The word currency has taken a new form in today’s world. Originally money was in the form of receipts which was later on replaced with metals which became a symbol to represent a value and also basis for trade. These forms of currencies was again replaced with Paper notes and then Banknotes which became accepted as a legal tender. As technology improved and the world moved towards Digitization a new form of currency has become popular and became the latest trend which is now called “ Digital Currency”.

What Is Digital Currency?

Digital Currency is a form of currency that is available only in digital or electronic form. It is a money like asset which can be primarily managed stored or exchanged on digital computer systems with the help of internet. Digital currency does not have a physical form unlike currencies printed as banknotes and coins. Digital currency is not issued by a government body and are not considered as legal tender. Digital Currencies can be centralized (i.e. Fiat currency- issued by government but not backed by any commodity such as Gold) or decentralized (Cryptocurrency Like Bitcoin, Litecoin, Ethereum).

Why Digital Currency Gained Popularity?

Digital Currency has improved the process of monetary transactions and eliminates the physical storage and safeguarding it. Cross border transfers have become faster and easier compared to standard money. This form of money will streamline the process of monetary policy and implementation for central banks. One aim of the Digital currency is to reduce the time lag and operating costs which banks are now charging for the digital transactions which are already in use. This can be done with the help of Distributed Ledger Technology. Digital Currency can be Centralized as well as decentralized.

Central Bank Digital Currency – CBDC

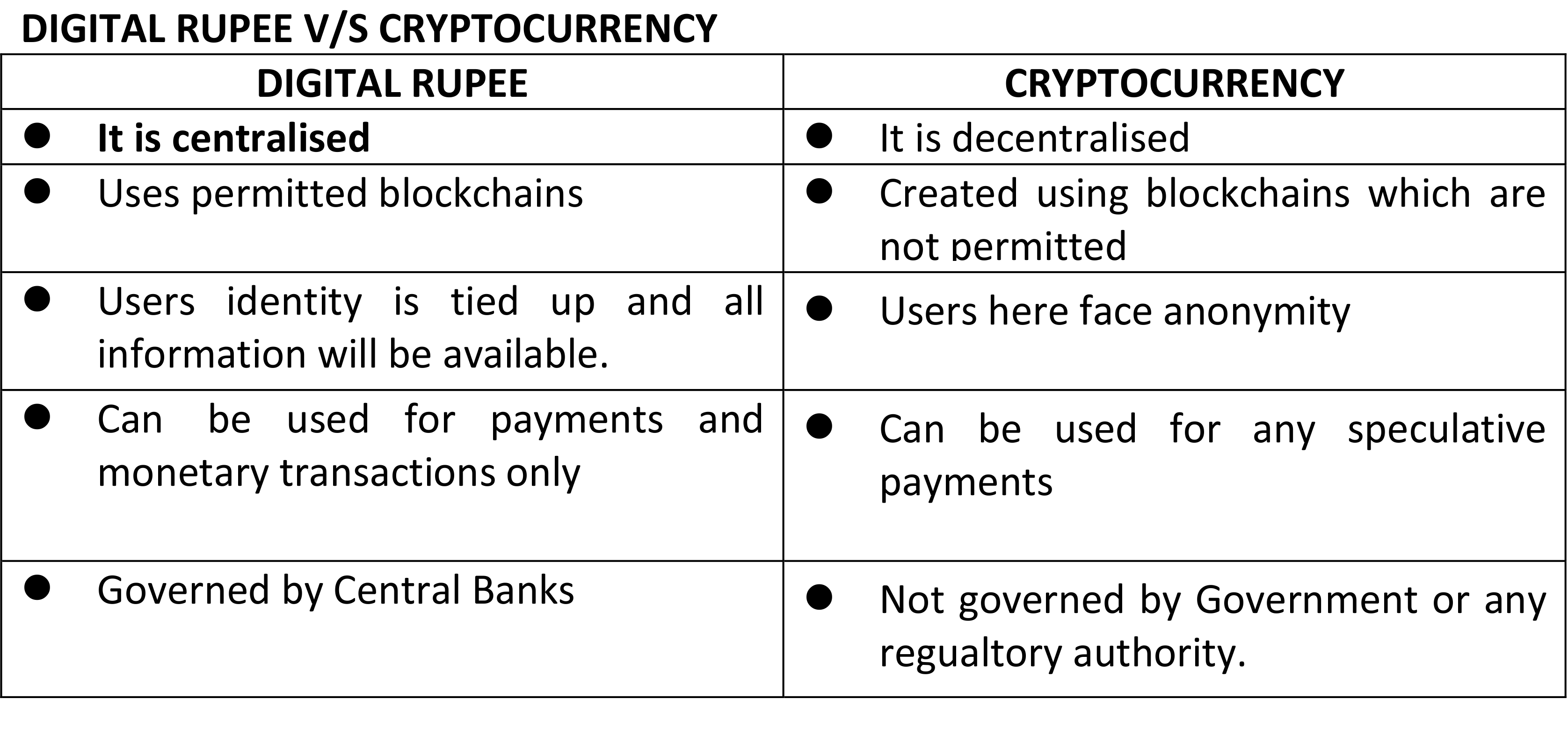

Central Bank Digital Currency also known as CBDCs is a legal tender in digital form, and are essentially the online version of their respective fiat currencies. In India’s case, that would be the Digital Rupee. In simpler terms, CBDC is an electronic form of central bank money that citizens can use to make digital payments and store value. The history of central bank digital currencies (CBDCs) is a short, recent history. CBDCs are still in a conceptual stage, with many countries exploring the possible implementation of them.The present concept of “central bank digital currency” may have been partially inspired by Bitcoin and similar Blockchain based Cryptocurrencies.

If a country issues a CBDC, its government will consider it to be legal tender, just like fiat currencies; both CBDC and physical cash would be legally acknowledged as a form of payment and act as a claim on the central bank or government.

Central Bank Digital Currency In India

The Reserve Bank of India may launch its first digital currency trial programs by December2021 named DIGITAL RUPEE .The RBI is studying various aspects of a digital currency including its security, impact on India’s financial sector as well as how it would affect monetary policy and currency in circulation, according to the governor. Central banks stepped up their efforts looking into digital currencies over the past year following a decline in cash usage and growing interest in cryptocurrencies like bitcoin.

Advantages

- Efficient and Potential payment System

- A large portion of population is unbanked so CBDC can prove helpful.

- Helpful for Financial Inclusion as bank account is not necessary.

- CBDC and cash would be considered as legal tender during currency unavailability.

- A central bank digital currency increases the safety and efficiency of both wholesale and retail payment systems.

Disadvantages

- Central Bank may be required to provide additional liquidity to the Banks as there would be demand and this might lead to credit risk

- Citizens can withdraw huge money from banks and invest in CBDCs , resulting in bank run.

- Cyber-security issues can be faced.

Decentralised Currency

Another types of digital money are decentralized. They eliminate the function of central authorities to oversee production and intermediaries needed to distribute the currency. Cryptography is used. Blind signatures hide the identity of transacting parties, and zero-knowledge proofs encrypt transaction details. Examples of this type of digital money are cryptocurrencies like Bitcoin and Ethereum.

What Is Cryptocurrency?

Cryptocurrencies are decentralized digital assets maintained on a public, permission less blockchain network that anyone may access. Cryptocurrencies can be used for both financial transactions and speculation. There is no central authority that can regulate their use. Cryptocurrencies are systems that allow for secure payments online which are denominated in terms of virtual “tokens,” which are represented by ledger entries internal to the system. “Crypto” refers to the various encryption algorithms and cryptographic techniques that safeguard these entries, such as elliptical curve encryption, public-private key pairs, and hashing functions. Any investor can purchase cryptocurrency through crypto exchanges like Coinbase, Cash app, and more.

Advantages

- Efficient and Potential payment System

- A large portion of population is unbanked so CBDC can prove helpful.

- Helpful for Financial Inclusion as bank account is not necessary.

- CBDC and cash would be considered as legal tender during currency unavailability.

Disadvantages

- Central Bank may be required to provide additional liquidity to the Banks as there would be demand and this might lead to credit risk

- Citizens can withdraw huge money from banks and invest in CBDCs , resulting in bank run.

- Cyber-security issues can be faced.

Will Digital Rupee And Cryptocurrency Co-Exist?

- As there are two sides of the same coin Currency in the new Digital version has advantages and disadvantages. Digital Rupee overcomes the problems of cash and makes payment faster and cheaper at the same time it has attendant problems of technology as it can be hacked and erode privacy.

- Government-backed coins and private cryptocurrencies will coexist for a while, despite rising regulatory walls set by the government to counter virtual coins. Noting that cryptocurrencies and digital currencies by governments are “two different animals,” they will coexist for now partly because current cryptocurrencies are not actually solving payment problems.This form of digital money could well coexist with a central bank digital currency. It will require a licensing arrangement and a set of regulations to fulfil public policy objectives, including operational resilience, consumer protection, market conduct and contestability, data privacy, and even prudential stability.

- In India, The Supreme Court, in March 2020, had struck down the Reserve Bank of India’s restrictions on banks to stop providing services to crypto trading platforms. This led to uncertainty about the status of virtual currencies in India. The new legislation will clear the government’s stand on cryptocurrencies.

- In May 2021, the RBI permitted banks to facilitate cryptos. “There are no differences between the central bank and the finance ministry,” RBI Governor Shaktikanta Das had said.

- Some experts say India cannot be as a laggard when the world is rapidly moving ahead with blockchain technology. This has led to reports that crypto as an asset class might be allowed in India but the government will not accept it as legal tender as yet.

- Nobody is yet certain about the government’s stance in the bill, but adds: “Legislation without a blanket ban would undoubtedly boost the crypto ecosystem in India.”