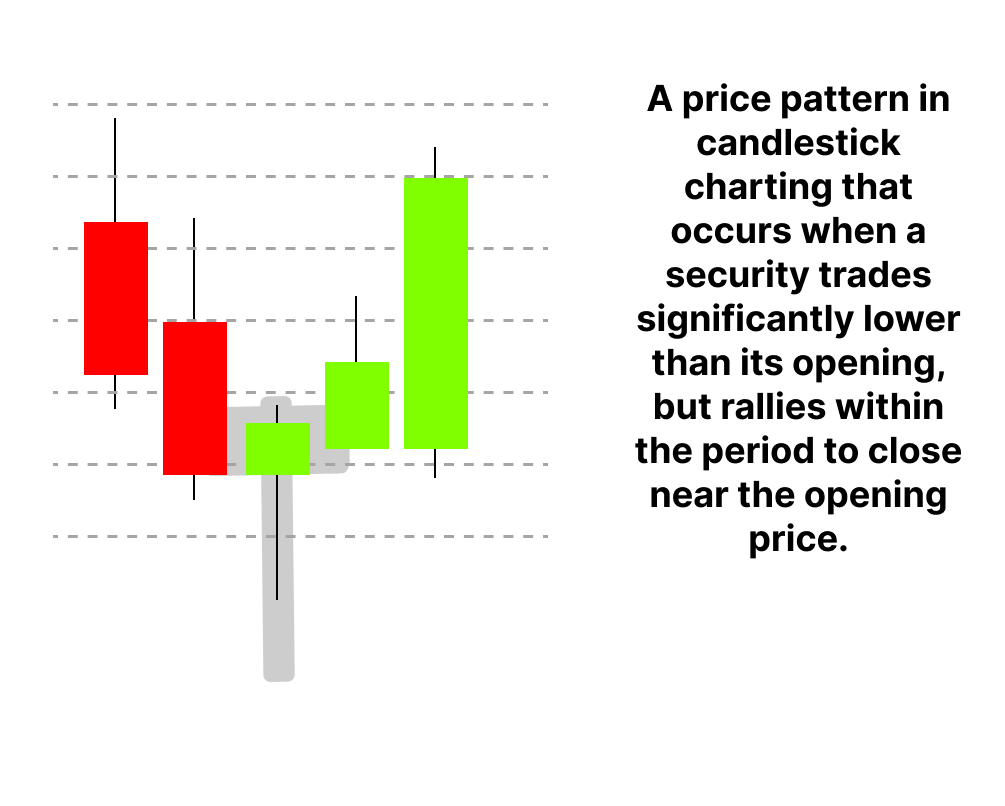

The Hammer Candlestick pattern is considered as one of the key candlestick patterns used by traders to analyse price action trading. A hammer occurs when a stock trades significantly lower than its opening price at the end of the session but rallies back to the close near the opening price at the end of the session. The hammer candlestick pattern is considered a reversal pattern as it signals the reversal of the ongoing trend and shows the presence of the opposing party in the stock. The bullish pattern which appears at the bottom end of a downtrend is considered a hammer pattern.

Introduction To Hammer Candlestick Pattern:

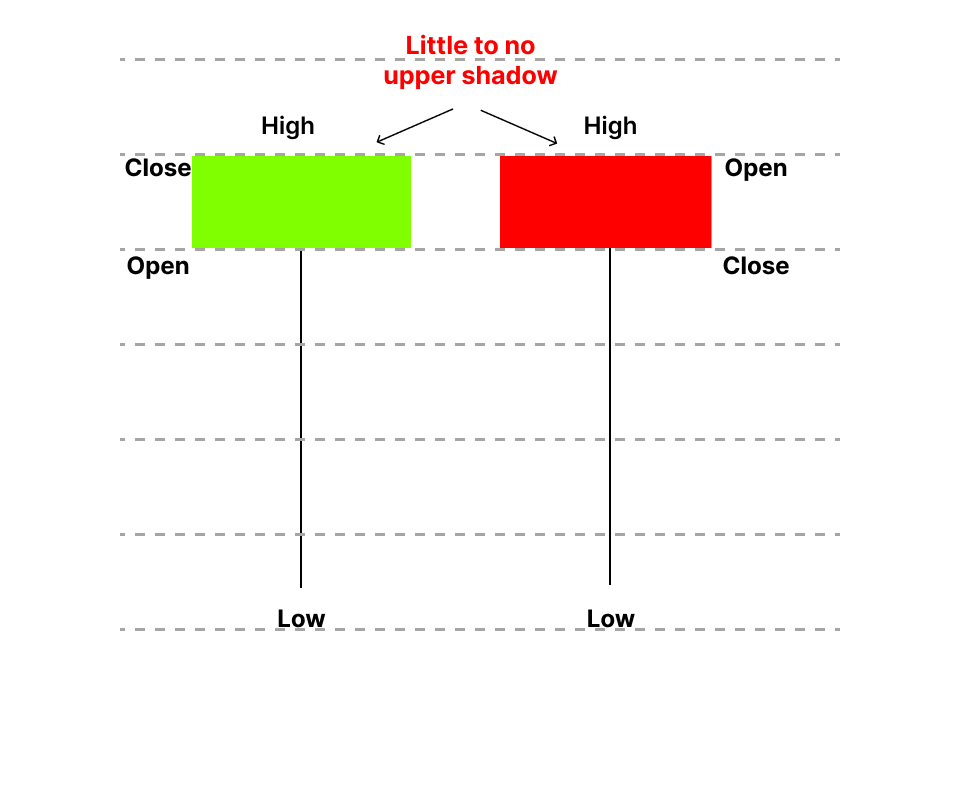

The Hammer candlestick pattern helps in setting up directional trades. A hammer-like candlestick occurs when prices increase after a sell-off that occurs during the period and closes relatively close to the open. As a result, the main body, which can be black, white, red, or green, is close to the upper end of the period’s trading range and has little to no upper shadow. The bottom shadow must be at least twice as long as the main body for the design to be considered legitimate.

What is Hammer candlestick Pattern?

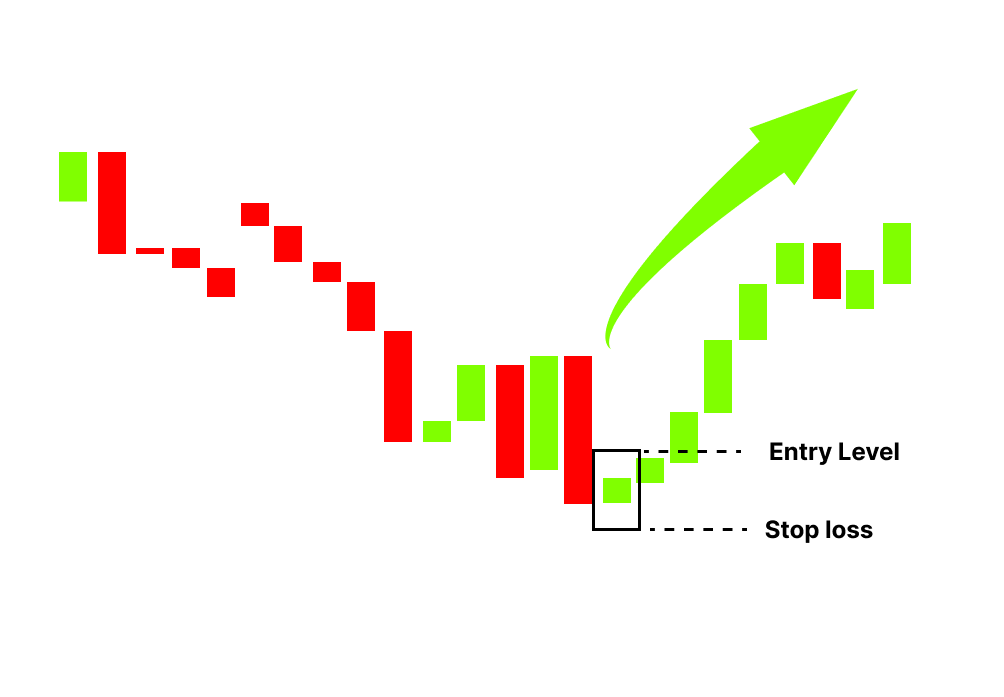

Hammer candlesticks indicate that sellers are likely to have reached their bottom, while price increases point to a possible price direction change. When the price declines after the opening but then rises to close nearly at the opening price during a downtrend, a hammer candle is created. A confirmation has happened if the candle that closes after the hammer does so is higher than the hammer’s closing price. The perfect confirmation candle would show active buying. Most candlestick traders try to enter long bets or exit short positions during the confirmation candle. For fresh long positions, a stop loss might be placed below the low of the hammer’s shadow.

How to Identify Hammer Candlestick Patterns?

When prices rise following a sell-off that happens during the time and closes reasonably close to the open, a candlestick that resembles a hammer will form.

Although the close should be close to the open for the real body of the candlestick to remain modest, it might be above or below the opening price. One of the most important criteria is that the lower shadow must be at least twice as tall as the real body. This necessitates that the lower wick is longer than the higher wick or that the candle cannot have an upper wick.

Example of How to Use a Hammer Candlestick?

Interpretation: This pattern is a reversal. The bulls are becoming more active and are indicating that there might be a reversal in price direction after a downtrend in which the price action produced a string of lower lows and lower highs. Because the bears were unable to capitalize on the new short-term low by enabling the bulls to drive the price higher to force a higher close, a hammer signaled a probable reversal in price direction. The high close specifically indicates that the bulls have just taken control of the market movement after defeating the bears in a crucial battle near the session lows.

On the TCS chart, we can observe that the Hammer appeared at the 3000 INR price level and the trend changed to an uptrend.

An inverted hammer pattern is bullish and appears during a descending trend. The Inverted Hammer resembles the Hammer candlestick shape turned on its head. It comprises of a little candle with a long upper wick. This bullish reversal pattern only lasts one day. In this TCS chart pattern, an inverted hammer formed at 3160 INR, and after two days, it reversed course and began moving upward for a few days.

The Difference Between a Hammer Candlestick and a Doji?

The hammer candlestick pattern, in contrast to the Doji, only has a long lower shadow, comes following a market decline, and suggests a likely upside reversal (if confirmed). whereas a doji is a different kind of candlestick with a smaller physical body. Uncertainty is symbolized by the upper and lower shadows that are present in doji symbols. Dojis can signify either a price reversal or a continuation of the trend, depending on the confirmation that follows.

The difference between an inverted hammer and shooting star?

The shooting star is essentially a top reversal pattern, as opposed to the inverted hammer, which is a bottom reversal pattern. Since the former is a bullish reversal pattern and the latter is a bearish reversal pattern, the only distinction between an inverted hammer and shooting star is that the former is a bullish reversal pattern. Typically, the shooting star pattern appears near the resistance level, during a bounce within a downtrend, or at the end of an uptrend.

During an ongoing, powerful rally, the stock price opens much higher and rises swiftly to form the shooting star candlestick pattern. The price, however, flips as the session draws to a close and closes close to the day’s low. This pattern should be confirmed by a significant bearish day on the next trading day.

In conclusion, the trend is upward, but the shooting star candlestick formation may be an early warning that bears and bulls are currently engaged in combat.

Is a hammer candlestick pattern bullish?

When prices rise following a sell-off that occurs over the course of the period and closes quite close to the open, a candlestick that resembles a hammer, or hammer candlestick, will appear. The hammer candlestick, a bullish trading pattern, may indicate that a stock has reached its low and is poised for a trend reversal. In the example, it implies that buyers eventually dominated sellers, driving up the asset’s price after sellers initially drove it down. The positive price reversal must be confirmed by the following candle closing above the hammer’s previous closing price. This is critical because it will show that buyers and bulls are in the market.

Limitations of the hammer pattern?

Even though the hammer is a successful indication, a trader should be aware of its limits before utilising it.

The hammer candlestick denotes buyers regaining momentum following a new low in an asset. The strength of the purchasers, however, can perhaps be a sellers’ retracement towards the conclusion of the day. Keep an eye on the retracement’s speed when using the hammer trading approach. A sharp recovery indicates a turn around, whereas a correction can trigger further selling pressure the following day.

Another crucial factor is where to put the hammer candlestick. If a hammer is discovered at the base of a trend, it is solid. Other indicators, such as the stochastic oscillator or RSI, are also available. We can trust the hammer if these indicators support it.

Conclusion

The pattern suggests that although buyers ultimately regained control and drove the price back to its initial level, which symbolizes the bull gaining strength, sellers may have attempted to drive the price lower. The pattern points to a potential price reversal to the upside. The candlestick that follows the hammer indicator should confirm the upward price movement. The rising confirmation candle is usually bought by traders looking for a hammer signal. It can be beneficial to place our stop loss below the bottom of the hammer pattern because it will safeguard us in case the downward pressure reappears, and the upward advance traders were anticipating doesn’t take place.

Read More About Trading Using Technical Indicators