What Are Earnings Per Share (EPS)?

Earnings per share is the portion of shareholder’s profit in relation to total profit of the company. EPS measures each common shares profit allocation in relation to the company’s total profit.

It is an important ration that is used in analysis of company’s performance, to predict the future earnings and also helps in understanding the valuation of a company.

If the EPS of a company is higher, it is considered to be more profitable and thus would have more profits available for distribution to its shareholders.

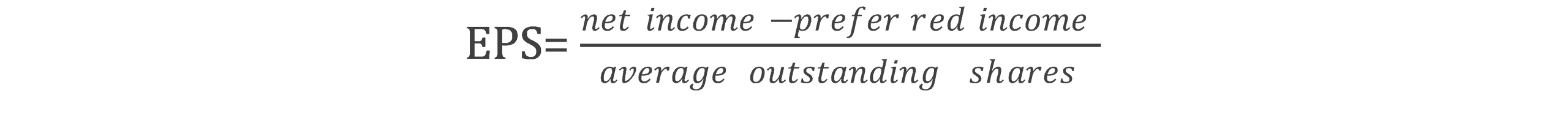

EPS Formula-

For instance, PQR a company is left with a net income of Rs. 7,30,00,000 and must also pay Rs. 30,00,000 as preferred dividends and has 70 lakh common share outstanding (weighted average) at the current period.

Therefore, the EPS of XYZ Company as per earnings per share formula would be;

= Rs. (7,30,00,000 – 30,00,000)/ 70,00,000

= Rs. 10 per share (Which is a pretty good EPS)

EPS ratio tends to depend on the type of earnings that have been used to arrive at it, it is vital to achieving familiarity with them in general.

Types of EPS-

Reported EPS or Generally Accepted Accounting Principles (GAAP) EPS: –

A company’s reported earnings can even be distorted by GAAP. For example, a one-time gain from the sale of machinery or a subsidiary could be considered as operating income under GAAP, causing EPS for the quarter to spike. Similarly, a company could classify a big lump of normal operating expenses as an “unusual charge,” which excludes it from the calculation and artificially boosts EPS.

On-Going/Pro Forma EPS: –

This variation is called Pro Forma EPS. The words “pro forma” indicate that some assumptions had to be used in the formula. Pro forma EPS generally excludes some expenses or incomes that were used in calculating reported earnings. For example, if a company sells a large division, it could, in reporting its historical results, exclude the past expenses and revenues associated with that unit. This allows for an “apples-to-apples” comparison.

Carrying Value/Book Value EPS-

Carrying value per share, more commonly referred to as the Book value of equity per share (BVPS), measures the amount of company equity in each share. This measure focuses on the balance sheet and not much else, so it is a static representation of company performance. Here current BVPS should tell the investor how much a share would be worth if the company had to be liquidated and all its assets sold.

Retained EPS-

The retained earnings per share are computed by adding the net earnings to the current retained earnings and then subtracting the total dividend paid from it. Lastly, the remainder is divided by the total number of outstanding shares

Therefore, the retained EPS calculation is completed using this formula –

Retained EPS = (Net earnings + Current rated earnings)- (Divided Paid / Total No. of outstanding shares)

Cash EPS-

Cash EPS is operating cash flow divided by diluted shares outstanding. Cash EPS is important because it is a purer number. That is, it represents real cash earned and it cannot be manipulated as easily as net income.

A company with reported EPS of 5 rupees and cash EPS of 10 is preferable to a firm with reported EPS of 1 and a cash EPS of 5. Although there are many factors to consider, the company that has the cash is generally in better financial shape.

Overview:

EPS | Calculation |

1. Reported EPS or GAAP EPS | Derived from generally accepted accounting principles (GAAP). |

2. On-going/ pro forma EPS | Excludes unusual one-time company gains or losses. |

3. Carrying value? Book value EPS | Real cash worth of each share of company stock. |

4. Retained EPS | The earnings kept by the company rather than shared as dividends. |

5. Cash EPS | The actual total number of dollars earned. |

What is a Good EPS?

What counts as a “good” EPS will depend on factors such as the recent performance of the company, the performance of its competitors, and the expectations of the analysts who follow the stock. It also depends on other factors such as price of the share, market capital of the company.

What Are Some Limitations of EPS?

There are also some drawbacks of using only EPS to make an investment or trading decision because EPS can be window dressed easily by the company by just buying back its shares which reduces the number of outstanding shares of the company and then increasing its EPS because of this. Even the changes in accounting principles can be used to window dress the EPS.