What Is Technical Analysis?

Technical analysis is a tool used to predict the probable future price movement of a security; such as stocks currency commodities based on market data. In Technical analysis, the price, volume, past trends in price movements, and other statistics are used to predict how the stock would perform in the future. In other words, technical analysis studies the past performance of the stock to predict its future movements.

Benefits of TA

Timing the market: The primary benefit of technical analysis is helping you find out when to invest and when to sell.

Fixing of stop: loss targets- Depending on our Risk appetite and strategy, we can fix a suitable stop-loss target using technical indicators.

Analysis of market trends: Technical analysis charts help us check the market trend, i.e. whether it is a bullish market or a bearish one

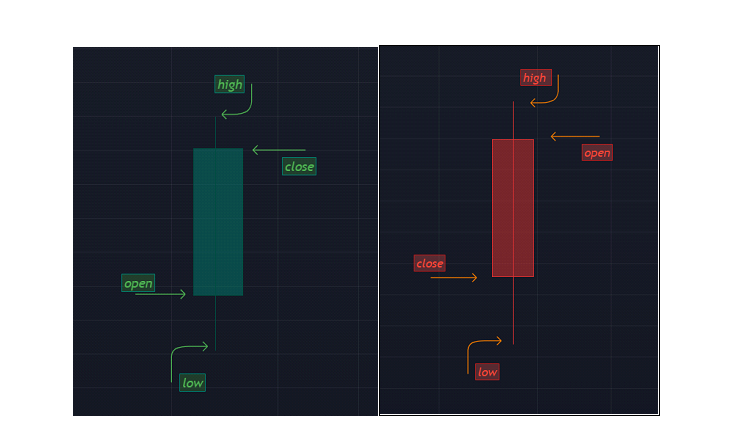

A complete picture of the stock price: Technical analysis of stocks gives us four main price points of the stock – the opening price, the closing price, the day’s high, the day’s low.

Technical Analysis Tool

Charts/ graphs

line chart

candles

Indicators

moving average (MA)

Simple moving average

Exponential moving average

Linear moving average

Relative Strength Index (RSI)

Moving average convergence divergence (MACD)

Charts- (candles)

Candlestick charting is the most commonly used method of showing price movement on chart. A candlestick is formed from price action during a single time period for any time frame.

How candlestick looks like and how to read it? Green candle means more people are buying and red candle means more people are selling.

Time Frames

The TA time frames shown on chart range, from 1 minute to monthly or even yearly time span. The most popular time frames that TA examine;

1 minute chart

5 minute chart

Hourly chart

4 hour chart

Daily chart

Intraday traders, who open and close their positions within a single trading day, favour analysing price movement on shorter time frame, such as 1min, 5min or 15min charts. Long term traders who hold positions overnight and for long period of time are more inclined to analyse market using hourly, daily or sometimes weekly charts.

A Price movement that occurs within 1min to 15min time span may very significant for intraday trader whose looking for an opportunity to realize a profit from price fluctuations occurring during one trading day. Or same price movement viewed on daily or weekly time frame may not be significant for long term trading purpose.

On smaller time frame there is too much volatility which we can see. Intraday trader tries to capture little little trend in shorter time. But here we cannot see actual trend of market.

On this chart we can see clear cut uptrend in market. That blue line is 21 MA, which show upward direction in market.

How we identify trend? Let’s see;

To be Conclude

To be honest, no single indicator gives you accurate result; sometimes it might help you, sometimes it not. Market runs with sentiments. If panic situation comes, then no indicator helps you. Yes it gives you indications. But sometimes panic situation just happened for short time on that time it difficult to get quick indication.