Sypnosis

A business cycle, sometimes called a “trade cycle” or “economic cycle,” refers to a series of stages in the economy as it expands and contracts. Constantly repeating, it is primarily measured by the rise and fall of gross domestic product (GDP) in a country. Business cycles are cyclical. So, while these can positively or negatively impact the economy, industries and even investor sentiment, can you find benefits in these business cycles?

We are all too familiar with the quote ‘After every dark night comes a bright morning’ – In fact it is often applies to equity investing to explain the market’s cyclical movement. But what if we could tweak this quote- so as to actually ‘find light even in a dark night’?. Can investors actually get benefits from business cycles rather than fearing them? Business cycles are universal to all nations that have capitalistic economies. All such economies will experience these natural periods of growth and declines, though not all at the same time. However, given the increased globalization, business cycles tend to happen at similar times across countries more often than they did before.

Stages Of A Business Cycle

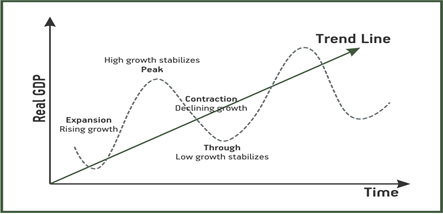

Think of business cycles like the tides: a natural, never-ending ebb and flow from high tide to low tide. And the same way the waves can suddenly seem to surge even when the tide’s going out or seem low when the tide’s coming in, there can be interim, contrarian bumps — either up or down — in the midst of particular phase. The business cycle shows how a nation’s aggregate economy fluctuates over time. All business cycles are bookended by a sustained period of economic growth, followed by a sustained period of economic decline. Throughout its life, a business cycle goes through four identifiable stages, known as phases: expansion, peak, contraction, and trough.

Expansion:

Expansion, considered the “normal” — or at least, the most desirable — state of the economy, is an up period. During an expansion, businesses and companies are steadily growing their production and profits, unemployment remains low, and the stock market is performing well. Consumers are buying and investing, and with this increasing demand for goods and services, prices begin to rise too. When the GDP growth rate is in the 2% to 3% range, inflation is at the 2% target, unemployment is between 3.5% and 4.5%, and the stock market is a bull market, then the economy is considered to be in a healthy period of expansion.

Peak:

Once these numbers start to increase outside of their traditional bands, though, then the economy is considered to be growing out of control. Companies may be expanding recklessly. Investors are overconfident, buying up assets and significantly increasing their prices, which are not supported by their underlying value. Everything is starting to cost too much. The peak marks the climax of all this feverish activity. It occurs when the expansion has reached its end and indicates that production and prices have reached their limit. This is the turning point: With no room for growth left, there’s nowhere to go but down. A contraction is forthcoming.

Contraction:

A contraction spans the length of time from the peak to the trough. It’s the period when economic activity is on the way down. During a contraction, unemployment numbers typically spike, stocks enter a bear market, and GDP growth is below 2%, indicating that businesses have cut back their activities. When the GDP has declined for two consecutive quarters, the economy is often considered to be in a recession.

Trough:

As the peak is the cycle’s high point, the trough is its low point. It occurs when the recession, or contraction phase, bottoms out and starts to rebound into an expansion phase — and the business cycle starts all over again. The rebound is not always quick, nor is it a straight line, along the way towards full economic recovery.

The Financial Takeaway

Even though they seem like something that only affects “the economy,” business cycles have plenty of real-world implications for individuals. Recognizing the current cycle can influence people and their lifestyle decisions.

For example, if we’re in a contraction phase, finding work often becomes more difficult. Individuals may take up less-than-ideal jobs just to ensure they are making an income, and hope to find better positions once the economy improves.

Understanding the business cycle is also crucial for investors. Knowing which assets — especially stocks — perform well in the different phases of a business cycle can help an investor avoid certain risks and even grow the value of their portfolio in a contractionary phase.

What Do These Business Cycles Mean For Investors?

Each phase of a business cycle opens up a different set of opportunities. They impact different sectors differently. An expansion phase egged on by favourable interest rates can positively impact high value sectors such as real estate or industry; an expansion egged on by government stimulus can favour the sectors being stimulated.

In most cases, these phases will have some lead indicators. Catching these early can actually multiply the growth opportunities for investors. Think of it as ‘first mover advantage’ for your investments.