticipate little volatility. In this manner, you can profit from the transaction. Between the two inner strike prices is where this method excels. Since the iron condor strategy involves four legs of trade, it is best to master the fundamentals before applying it. Making wise trading decisions is also necessary here because you should only use this strategy when the market is at its ideal state.